Found 4 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

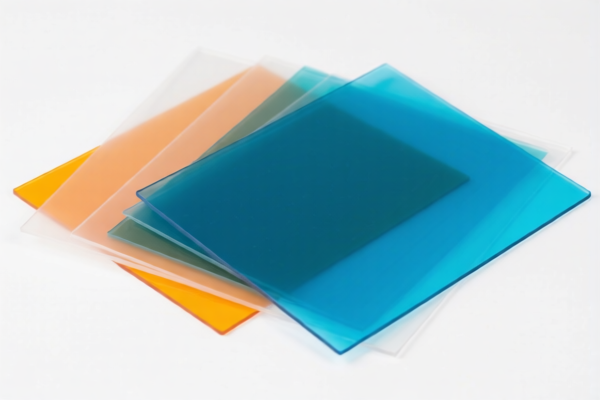

- Product Classification: Acrylic Plastic Thermoforming Sheets

-

HS CODEs and Tax Details:

-

HS CODE: 3920515050

- Description: Applicable for flame-retardant acrylic plastic sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to flame-retardant acrylic sheets, which may require specific certifications for compliance.

-

HS CODE: 3920598000

- Description: Applicable for acrylic thermoforming sheets and acrylic craft sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general-purpose acrylic sheets used in thermoforming and crafting.

-

HS CODE: 3921905050

- Description: Applicable for thermoplastic sheets

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for general thermoplastic sheets, not specifically acrylic-based.

-

HS CODE: 3926909989

- Description: Applicable for plastic acrylic sheets

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for general acrylic plastic sheets, possibly including non-specialized variants.

-

Important Notes:

- April 11, 2025 Special Tariff: All four HS codes will be subject to an additional 30.0% tariff after this date. This is a time-sensitive policy and should be considered in cost planning.

- Anti-dumping duties: Not applicable for these product categories.

- Certifications: Verify if your product requires any specific certifications (e.g., flame-retardant certifications for 3920515050).

-

Material and Unit Price: Confirm the exact material composition and unit price to ensure correct classification and tax calculation.

-

Proactive Advice:

- Double-check the exact product description and specifications to ensure the correct HS code is applied.

- If exporting to China, be aware of the April 11, 2025, tariff increase and plan accordingly.

- Consult with customs or a compliance expert if the product involves special treatments or certifications.

- Product Classification: Acrylic Plastic Thermoforming Sheets

-

HS CODEs and Tax Details:

-

HS CODE: 3920515050

- Description: Applicable for flame-retardant acrylic plastic sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code applies to flame-retardant acrylic sheets, which may require specific certifications for compliance.

-

HS CODE: 3920598000

- Description: Applicable for acrylic thermoforming sheets and acrylic craft sheets

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is suitable for general-purpose acrylic sheets used in thermoforming and crafting.

-

HS CODE: 3921905050

- Description: Applicable for thermoplastic sheets

- Total Tax Rate: 34.8%

- Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for general thermoplastic sheets, not specifically acrylic-based.

-

HS CODE: 3926909989

- Description: Applicable for plastic acrylic sheets

- Total Tax Rate: 42.8%

- Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 7.5%

- Tariff after April 11, 2025: 30.0%

- Note: This code is for general acrylic plastic sheets, possibly including non-specialized variants.

-

Important Notes:

- April 11, 2025 Special Tariff: All four HS codes will be subject to an additional 30.0% tariff after this date. This is a time-sensitive policy and should be considered in cost planning.

- Anti-dumping duties: Not applicable for these product categories.

- Certifications: Verify if your product requires any specific certifications (e.g., flame-retardant certifications for 3920515050).

-

Material and Unit Price: Confirm the exact material composition and unit price to ensure correct classification and tax calculation.

-

Proactive Advice:

- Double-check the exact product description and specifications to ensure the correct HS code is applied.

- If exporting to China, be aware of the April 11, 2025, tariff increase and plan accordingly.

- Consult with customs or a compliance expert if the product involves special treatments or certifications.

Customer Reviews

No reviews yet.