| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907610010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610010 | Doc | 61.5% | CN | US | 2025-05-12 |

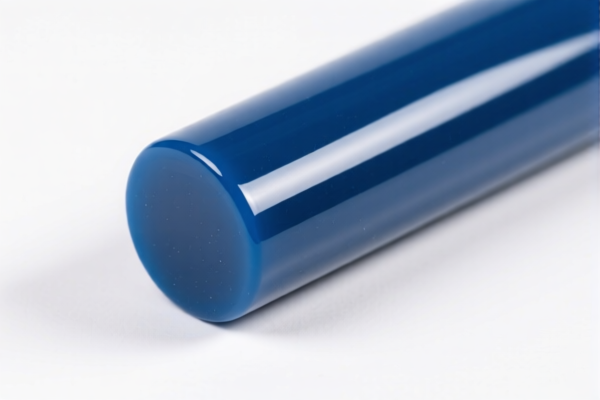

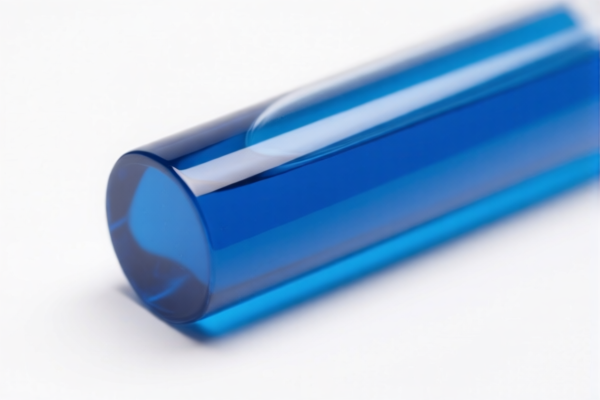

Product Name: Acrylic Resin Pharmaceutical Grade Material

HS CODE Classification: Based on the provided data, the product falls under the following HS codes:

✅ HS CODE: 3907610010

Description:

- Applies to acrylic resin in its primary polymer form, including pharmaceutical-grade materials.

- This code is used for both raw materials and industrial-grade acrylic resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3907690010

Description:

- Applies to industrial-grade acrylic resins in their primary polymer form.

- This code is for non-pharmaceutical, industrial applications.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3907690050

Description:

- Applies to industrial-grade acrylic resins in their primary polymer form.

- This code is for specific types of industrial resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic resins in this context. However, always verify with local customs authorities for any recent updates. -

Certifications Required:

For pharmaceutical-grade materials, ensure compliance with relevant standards (e.g., GMP, ISO, FDA, or local equivalents). This may affect classification and tax treatment. -

Material and Unit Price Verification:

Confirm the exact chemical composition and intended use of the acrylic resin, as this can influence the correct HS code and applicable tariffs. -

Customs Declaration Accuracy:

Use the correct HS code based on the product's end use (pharmaceutical vs. industrial) and material form (raw polymer vs. processed resin).

🛑 Action Required:

- Confirm the exact HS code based on the product's specifications and end use.

- Check for any new regulations or policy updates from customs authorities.

- Ensure certifications and documentation are in place for pharmaceutical-grade materials.

Let me know if you need help with customs documentation or further classification details.

Product Name: Acrylic Resin Pharmaceutical Grade Material

HS CODE Classification: Based on the provided data, the product falls under the following HS codes:

✅ HS CODE: 3907610010

Description:

- Applies to acrylic resin in its primary polymer form, including pharmaceutical-grade materials.

- This code is used for both raw materials and industrial-grade acrylic resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3907690010

Description:

- Applies to industrial-grade acrylic resins in their primary polymer form.

- This code is for non-pharmaceutical, industrial applications.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

✅ HS CODE: 3907690050

Description:

- Applies to industrial-grade acrylic resins in their primary polymer form.

- This code is for specific types of industrial resins.

Tariff Breakdown:

- Base Tariff Rate: 6.5%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

📌 Key Notes and Recommendations:

-

April 11, 2025 Special Tariff:

A 30% additional tariff will be applied after April 11, 2025. Ensure your customs clearance is completed before this date to avoid higher costs. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic resins in this context. However, always verify with local customs authorities for any recent updates. -

Certifications Required:

For pharmaceutical-grade materials, ensure compliance with relevant standards (e.g., GMP, ISO, FDA, or local equivalents). This may affect classification and tax treatment. -

Material and Unit Price Verification:

Confirm the exact chemical composition and intended use of the acrylic resin, as this can influence the correct HS code and applicable tariffs. -

Customs Declaration Accuracy:

Use the correct HS code based on the product's end use (pharmaceutical vs. industrial) and material form (raw polymer vs. processed resin).

🛑 Action Required:

- Confirm the exact HS code based on the product's specifications and end use.

- Check for any new regulations or policy updates from customs authorities.

- Ensure certifications and documentation are in place for pharmaceutical-grade materials.

Let me know if you need help with customs documentation or further classification details.

Customer Reviews

No reviews yet.