Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907610010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

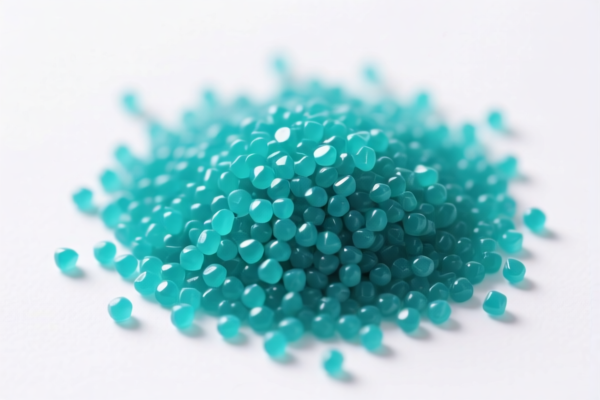

Product Name: Acrylic Polymer for Granules

Classification HS Codes and Tax Details:

- HS CODE: 3906100000

- Description: Acrylic polymer granules that match the description of HS code 3906100000

- Total Tax Rate: 61.3%

-

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906902000

- Description: Acrylic polymer granules classified under HS code 3906902000, which falls under the category of primary forms of acrylic resins

- Total Tax Rate: 61.3%

-

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907610010

- Description: Acrylic resin granules classified under HS code 3907.61.00.10 or 3907.61.00.50

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907690050

- Description: Acrylic resin granules classified under HS code 3907.69.00.50

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906905000

- Description: Acrylic resin granules classified under HS code 3906

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your customs clearance is completed before this date to avoid higher costs.

- Anti-dumping duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Certifications: Confirm if any specific certifications (e.g., REACH, RoHS, or product-specific documentation) are required for import.

- Material Verification: Ensure the product is accurately classified based on its chemical composition and form (e.g., whether it is a polymer, resin, or modified form).

- Unit Price: Verify the unit price and total value for accurate duty calculation, as customs may use the transaction value method.

✅ Proactive Advice:

- Double-check the exact HS code based on the product's chemical structure and intended use.

- Consult with a customs broker or regulatory authority if the product is a modified or blended form of acrylic polymer.

-

Keep updated records of product specifications and origin to ensure compliance with import regulations. Product Name: Acrylic Polymer for Granules

Classification HS Codes and Tax Details: -

HS CODE: 3906100000

- Description: Acrylic polymer granules that match the description of HS code 3906100000

- Total Tax Rate: 61.3%

-

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906902000

- Description: Acrylic polymer granules classified under HS code 3906902000, which falls under the category of primary forms of acrylic resins

- Total Tax Rate: 61.3%

-

Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907610010

- Description: Acrylic resin granules classified under HS code 3907.61.00.10 or 3907.61.00.50

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3907690050

- Description: Acrylic resin granules classified under HS code 3907.69.00.50

- Total Tax Rate: 61.5%

-

Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 3906905000

- Description: Acrylic resin granules classified under HS code 3906

- Total Tax Rate: 59.2%

- Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

📌 Important Notes:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after this date. Ensure your customs clearance is completed before this date to avoid higher costs.

- Anti-dumping duties: Not specifically mentioned for this product, but always verify if any anti-dumping or countervailing duties apply based on the origin of the goods.

- Certifications: Confirm if any specific certifications (e.g., REACH, RoHS, or product-specific documentation) are required for import.

- Material Verification: Ensure the product is accurately classified based on its chemical composition and form (e.g., whether it is a polymer, resin, or modified form).

- Unit Price: Verify the unit price and total value for accurate duty calculation, as customs may use the transaction value method.

✅ Proactive Advice:

- Double-check the exact HS code based on the product's chemical structure and intended use.

- Consult with a customs broker or regulatory authority if the product is a modified or blended form of acrylic polymer.

- Keep updated records of product specifications and origin to ensure compliance with import regulations.

Customer Reviews

No reviews yet.