| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3704000000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3701996060 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3701996030 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3701300000 | Doc | 55.0% | CN | US | 2025-05-12 |

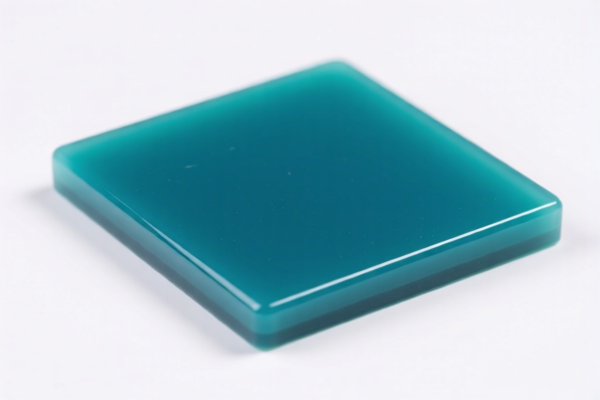

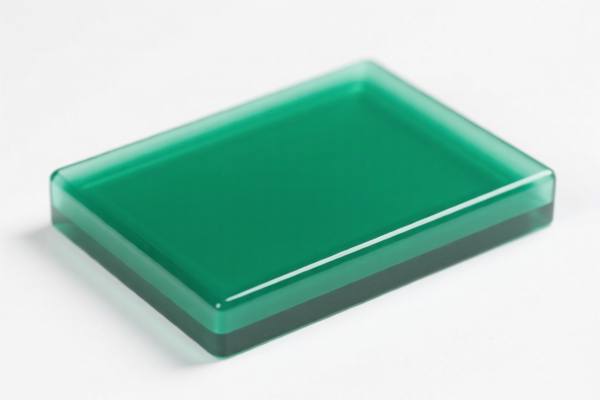

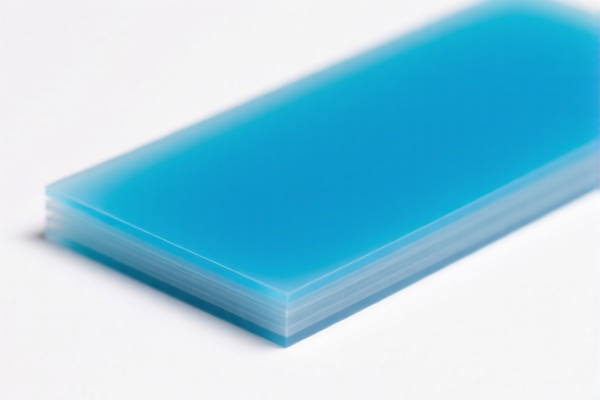

Product Name: Acrylic Resin Photosensitive Material

Classification HS Code: 3906100000

✅ HS CODE: 3906100000

Description: Acrylic resin material for polymethyl methacrylate (PMMA)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-dumping duties currently apply to this product category.

- No specific anti-dumping duties on iron or aluminum are relevant here, as this is a polymer-based material.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of acrylic resin (PMMA) and not a composite or modified version that might fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially regarding the April 11, 2025, tariff increase.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Comparison with Other HS Codes (for reference):

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3704000000 | Exposed but unprocessed photographic films | 55.0% | No base tariff |

| 3701996060 | Flat photographic films, non-paper | 55.0% | No base tariff |

| 3701996030 | Artistic graphic films, unexposed | 55.0% | No base tariff |

| 3701300000 | Large-format photographic films | 55.0% | No base tariff |

Note: These other HS codes are for photographic materials, not acrylic resin. Ensure your product is correctly classified under 3906100000 to avoid misclassification penalties.

If you have further details about the product (e.g., specific use, packaging, or origin), I can provide a more tailored analysis.

Product Name: Acrylic Resin Photosensitive Material

Classification HS Code: 3906100000

✅ HS CODE: 3906100000

Description: Acrylic resin material for polymethyl methacrylate (PMMA)

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 6.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

⚠️ Important Notes:

- April 11 Special Tariff: A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total tax burden.

- No Anti-dumping duties currently apply to this product category.

- No specific anti-dumping duties on iron or aluminum are relevant here, as this is a polymer-based material.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is indeed made of acrylic resin (PMMA) and not a composite or modified version that might fall under a different HS code.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., RoHS, REACH, or specific customs documentation) are required for import.

- Monitor Tariff Updates: Keep track of any changes in customs policies, especially regarding the April 11, 2025, tariff increase.

- Consult a Customs Broker: For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

📊 Comparison with Other HS Codes (for reference):

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 3704000000 | Exposed but unprocessed photographic films | 55.0% | No base tariff |

| 3701996060 | Flat photographic films, non-paper | 55.0% | No base tariff |

| 3701996030 | Artistic graphic films, unexposed | 55.0% | No base tariff |

| 3701300000 | Large-format photographic films | 55.0% | No base tariff |

Note: These other HS codes are for photographic materials, not acrylic resin. Ensure your product is correctly classified under 3906100000 to avoid misclassification penalties.

If you have further details about the product (e.g., specific use, packaging, or origin), I can provide a more tailored analysis.

Customer Reviews

No reviews yet.