Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3920200055 | Doc | 59.2% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Acrylic Polymer Films based on the provided HS codes:

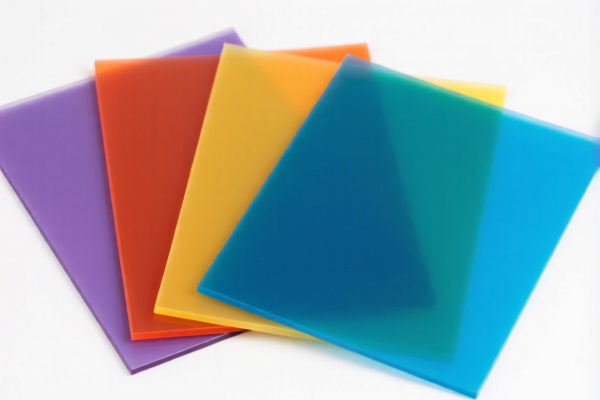

✅ Product Classification: Acrylic Polymer Films

🔢 HS CODE: 3920598000

- Description: Acrylic polymer plastic films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general acrylic polymer films, not specifically for resins.

🔢 HS CODE: 3907690050

- Description: Acrylic resin films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for acrylic resin-based films, likely used in industrial or coating applications.

🔢 HS CODE: 3906902000

- Description: Acrylic resin films

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff compared to 3907690050, possibly for different thickness or use.

🔢 HS CODE: 3906905000

- Description: Acrylic resin films

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest total tax rate among the options, possibly for thinner or more specialized films.

🔢 HS CODE: 3920200055

- Description: Acrylic plastic films

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general acrylic plastic films, possibly used in packaging or signage.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specified in the data, but if the product is imported from countries under anti-dumping investigations, additional duties may apply.

- Certifications: Ensure the product meets any required certifications (e.g., RoHS, REACH, or specific import permits) depending on the destination country.

📌 Proactive Advice:

- Verify Material Specifications: Confirm whether the product is classified as "resin" or "plastic" as this can affect the HS code.

- Check Unit Price and Thickness: These factors may influence the applicable HS code and tax rate.

- Consult Customs Authority: For the most accurate classification, especially if the product has mixed materials or special uses.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the additional 30.0% tariff.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Acrylic Polymer Films based on the provided HS codes:

✅ Product Classification: Acrylic Polymer Films

🔢 HS CODE: 3920598000

- Description: Acrylic polymer plastic films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general acrylic polymer films, not specifically for resins.

🔢 HS CODE: 3907690050

- Description: Acrylic resin films

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for acrylic resin-based films, likely used in industrial or coating applications.

🔢 HS CODE: 3906902000

- Description: Acrylic resin films

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: Slightly lower base tariff compared to 3907690050, possibly for different thickness or use.

🔢 HS CODE: 3906905000

- Description: Acrylic resin films

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This is the lowest total tax rate among the options, possibly for thinner or more specialized films.

🔢 HS CODE: 3920200055

- Description: Acrylic plastic films

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for general acrylic plastic films, possibly used in packaging or signage.

⚠️ Important Notes:

- April 11, 2025 Special Tariff: All the above HS codes are subject to an additional 30.0% tariff after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not specified in the data, but if the product is imported from countries under anti-dumping investigations, additional duties may apply.

- Certifications: Ensure the product meets any required certifications (e.g., RoHS, REACH, or specific import permits) depending on the destination country.

📌 Proactive Advice:

- Verify Material Specifications: Confirm whether the product is classified as "resin" or "plastic" as this can affect the HS code.

- Check Unit Price and Thickness: These factors may influence the applicable HS code and tax rate.

- Consult Customs Authority: For the most accurate classification, especially if the product has mixed materials or special uses.

- Plan for Tariff Increases: If importing after April 11, 2025, budget for the additional 30.0% tariff.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.