| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

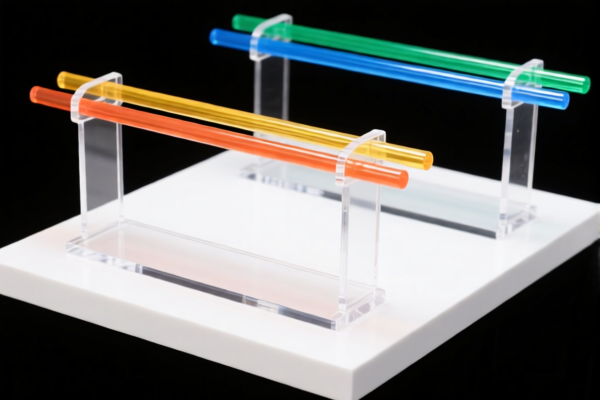

Product Classification: Acrylic Plastic Rods for Display Stands

HS CODE: 3916901000

🔍 Classification Summary

- Product: Acrylic plastic rods used for display stands.

- Material: Made from acrylic polymer (polymethyl methacrylate, PMMA).

- HS Code: 3916901000 (Plastic rods, of acrylic polymer, not elsewhere specified).

📊 Tariff Breakdown (As of Now)

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⏰ Time-Sensitive Policy Alert

Additional Tariffs Imposed After April 11, 2025:

A 30.0% additional tariff will be applied to this product after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties (Not Applicable Here)

- Iron and Aluminum Products: Not applicable for acrylic plastic rods.

- No anti-dumping duties currently apply to this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of acrylic polymer (PMMA) and not a composite or mixed material.

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Confirm if any specific certifications (e.g., RoHS, REACH) are needed for import into the destination country.

- Plan Ahead for Tariff Changes: If importing after April 11, 2025, budget for the 30.0% additional tariff.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has multiple uses or is part of a larger kit.

✅ Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 6.5% |

| General Additional Tariff | 25.0% |

| Special Tariff (After 2025.4.11) | 30.0% |

| Total Tariff | 61.5% |

Let me know if you need help with customs documentation or classification of related products.

Product Classification: Acrylic Plastic Rods for Display Stands

HS CODE: 3916901000

🔍 Classification Summary

- Product: Acrylic plastic rods used for display stands.

- Material: Made from acrylic polymer (polymethyl methacrylate, PMMA).

- HS Code: 3916901000 (Plastic rods, of acrylic polymer, not elsewhere specified).

📊 Tariff Breakdown (As of Now)

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tariff Rate: 61.5%

⏰ Time-Sensitive Policy Alert

Additional Tariffs Imposed After April 11, 2025:

A 30.0% additional tariff will be applied to this product after April 11, 2025. This is a critical date for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties (Not Applicable Here)

- Iron and Aluminum Products: Not applicable for acrylic plastic rods.

- No anti-dumping duties currently apply to this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the product is indeed made of acrylic polymer (PMMA) and not a composite or mixed material.

- Check Unit Price: Tariff rates may vary based on the declared value and classification.

- Certifications Required: Confirm if any specific certifications (e.g., RoHS, REACH) are needed for import into the destination country.

- Plan Ahead for Tariff Changes: If importing after April 11, 2025, budget for the 30.0% additional tariff.

- Consult Customs Broker: For accurate classification and compliance, especially if the product has multiple uses or is part of a larger kit.

✅ Summary Table

| Tariff Component | Rate |

|---|---|

| Base Tariff | 6.5% |

| General Additional Tariff | 25.0% |

| Special Tariff (After 2025.4.11) | 30.0% |

| Total Tariff | 61.5% |

Let me know if you need help with customs documentation or classification of related products.

Customer Reviews

No reviews yet.