| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Acrylic Resin Vacuum Coating Material, based on the provided HS codes and tariff details:

✅ HS CODE: 3906100000

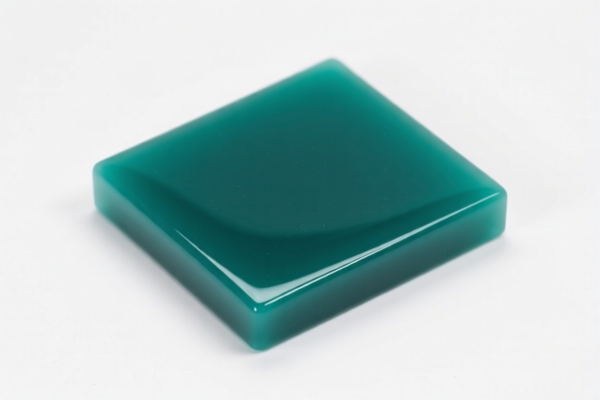

Product Description: Polymethyl methacrylate (PMMA), applicable to acrylic resin.

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This code is for pure acrylic resin (PMMA), not for coatings or finished products.

✅ HS CODE: 3906902000

Product Description: Other acrylic resins (primary form), applicable to acrylic resin coatings.

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This code is for other acrylic resins in primary form, suitable for coating applications.

✅ HS CODE: 3907610050

Product Description: Other polyesters, applicable to acrylic resin films, composites, and injection-molded resins.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for other polyesters, including films, composites, and injection-molded resins.

✅ HS CODE: 3920591000

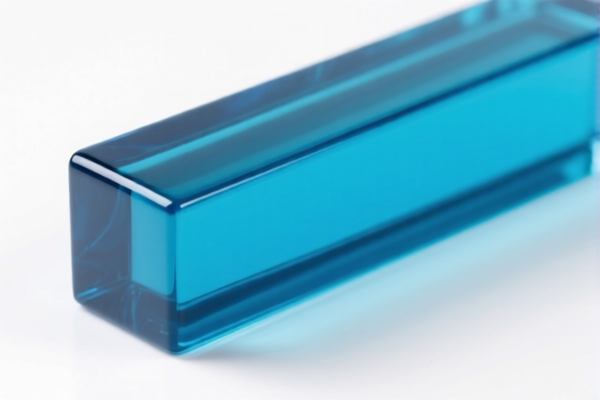

Product Description: Sheets, plates, films, foils, and strips, applicable to acrylic transparent films.

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: This code is for finished acrylic films or sheets, suitable for transparent applications.

📌 Important Notes and Recommendations:

- Tariff Increase Alert: All the above HS codes are subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Material Verification: Confirm the exact chemical composition and form of the acrylic resin (e.g., PMMA, primary form, or finished product) to ensure correct HS code selection.

- Certifications Required: Check if customs documentation, product certifications, or origin declarations are needed for compliance.

- Unit Price Review: Verify the unit price and product classification to avoid misclassification penalties.

If you need further assistance with customs documentation or HS code verification, feel free to provide more product details. Here is the structured classification and tariff information for Acrylic Resin Vacuum Coating Material, based on the provided HS codes and tariff details:

✅ HS CODE: 3906100000

Product Description: Polymethyl methacrylate (PMMA), applicable to acrylic resin.

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This code is for pure acrylic resin (PMMA), not for coatings or finished products.

✅ HS CODE: 3906902000

Product Description: Other acrylic resins (primary form), applicable to acrylic resin coatings.

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This code is for other acrylic resins in primary form, suitable for coating applications.

✅ HS CODE: 3907610050

Product Description: Other polyesters, applicable to acrylic resin films, composites, and injection-molded resins.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for other polyesters, including films, composites, and injection-molded resins.

✅ HS CODE: 3920591000

Product Description: Sheets, plates, films, foils, and strips, applicable to acrylic transparent films.

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.0%

- Notes: This code is for finished acrylic films or sheets, suitable for transparent applications.

📌 Important Notes and Recommendations:

- Tariff Increase Alert: All the above HS codes are subject to an additional 30% tariff after April 11, 2025. Ensure your import timeline aligns with this policy.

- Material Verification: Confirm the exact chemical composition and form of the acrylic resin (e.g., PMMA, primary form, or finished product) to ensure correct HS code selection.

- Certifications Required: Check if customs documentation, product certifications, or origin declarations are needed for compliance.

- Unit Price Review: Verify the unit price and product classification to avoid misclassification penalties.

If you need further assistance with customs documentation or HS code verification, feel free to provide more product details.

Customer Reviews

No reviews yet.