| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

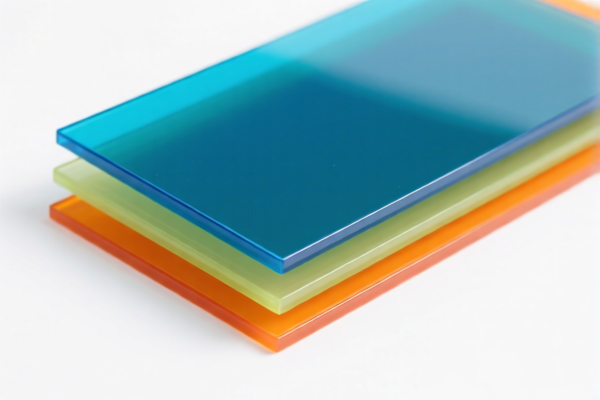

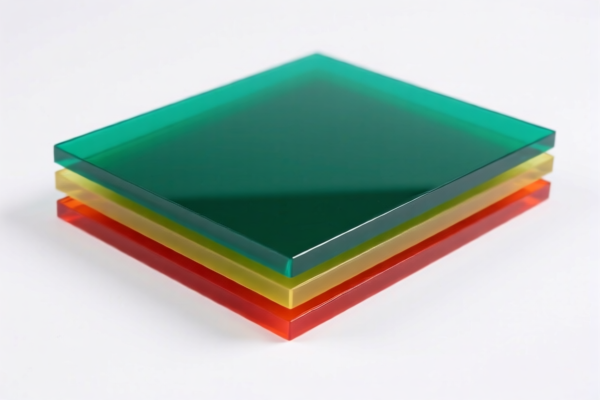

Here is the structured classification and tariff information for Acrylic Plastic Thickened Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920598000

Description:

Plastic sheets, plates, films, foils and strips based on acrylic polymers, other unspecified.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920515050

Description:

Non-cellular and non-reinforced, laminated, supported or otherwise combined with other materials, acrylic polymer polymethyl methacrylate sheets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

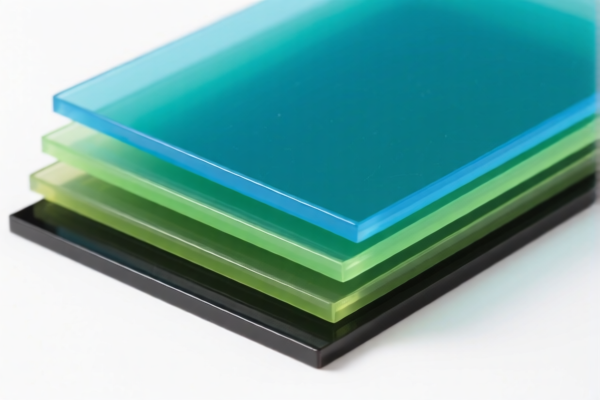

✅ HS CODE: 3920515090

Description:

Other plastic sheets, plates, films, foils and strips, non-cellular and non-reinforced, laminated, supported or otherwise combined with other materials.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3926909989

Description:

Other plastic articles and articles of other materials of heading 3901 to 3914: Other: Other.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

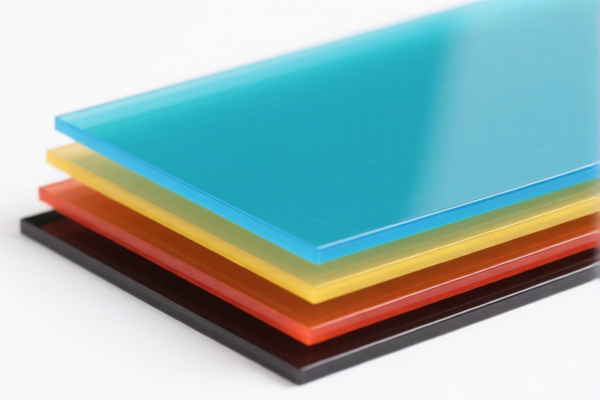

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-dumping duties:

Not specifically mentioned for acrylic plastic sheets in the provided data. However, if the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert. -

Material and Certification Requirements:

Ensure the product is correctly classified based on its material composition, thickness, and processing method (e.g., laminated, reinforced, etc.).

Confirm if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination market.

📌 Proactive Advice:

- Verify the exact product description (e.g., whether it is PMMA, laminated, reinforced, etc.) to ensure correct HS code selection.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs or a compliance expert if the product is part of a sensitive category or subject to additional duties.

Let me know if you need help determining the most accurate HS code for your specific product. Here is the structured classification and tariff information for Acrylic Plastic Thickened Sheets, based on the provided HS codes and tax details:

✅ HS CODE: 3920598000

Description:

Plastic sheets, plates, films, foils and strips based on acrylic polymers, other unspecified.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920515050

Description:

Non-cellular and non-reinforced, laminated, supported or otherwise combined with other materials, acrylic polymer polymethyl methacrylate sheets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3920515090

Description:

Other plastic sheets, plates, films, foils and strips, non-cellular and non-reinforced, laminated, supported or otherwise combined with other materials.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3926909989

Description:

Other plastic articles and articles of other materials of heading 3901 to 3914: Other: Other.

Tariff Breakdown:

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes:

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above HS codes after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning and customs declarations. -

Anti-dumping duties:

Not specifically mentioned for acrylic plastic sheets in the provided data. However, if the product is imported from countries under anti-dumping investigations, additional duties may apply. Verify with customs or a trade compliance expert. -

Material and Certification Requirements:

Ensure the product is correctly classified based on its material composition, thickness, and processing method (e.g., laminated, reinforced, etc.).

Confirm if certifications (e.g., RoHS, REACH, or specific import permits) are required for the destination market.

📌 Proactive Advice:

- Verify the exact product description (e.g., whether it is PMMA, laminated, reinforced, etc.) to ensure correct HS code selection.

- Check the unit price and total value to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Consult customs or a compliance expert if the product is part of a sensitive category or subject to additional duties.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.