| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

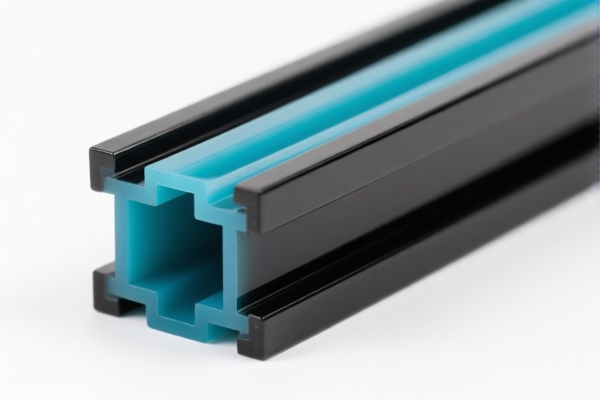

Here is the structured analysis and customs compliance guidance for the Acrylic Resin Extrusion Material based on the provided HS codes and tax details:

🔍 Product Classification Overview

The product "Acrylic Resin Extrusion Material" falls under several HS codes depending on its specific form and properties. Below are the key classifications and associated tariff details:

📦 HS Code Classification & Tax Details

1. HS Code: 3907610050

Description:

- Original form of acrylic polymer (not specific viscosity)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

2. HS Code: 3906100000

Description:

- Polymethyl methacrylate (PMMA)

- Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code also applies to extrusion-grade PMMA, which is relevant to your product.

3. HS Code: 3906902000

Description:

- Original form of acrylic resin

- Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Tariff Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for iron or aluminum in this context. However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Compliance Advice

-

Verify Material Specifications:

Ensure the product is correctly classified based on its chemical composition, viscosity, and intended use (e.g., extrusion-grade vs. general-purpose). -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product. -

Monitor Tariff Changes:

Keep track of April 11, 2025 and any potential tariff adjustments that may affect your import costs. -

Consult a Customs Broker:

For complex or high-value shipments, it is advisable to seek professional customs advice to avoid delays or penalties.

✅ Summary of Key Tax Rates

| HS Code | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff |

|---|---|---|---|---|

| 3907610050 | Acrylic polymer (non-specific) | 6.5% | 25.0% | 30.0% |

| 3906100000 | PMMA (including extrusion-grade) | 6.3% | 25.0% | 30.0% |

| 3906902000 | Original acrylic resin | 6.3% | 25.0% | 30.0% |

If you provide more details about the specific chemical structure or intended use of the acrylic resin, I can help further refine the HS code and compliance strategy. Here is the structured analysis and customs compliance guidance for the Acrylic Resin Extrusion Material based on the provided HS codes and tax details:

🔍 Product Classification Overview

The product "Acrylic Resin Extrusion Material" falls under several HS codes depending on its specific form and properties. Below are the key classifications and associated tariff details:

📦 HS Code Classification & Tax Details

1. HS Code: 3907610050

Description:

- Original form of acrylic polymer (not specific viscosity)

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

2. HS Code: 3906100000

Description:

- Polymethyl methacrylate (PMMA)

- Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Note: This code also applies to extrusion-grade PMMA, which is relevant to your product.

3. HS Code: 3906902000

Description:

- Original form of acrylic resin

- Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Tariff Notes

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all these products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost estimation and customs planning. -

No Anti-Dumping Duties Mentioned:

There are no specific anti-dumping duties listed for iron or aluminum in this context. However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Compliance Advice

-

Verify Material Specifications:

Ensure the product is correctly classified based on its chemical composition, viscosity, and intended use (e.g., extrusion-grade vs. general-purpose). -

Check Unit Price and Certification Requirements:

Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or specific import permits) are required for the product. -

Monitor Tariff Changes:

Keep track of April 11, 2025 and any potential tariff adjustments that may affect your import costs. -

Consult a Customs Broker:

For complex or high-value shipments, it is advisable to seek professional customs advice to avoid delays or penalties.

✅ Summary of Key Tax Rates

| HS Code | Description | Base Tariff | Additional Tariff | April 11, 2025 Tariff |

|---|---|---|---|---|

| 3907610050 | Acrylic polymer (non-specific) | 6.5% | 25.0% | 30.0% |

| 3906100000 | PMMA (including extrusion-grade) | 6.3% | 25.0% | 30.0% |

| 3906902000 | Original acrylic resin | 6.3% | 25.0% | 30.0% |

If you provide more details about the specific chemical structure or intended use of the acrylic resin, I can help further refine the HS code and compliance strategy.

Customer Reviews

No reviews yet.