| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3916901000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

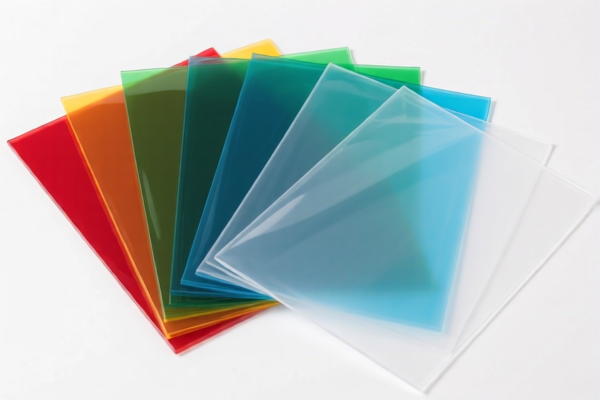

Here is the structured classification and tariff information for Acrylic Plastic Sample Sheets based on the provided HS codes and tax details:

🔍 HS CODE: 3926909989

Product Description: Plastic products and sheets (general category)

Total Tax Rate: 42.8%

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for plastic products and sheets, which may include acrylic but is not specific to it.

🔍 HS CODE: 3920515050

Product Description: Polymethyl methacrylate (PMMA) sheets

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most specific code for acrylic sheets, ideal for your product if it is made of PMMA.

🔍 HS CODE: 3920598000

Product Description: Products based on acrylic polymers (other than sheets)

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to other acrylic-based products, not specifically sheets.

🔍 HS CODE: 3916901000

Product Description: Plastic rods

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic rods, not sheets, so not applicable to your product.

🔍 HS CODE: 3920515090

Product Description: Other polymethyl methacrylate (PMMA) products

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to other PMMA products, not specifically sheets.

📌 Proactive Advice:

- Verify Material: Confirm whether your product is made of PMMA (polymethyl methacrylate) or another type of acrylic polymer. This will determine the correct HS code.

- Check Unit Price: The total tax rate is based on the unit price of the product. If the price is above a certain threshold, additional tariffs may apply.

- Certifications Required: Ensure your product complies with any customs documentation or certifications required for import.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. If your product is imported after this date, the 30% additional tariff will apply.

- Anti-dumping duties: Not applicable for acrylic products, but always check for any anti-dumping or countervailing duties that may be in effect.

If you provide more details about the material composition and intended use of the acrylic sheets, I can help you further narrow down the most accurate HS code and tax implications. Here is the structured classification and tariff information for Acrylic Plastic Sample Sheets based on the provided HS codes and tax details:

🔍 HS CODE: 3926909989

Product Description: Plastic products and sheets (general category)

Total Tax Rate: 42.8%

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is a general category for plastic products and sheets, which may include acrylic but is not specific to it.

🔍 HS CODE: 3920515050

Product Description: Polymethyl methacrylate (PMMA) sheets

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the most specific code for acrylic sheets, ideal for your product if it is made of PMMA.

🔍 HS CODE: 3920598000

Product Description: Products based on acrylic polymers (other than sheets)

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to other acrylic-based products, not specifically sheets.

🔍 HS CODE: 3916901000

Product Description: Plastic rods

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is for plastic rods, not sheets, so not applicable to your product.

🔍 HS CODE: 3920515090

Product Description: Other polymethyl methacrylate (PMMA) products

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to other PMMA products, not specifically sheets.

📌 Proactive Advice:

- Verify Material: Confirm whether your product is made of PMMA (polymethyl methacrylate) or another type of acrylic polymer. This will determine the correct HS code.

- Check Unit Price: The total tax rate is based on the unit price of the product. If the price is above a certain threshold, additional tariffs may apply.

- Certifications Required: Ensure your product complies with any customs documentation or certifications required for import.

- April 11, 2025 Deadline: Be aware of the special tariff increase after this date. If your product is imported after this date, the 30% additional tariff will apply.

- Anti-dumping duties: Not applicable for acrylic products, but always check for any anti-dumping or countervailing duties that may be in effect.

If you provide more details about the material composition and intended use of the acrylic sheets, I can help you further narrow down the most accurate HS code and tax implications.

Customer Reviews

No reviews yet.