| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

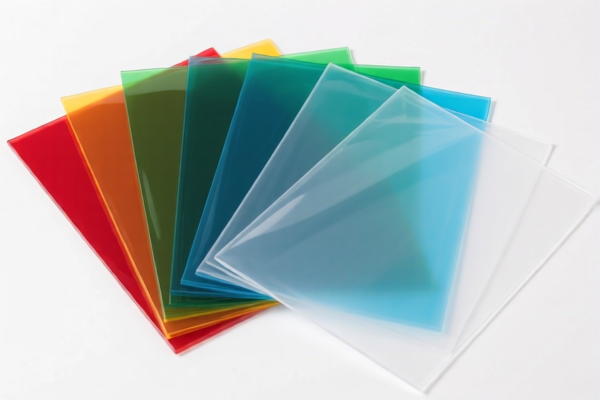

Product Classification: Acrylic Plastic Transparent Sheets

Based on the provided HS codes and descriptions, the acrylic plastic transparent sheets fall under the following classifications:

HS CODE: 3920515050

Description:

- Applicable to acrylic transparent sheets, made from acrylic polymer (polymethyl methacrylate, PMMA).

- This code is typically used for clear, uncolored acrylic sheets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

HS CODE: 3920598000

Description:

- Applicable to acrylic transparent sheets, made from acrylic polymer.

- This code is typically used for colored or other variations of acrylic sheets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

HS CODE: 3921905050

Description:

- Applicable to plastic transparent sheets, which may include non-acrylic plastics (e.g., polycarbonate, PVC, etc.).

- This code is broader and may not be specific to acrylic.

Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all three codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Material Verification:

Ensure the product is specifically acrylic (PMMA) and not another type of plastic (e.g., polycarbonate), as this will determine the correct HS code. -

Certifications and Documentation:

Confirm if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country. -

Unit Price and Classification:

The HS code may vary based on the thickness, color, and intended use of the acrylic sheets. Always verify with customs or a classification expert if the product has special features.

Proactive Advice:

- Double-check the material composition (e.g., is it 100% PMMA or a blend?).

- Confirm the product’s intended use (e.g., industrial, commercial, or consumer).

- Review the latest customs regulations before April 11, 2025, to avoid unexpected tax increases.

Product Classification: Acrylic Plastic Transparent Sheets

Based on the provided HS codes and descriptions, the acrylic plastic transparent sheets fall under the following classifications:

HS CODE: 3920515050

Description:

- Applicable to acrylic transparent sheets, made from acrylic polymer (polymethyl methacrylate, PMMA).

- This code is typically used for clear, uncolored acrylic sheets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

HS CODE: 3920598000

Description:

- Applicable to acrylic transparent sheets, made from acrylic polymer.

- This code is typically used for colored or other variations of acrylic sheets.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

HS CODE: 3921905050

Description:

- Applicable to plastic transparent sheets, which may include non-acrylic plastics (e.g., polycarbonate, PVC, etc.).

- This code is broader and may not be specific to acrylic.

Tariff Breakdown:

- Base Tariff Rate: 4.8%

- Additional Tariff (General): 0.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 34.8%

Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied to all three codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning. -

Material Verification:

Ensure the product is specifically acrylic (PMMA) and not another type of plastic (e.g., polycarbonate), as this will determine the correct HS code. -

Certifications and Documentation:

Confirm if any certifications (e.g., RoHS, REACH, or import permits) are required for the product in the destination country. -

Unit Price and Classification:

The HS code may vary based on the thickness, color, and intended use of the acrylic sheets. Always verify with customs or a classification expert if the product has special features.

Proactive Advice:

- Double-check the material composition (e.g., is it 100% PMMA or a blend?).

- Confirm the product’s intended use (e.g., industrial, commercial, or consumer).

- Review the latest customs regulations before April 11, 2025, to avoid unexpected tax increases.

Customer Reviews

No reviews yet.