| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

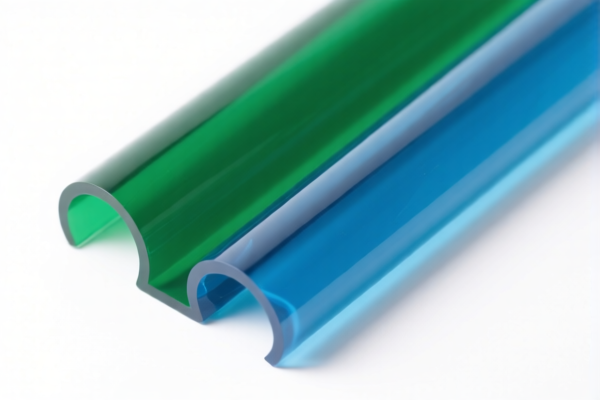

Here is the structured analysis and customs compliance guidance for the Acrylic Resin Thermoplastic Material based on the provided HS codes and tax details:

✅ Product Classification Overview

The product "Acrylic Resin Thermoplastic Material" falls under several HS codes, depending on its specific form and composition. The most relevant HS codes are:

- 3906100000 – Poly(methyl methacrylate) (PMMA)

- 3906902000 – Other acrylic resins (primary forms)

- 3907610050 – Other thermoplastic materials (e.g., acrylic polymers not of specific viscosity)

📊 Tariff Summary (as of now)

All listed HS codes share the following tariff structure:

- Base Tariff Rate: 6.3% to 6.5% (varies slightly by code)

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs declarations.

📌 Key Tax Rate Changes

- Base Tariff: 6.3% (3906100000, 3906902000) or 6.5% (3907610050)

- Additional Tariff: 25.0% (applies to all)

- April 11 Special Tariff: 30.0% (applies to all, effective after April 11, 2025)

📌 Total Tax Rate: 61.3% to 61.5% (depending on the HS code)

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum: Not applicable for acrylic resins.

- Other Materials: No specific anti-dumping duties are listed for acrylic resins in the provided data.

📌 Proactive Compliance Advice

- Verify Material Specifications: Confirm whether the product is PMMA (3906100000), other acrylic resins (3906902000), or a different thermoplastic (3907610050).

- Check Unit Price and Composition: Tariff classification may change based on the exact chemical structure or viscosity.

- Certifications Required: Ensure compliance with any required documentation (e.g., Material Safety Data Sheets, import permits, or technical specifications).

- Plan for April 11, 2025: If importing after this date, budget for the 30.0% additional tariff to avoid unexpected costs.

📌 Recommendation

For accurate classification, it is recommended to: - Provide a detailed product description, including chemical name, viscosity, and intended use. - Consult with a customs broker or classification expert if the product is not clearly defined in the HS code list.

Let me know if you need help with a specific product description or customs documentation. Here is the structured analysis and customs compliance guidance for the Acrylic Resin Thermoplastic Material based on the provided HS codes and tax details:

✅ Product Classification Overview

The product "Acrylic Resin Thermoplastic Material" falls under several HS codes, depending on its specific form and composition. The most relevant HS codes are:

- 3906100000 – Poly(methyl methacrylate) (PMMA)

- 3906902000 – Other acrylic resins (primary forms)

- 3907610050 – Other thermoplastic materials (e.g., acrylic polymers not of specific viscosity)

📊 Tariff Summary (as of now)

All listed HS codes share the following tariff structure:

- Base Tariff Rate: 6.3% to 6.5% (varies slightly by code)

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and must be considered in cost planning and customs declarations.

📌 Key Tax Rate Changes

- Base Tariff: 6.3% (3906100000, 3906902000) or 6.5% (3907610050)

- Additional Tariff: 25.0% (applies to all)

- April 11 Special Tariff: 30.0% (applies to all, effective after April 11, 2025)

📌 Total Tax Rate: 61.3% to 61.5% (depending on the HS code)

🛑 Anti-Dumping Duties (if applicable)

- Iron and Aluminum: Not applicable for acrylic resins.

- Other Materials: No specific anti-dumping duties are listed for acrylic resins in the provided data.

📌 Proactive Compliance Advice

- Verify Material Specifications: Confirm whether the product is PMMA (3906100000), other acrylic resins (3906902000), or a different thermoplastic (3907610050).

- Check Unit Price and Composition: Tariff classification may change based on the exact chemical structure or viscosity.

- Certifications Required: Ensure compliance with any required documentation (e.g., Material Safety Data Sheets, import permits, or technical specifications).

- Plan for April 11, 2025: If importing after this date, budget for the 30.0% additional tariff to avoid unexpected costs.

📌 Recommendation

For accurate classification, it is recommended to: - Provide a detailed product description, including chemical name, viscosity, and intended use. - Consult with a customs broker or classification expert if the product is not clearly defined in the HS code list.

Let me know if you need help with a specific product description or customs documentation.

Customer Reviews

No reviews yet.