Found 6 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515090 | Doc | 61.5% | CN | US | 2025-05-12 |

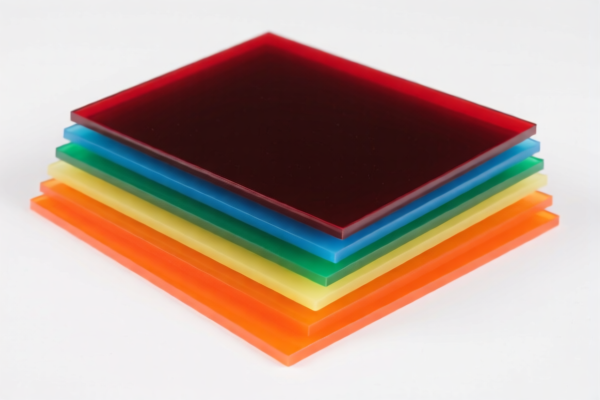

Product Classification: Acrylic Polymer Sheets

HS CODE: 3920594000 (Primary classification for acrylic polymer sheets)

Alternative HS CODE: 3926909989 (General category for other plastic products)

3920515050 (for acrylic sheets with flame retardant additives)

🔍 Classification Summary

- 3920594000 is the most specific and accurate HS code for acrylic polymer sheets (e.g., plastic sheets, films, foils, etc. made from acrylic polymers).

- 3920515050 applies if the acrylic sheets contain flame retardant additives.

- 3926909989 is a broader category for other plastic products, which may apply if the product is not clearly classified under 3920.

📊 Tariff Breakdown (as of now)

For HS CODE: 3920594000

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

For HS CODE: 3920515050

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

For HS CODE: 3926909989

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all three HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for acrylic polymer sheets, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material and Certification: Confirm the exact composition of the acrylic sheets (e.g., presence of flame retardants, additives, or other modifiers) to ensure correct HS code classification. Some certifications (e.g., fire safety, RoHS compliance) may be required for import.

✅ Proactive Advice

- Verify the product composition (e.g., flame retardant content) to determine the correct HS code.

- Check the unit price and total value to ensure the correct tariff category is applied.

- Review import documentation and certifications required by the importing country.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help with HS code verification or customs documentation!

Product Classification: Acrylic Polymer Sheets

HS CODE: 3920594000 (Primary classification for acrylic polymer sheets)

Alternative HS CODE: 3926909989 (General category for other plastic products)

3920515050 (for acrylic sheets with flame retardant additives)

🔍 Classification Summary

- 3920594000 is the most specific and accurate HS code for acrylic polymer sheets (e.g., plastic sheets, films, foils, etc. made from acrylic polymers).

- 3920515050 applies if the acrylic sheets contain flame retardant additives.

- 3926909989 is a broader category for other plastic products, which may apply if the product is not clearly classified under 3920.

📊 Tariff Breakdown (as of now)

For HS CODE: 3920594000

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

For HS CODE: 3920515050

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

For HS CODE: 3926909989

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 42.8%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed on all three HS codes after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- Anti-dumping duties: Not explicitly mentioned for acrylic polymer sheets, but always verify if any anti-dumping or countervailing duties apply based on the country of origin.

- Material and Certification: Confirm the exact composition of the acrylic sheets (e.g., presence of flame retardants, additives, or other modifiers) to ensure correct HS code classification. Some certifications (e.g., fire safety, RoHS compliance) may be required for import.

✅ Proactive Advice

- Verify the product composition (e.g., flame retardant content) to determine the correct HS code.

- Check the unit price and total value to ensure the correct tariff category is applied.

- Review import documentation and certifications required by the importing country.

- Monitor the April 11, 2025 deadline to avoid unexpected cost increases.

Let me know if you need help with HS code verification or customs documentation!

Customer Reviews

No reviews yet.