Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907610010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3907690010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

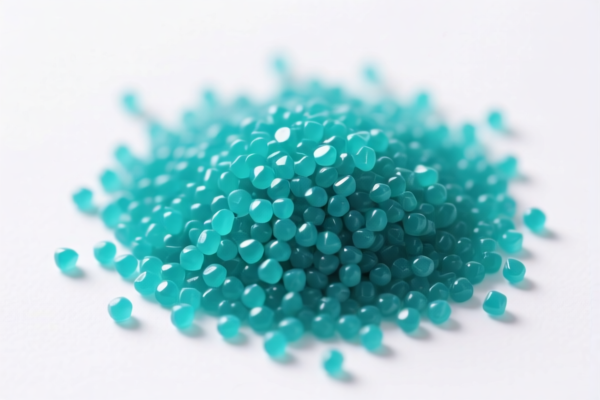

Product Name: Acrylic Resin Granules

Classification: Plastic Resin Granules (Acrylic Resin)

HS Code Classification Overview:

✅ HS CODE: 3906905000

- Description: Acrylic resin granules in their primary form, classified under HS CODE 3906.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to acrylic resin in its original form, in granular form.

- Lower base tariff compared to other codes, but still subject to significant additional tariffs.

✅ HS CODE: 3907690010

- Description: Acrylic resin granules in their primary form, with a viscosity number between 70 ml/g and 78 ml/g.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for acrylic polymers with specific viscosity ranges.

- Higher base tariff than 3906905000, but same additional and special tariffs.

✅ HS CODE: 3907690050

- Description: Acrylic resin granules in their primary form, classified under HS CODE 3907.69.00.50.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- Similar to 3907690010, but may differ in specific technical parameters.

- Same tax structure as 3907690010.

✅ HS CODE: 3906902000

- Description: Acrylic resin granules classified as primary plastic forms under HS CODE 3906902000.

- Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- Slightly higher base tariff than 3906905000.

- Still subject to the same additional and special tariffs.

✅ HS CODE: 3907610010

- Description: Acrylic resin granules classified under HS CODE 3907.61.00.10 or 3907.61.00.50, depending on viscosity.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code requires further classification based on the viscosity number.

- Ensure you have the viscosity data to determine the exact HS code.

📌 Important Reminders:

- Verify Material Specifications: Confirm the viscosity number and chemical composition to determine the correct HS code.

- Check Unit Price: Tariff calculations may depend on the unit price and product form (e.g., granules vs. pellets).

- Certifications Required: Some HS codes may require technical documentation or certifications for customs clearance.

- April 11, 2025, Deadline: Be aware of the special tariff imposed after this date, which increases the total tax burden by 5%.

- Anti-Dumping Duties: Not applicable for acrylic resin granules, but always verify for any anti-dumping or countervailing duties based on the country of origin.

🛑 Action Required:

- Confirm the viscosity number and chemical structure of the acrylic resin granules.

- Obtain technical specifications and certifications if required.

- Review tariff changes after April 11, 2025, and plan accordingly for cost management and customs compliance.

Product Name: Acrylic Resin Granules

Classification: Plastic Resin Granules (Acrylic Resin)

HS Code Classification Overview:

✅ HS CODE: 3906905000

- Description: Acrylic resin granules in their primary form, classified under HS CODE 3906.

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code applies to acrylic resin in its original form, in granular form.

- Lower base tariff compared to other codes, but still subject to significant additional tariffs.

✅ HS CODE: 3907690010

- Description: Acrylic resin granules in their primary form, with a viscosity number between 70 ml/g and 78 ml/g.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code is for acrylic polymers with specific viscosity ranges.

- Higher base tariff than 3906905000, but same additional and special tariffs.

✅ HS CODE: 3907690050

- Description: Acrylic resin granules in their primary form, classified under HS CODE 3907.69.00.50.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- Similar to 3907690010, but may differ in specific technical parameters.

- Same tax structure as 3907690010.

✅ HS CODE: 3906902000

- Description: Acrylic resin granules classified as primary plastic forms under HS CODE 3906902000.

- Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- Slightly higher base tariff than 3906905000.

- Still subject to the same additional and special tariffs.

✅ HS CODE: 3907610010

- Description: Acrylic resin granules classified under HS CODE 3907.61.00.10 or 3907.61.00.50, depending on viscosity.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Key Notes:

- This code requires further classification based on the viscosity number.

- Ensure you have the viscosity data to determine the exact HS code.

📌 Important Reminders:

- Verify Material Specifications: Confirm the viscosity number and chemical composition to determine the correct HS code.

- Check Unit Price: Tariff calculations may depend on the unit price and product form (e.g., granules vs. pellets).

- Certifications Required: Some HS codes may require technical documentation or certifications for customs clearance.

- April 11, 2025, Deadline: Be aware of the special tariff imposed after this date, which increases the total tax burden by 5%.

- Anti-Dumping Duties: Not applicable for acrylic resin granules, but always verify for any anti-dumping or countervailing duties based on the country of origin.

🛑 Action Required:

- Confirm the viscosity number and chemical structure of the acrylic resin granules.

- Obtain technical specifications and certifications if required.

- Review tariff changes after April 11, 2025, and plan accordingly for cost management and customs compliance.

Customer Reviews

No reviews yet.