Found 2 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

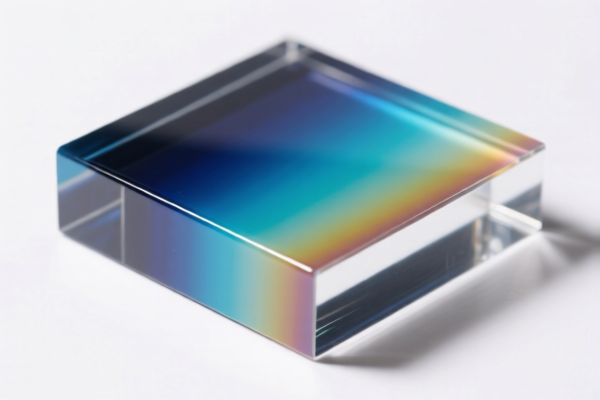

Product Name: Acrylic Resin Optical Material

Classification: HS Code 3906905000

🔍 HS Code and Classification Details:

- HS CODE: 3906905000

- Product Description: Acrylic resin optical material, which is considered a primary form of acrylic resin.

- Classification Basis: This code is specifically for acrylic resins in their primary form, used in optical applications.

📊 Tariff Rates and Policy Notes:

- Base Tariff Rate: 4.2%

- Additional Tariffs (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Policy Notes:

- April 11 Special Tariff: A 30.0% additional tariff is imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for this product category.

- No Specific Tariff on Aluminum or Iron: This product is not subject to additional tariffs related to aluminum or iron.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in its primary form and not processed or compounded with other materials, as this could affect classification.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., optical performance, safety, or environmental compliance) are required for import.

- Monitor Policy Updates: Stay updated on any changes in tariff policies, especially the April 11, 2025, deadline for the special tariff.

- Consult Customs Broker: For complex classifications or large shipments, consider consulting a customs broker or expert for accurate compliance.

Let me know if you need help with customs documentation or further classification details.

Product Name: Acrylic Resin Optical Material

Classification: HS Code 3906905000

🔍 HS Code and Classification Details:

- HS CODE: 3906905000

- Product Description: Acrylic resin optical material, which is considered a primary form of acrylic resin.

- Classification Basis: This code is specifically for acrylic resins in their primary form, used in optical applications.

📊 Tariff Rates and Policy Notes:

- Base Tariff Rate: 4.2%

- Additional Tariffs (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.2%

⚠️ Important Policy Notes:

- April 11 Special Tariff: A 30.0% additional tariff is imposed on imports after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for this product category.

- No Specific Tariff on Aluminum or Iron: This product is not subject to additional tariffs related to aluminum or iron.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed in its primary form and not processed or compounded with other materials, as this could affect classification.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., optical performance, safety, or environmental compliance) are required for import.

- Monitor Policy Updates: Stay updated on any changes in tariff policies, especially the April 11, 2025, deadline for the special tariff.

- Consult Customs Broker: For complex classifications or large shipments, consider consulting a customs broker or expert for accurate compliance.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.