| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 5808900010 | Doc | 58.9% | CN | US | 2025-05-12 |

| 5515290035 | Doc | 55.0% | CN | US | 2025-05-12 |

| 5512290020 | Doc | 67.0% | CN | US | 2025-05-12 |

| 3920200020 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921190010 | Doc | 61.5% | CN | US | 2025-05-12 |

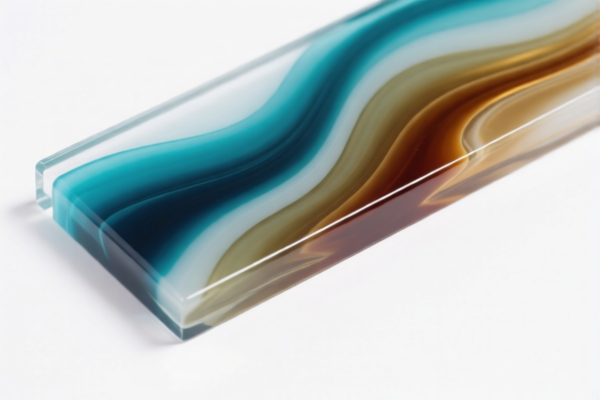

Here is the structured analysis and customs compliance guidance for the Acrylic Resin Decorative Material based on the provided HS codes and tariff details:

✅ HS CODE: 5808900010

Product Description:

- Applicable to acrylic woven decorative items, acrylic decorative strips, acrylic tassels, etc., made of acrylic (synthetic fiber).

Tariff Summary:

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.9%

Key Notes:

- This code is suitable for decorative items made of acrylic fibers.

- Ensure the product is not classified under a different category (e.g., plastic-based products).

✅ HS CODE: 5515290035

Product Description:

- Applicable to acrylic fiber decorative fabric, classified as other synthetic short fiber woven fabrics.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for fabric made of acrylic short fibers.

- Confirm the fabric is not woven with other fibers (e.g., cotton or polyester), which may change the classification.

✅ HS CODE: 5512290020

Product Description:

- Applicable to acrylic fiber decorative fabric, classified as woven fabrics containing 85% or more acrylic short fibers.

Tariff Summary:

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

Key Notes:

- This code applies to fabrics with a high acrylic fiber content (≥85%).

- Verify the fiber composition to ensure compliance with this classification.

✅ HS CODE: 3920200020

Product Description:

- Applicable to acrylic plastic decorative packaging film, classified as polypropylene plastic sheets, films, etc.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for plastic films or sheets made of acrylic resin.

- Ensure the product is not classified as a decorative item (which may fall under 5808900010).

✅ HS CODE: 3921190010

Product Description:

- Applicable to acrylic plastic decorative products, classified as other plastic products.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for general acrylic plastic decorative products not covered by other categories.

- Confirm the product is not a woven fabric or decorative item, which may fall under different HS codes.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact material (e.g., acrylic fiber vs. acrylic resin) and fiber content percentage to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., textile certifications) or may be subject to additional duties based on value.

- Monitor April 11, 2025 Deadline: Be aware of the special tariff increase after this date, which may significantly impact your total import cost.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a classification expert to avoid misclassification penalties.

Let me know if you need help determining the most suitable HS code for your specific product. Here is the structured analysis and customs compliance guidance for the Acrylic Resin Decorative Material based on the provided HS codes and tariff details:

✅ HS CODE: 5808900010

Product Description:

- Applicable to acrylic woven decorative items, acrylic decorative strips, acrylic tassels, etc., made of acrylic (synthetic fiber).

Tariff Summary:

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 58.9%

Key Notes:

- This code is suitable for decorative items made of acrylic fibers.

- Ensure the product is not classified under a different category (e.g., plastic-based products).

✅ HS CODE: 5515290035

Product Description:

- Applicable to acrylic fiber decorative fabric, classified as other synthetic short fiber woven fabrics.

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code is for fabric made of acrylic short fibers.

- Confirm the fabric is not woven with other fibers (e.g., cotton or polyester), which may change the classification.

✅ HS CODE: 5512290020

Product Description:

- Applicable to acrylic fiber decorative fabric, classified as woven fabrics containing 85% or more acrylic short fibers.

Tariff Summary:

- Base Tariff Rate: 12.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 67.0%

Key Notes:

- This code applies to fabrics with a high acrylic fiber content (≥85%).

- Verify the fiber composition to ensure compliance with this classification.

✅ HS CODE: 3920200020

Product Description:

- Applicable to acrylic plastic decorative packaging film, classified as polypropylene plastic sheets, films, etc.

Tariff Summary:

- Base Tariff Rate: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

Key Notes:

- This code is for plastic films or sheets made of acrylic resin.

- Ensure the product is not classified as a decorative item (which may fall under 5808900010).

✅ HS CODE: 3921190010

Product Description:

- Applicable to acrylic plastic decorative products, classified as other plastic products.

Tariff Summary:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

Key Notes:

- This code is for general acrylic plastic decorative products not covered by other categories.

- Confirm the product is not a woven fabric or decorative item, which may fall under different HS codes.

📌 Proactive Advice for Importers:

- Verify Material Composition: Confirm the exact material (e.g., acrylic fiber vs. acrylic resin) and fiber content percentage to ensure correct HS code classification.

- Check Unit Price and Certification: Some HS codes may require specific certifications (e.g., textile certifications) or may be subject to additional duties based on value.

- Monitor April 11, 2025 Deadline: Be aware of the special tariff increase after this date, which may significantly impact your total import cost.

- Consult Customs Broker: For complex classifications, it is advisable to consult a customs broker or a classification expert to avoid misclassification penalties.

Let me know if you need help determining the most suitable HS code for your specific product.

Customer Reviews

No reviews yet.