| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906905000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3907610010 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907690050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3907610050 | Doc | 61.5% | CN | US | 2025-05-12 |

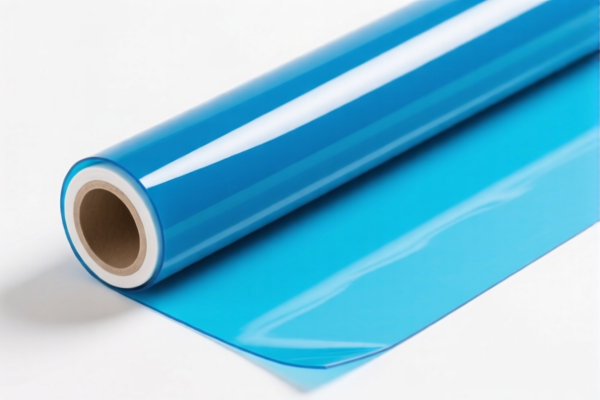

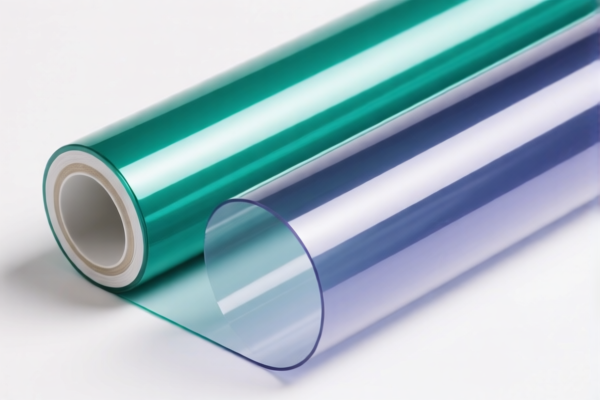

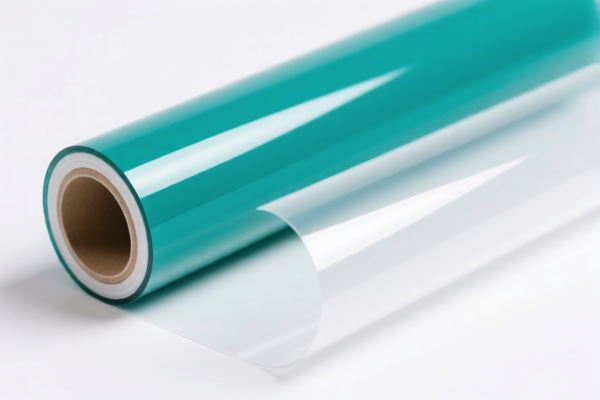

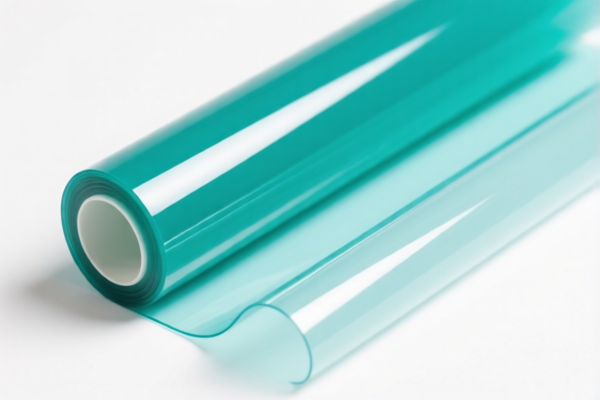

Product Name: Acrylic Self Adhesive Film

Classification: Plastic and Articles of Plastic (Chapter 39)

✅ HS CODE Classification Overview

Below are the possible HS codes and associated tax rates for Acrylic Self Adhesive Film, based on the provided data:

🔢 HS CODE: 3906902000

Description: Acrylic resin film or adhesive in its primary form.

Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3906905000

Description: Acrylic resin film or adhesive in its primary form.

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3907610010

Description: Acrylic resin adhesive in its primary form.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3907690050

Description: Acrylic resin film, categorized under plastics and plastic articles.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3907610050

Description: Acrylic resin adhesive in its primary form.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the acrylic adhesive film (e.g., whether it is a film or adhesive, and whether it contains other additives).

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may use this to determine the correct classification.

- Anti-dumping duties: While not specified in the data, be aware that anti-dumping duties may apply depending on the country of origin and product specifics.

📌 Proactive Advice

- Consult a customs broker or tax authority for the most up-to-date classification and duty rates.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

- Monitor policy updates related to April 11, 2025 and any new trade agreements or tariffs.

Let me know if you need help determining the most accurate HS code for your specific product.

Product Name: Acrylic Self Adhesive Film

Classification: Plastic and Articles of Plastic (Chapter 39)

✅ HS CODE Classification Overview

Below are the possible HS codes and associated tax rates for Acrylic Self Adhesive Film, based on the provided data:

🔢 HS CODE: 3906902000

Description: Acrylic resin film or adhesive in its primary form.

Total Tax Rate: 61.3%

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3906905000

Description: Acrylic resin film or adhesive in its primary form.

Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3907610010

Description: Acrylic resin adhesive in its primary form.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3907690050

Description: Acrylic resin film, categorized under plastics and plastic articles.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

🔢 HS CODE: 3907610050

Description: Acrylic resin adhesive in its primary form.

Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Anti-dumping duties: Not specified for this code.

⚠️ Important Notes and Recommendations

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be imposed after this date. Ensure your import timeline is planned accordingly.

- Material Verification: Confirm the exact composition of the acrylic adhesive film (e.g., whether it is a film or adhesive, and whether it contains other additives).

- Certifications: Check if any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Unit Price: Verify the unit price and quantity for accurate tax calculation, as customs may use this to determine the correct classification.

- Anti-dumping duties: While not specified in the data, be aware that anti-dumping duties may apply depending on the country of origin and product specifics.

📌 Proactive Advice

- Consult a customs broker or tax authority for the most up-to-date classification and duty rates.

- Keep documentation (e.g., product specifications, invoices, and certificates) ready for customs inspection.

- Monitor policy updates related to April 11, 2025 and any new trade agreements or tariffs.

Let me know if you need help determining the most accurate HS code for your specific product.

Customer Reviews

No reviews yet.