| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

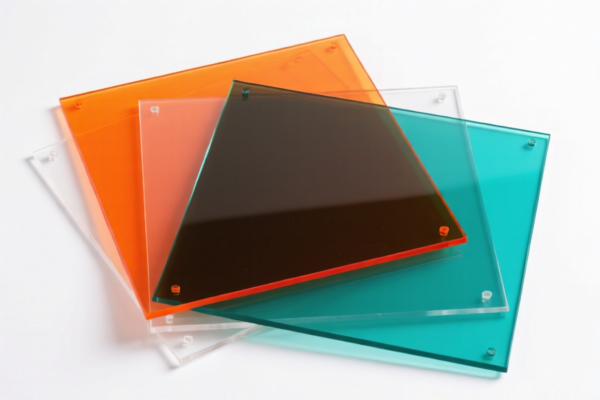

Product Classification: Acrylic Sheets for Advertising

HS CODE: 3920594000 (Primary classification for acrylic sheets)

🔍 Classification Summary:

- HS CODE: 3920594000

- Description: Acrylic polymer sheets, plates, films, foils, and strips.

- Applicable to: Acrylic sheets used in advertising (e.g., for signage, displays, etc.)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation. -

Anti-dumping duties:

Not applicable for acrylic sheets unless specific anti-dumping measures are in place for this product category (check with customs or trade authorities for updates).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the acrylic sheets are made from poly(methyl methacrylate) (PMMA) or similar polymers to confirm correct classification under HS CODE 3920594000.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, environmental compliance) are required for advertising use.

- Monitor Tariff Updates: Stay informed about April 11, 2025 policy changes and consider adjusting import timelines or seeking duty relief if applicable.

- Consider Alternative HS Codes: If your product includes fire retardants or other additives, it may fall under HS CODE 3920515050 (which has a higher base tariff of 6.5%).

📌 Alternative HS Code for Reference:

- HS CODE: 3920515050

- Description: Acrylic polymer sheets containing flame retardants.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

✅ Conclusion:

For standard acrylic sheets used in advertising, HS CODE 3920594000 is the most appropriate classification. Be mindful of the 30.0% special tariff after April 11, 2025, and ensure your product meets all customs and certification requirements.

Product Classification: Acrylic Sheets for Advertising

HS CODE: 3920594000 (Primary classification for acrylic sheets)

🔍 Classification Summary:

- HS CODE: 3920594000

- Description: Acrylic polymer sheets, plates, films, foils, and strips.

- Applicable to: Acrylic sheets used in advertising (e.g., for signage, displays, etc.)

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⚠️ Important Notes:

-

April 11 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost of importation. -

Anti-dumping duties:

Not applicable for acrylic sheets unless specific anti-dumping measures are in place for this product category (check with customs or trade authorities for updates).

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the acrylic sheets are made from poly(methyl methacrylate) (PMMA) or similar polymers to confirm correct classification under HS CODE 3920594000.

- Check Unit Price and Certification: Confirm whether any certifications (e.g., fire resistance, environmental compliance) are required for advertising use.

- Monitor Tariff Updates: Stay informed about April 11, 2025 policy changes and consider adjusting import timelines or seeking duty relief if applicable.

- Consider Alternative HS Codes: If your product includes fire retardants or other additives, it may fall under HS CODE 3920515050 (which has a higher base tariff of 6.5%).

📌 Alternative HS Code for Reference:

- HS CODE: 3920515050

- Description: Acrylic polymer sheets containing flame retardants.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff (after April 11, 2025): 30.0%

✅ Conclusion:

For standard acrylic sheets used in advertising, HS CODE 3920594000 is the most appropriate classification. Be mindful of the 30.0% special tariff after April 11, 2025, and ensure your product meets all customs and certification requirements.

Customer Reviews

No reviews yet.