| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

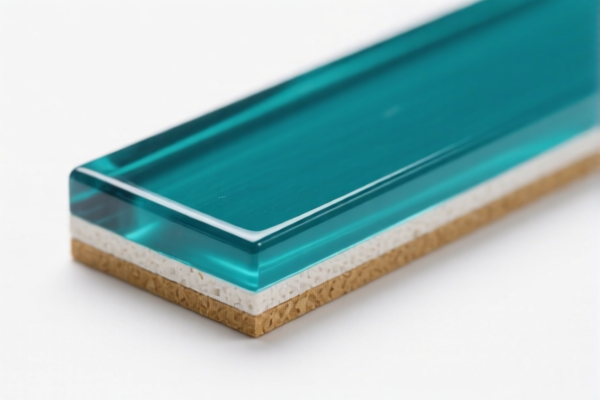

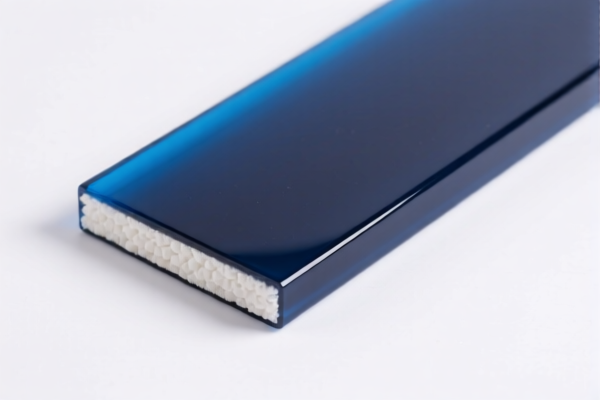

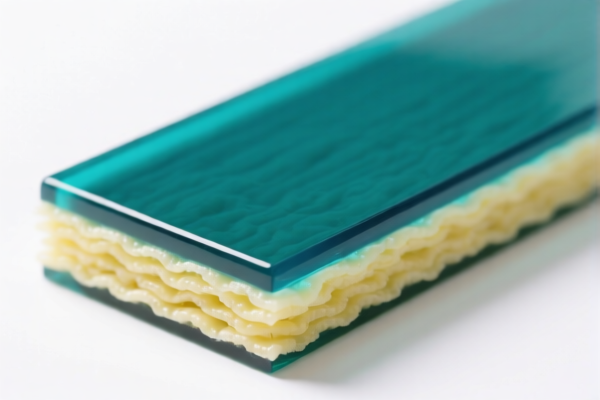

Product Name: Acrylic Resin Insulating Material

HS CODE: 3906905000

✅ Classification Summary

Acrylic resin insulating materials fall under HS Code 3906905000, which is designated for other acrylic resins. This classification includes various types of acrylic resin products such as flame-retardant, conductive, UV-resistant, and film materials, as long as they are made from acrylic resins.

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Note: The additional tariff of 30.0% applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of acrylic resin and not a composite or modified material that may fall under a different HS code.

- Unit Price: Accurate pricing is essential for customs valuation and duty calculation.

- Certifications: Check if any specific certifications (e.g., electrical safety, fire resistance) are required for import into the destination country.

- Documentation: Ensure all product descriptions, technical specifications, and certificates are clear and match the HS code classification.

🛑 Proactive Advice

- Double-check the product composition to ensure it is not classified under a different category (e.g., if it contains additives or is used in a specific application).

- Consult a customs broker or a local customs authority if the product is used in specialized industries (e.g., electrical, automotive, or construction).

- Monitor policy updates regarding tariffs and trade agreements, especially after April 11, 2025.

Let me know if you need help with customs documentation or further classification details.

Product Name: Acrylic Resin Insulating Material

HS CODE: 3906905000

✅ Classification Summary

Acrylic resin insulating materials fall under HS Code 3906905000, which is designated for other acrylic resins. This classification includes various types of acrylic resin products such as flame-retardant, conductive, UV-resistant, and film materials, as long as they are made from acrylic resins.

📊 Tariff Breakdown

- Base Tariff Rate: 4.2%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Note: The additional tariff of 30.0% applies after April 11, 2025. Ensure your customs clearance is completed before this date to avoid the higher rate.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the product is indeed made of acrylic resin and not a composite or modified material that may fall under a different HS code.

- Unit Price: Accurate pricing is essential for customs valuation and duty calculation.

- Certifications: Check if any specific certifications (e.g., electrical safety, fire resistance) are required for import into the destination country.

- Documentation: Ensure all product descriptions, technical specifications, and certificates are clear and match the HS code classification.

🛑 Proactive Advice

- Double-check the product composition to ensure it is not classified under a different category (e.g., if it contains additives or is used in a specific application).

- Consult a customs broker or a local customs authority if the product is used in specialized industries (e.g., electrical, automotive, or construction).

- Monitor policy updates regarding tariffs and trade agreements, especially after April 11, 2025.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.