| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3906100000 | Doc | 61.3% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for Acrylic Sheets for Building:

📦 Product Classification Overview

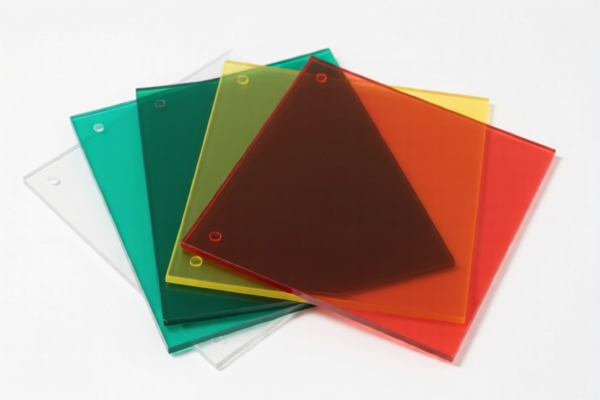

All the listed products fall under Chapter 39 of the HS code, which covers Plastics and articles thereof. Specifically, they are classified under 3920 (Plastics and articles thereof, of polymethyl methacrylate (PMMA), also known as acrylic).

📊 HS Code Breakdown with Tax Rates

1. 3920515050 - 亚克力建筑板材 (Acrylic Building Sheets)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for specific types of acrylic building sheets.

2. 3920598000 - 亚克力建筑板 (Acrylic Building Board)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a broader category for acrylic building boards.

3. 3920594000 - 建筑级亚克力板材 (Building-Grade Acrylic Sheets)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This code may be more favorable for building-grade acrylic sheets, possibly due to specific technical or quality classifications.

4. 3906902000 - 亚克力树脂板材 (Acrylic Resin Sheets)

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This code is for acrylic resin sheets, which may be used in manufacturing processes.

5. 3906100000 - 亚克力板材原料 (Acrylic Sheet Raw Material)

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This is for raw materials used in the production of acrylic sheets.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic products in this context, but it's advisable to check for any ongoing investigations or duties related to your specific product origin. -

Material and Certification Requirements:

Ensure that the product meets building standards and certifications (e.g., fire resistance, UV resistance, etc.) required by the importing country.

✅ Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the product is classified as "building-grade" or "general use" as this can affect the applicable HS code and tax rate.

- Check Unit Price and Quantity: Tariff rates can vary based on the unit price and quantity of the goods, especially under preferential trade agreements.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline or has multiple uses.

- Stay Updated on Tariff Changes: Monitor any updates after April 11, 2025, as the additional tariff may significantly impact your import costs.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools. Here is the structured and professional breakdown of the HS codes and associated tariffs for Acrylic Sheets for Building:

📦 Product Classification Overview

All the listed products fall under Chapter 39 of the HS code, which covers Plastics and articles thereof. Specifically, they are classified under 3920 (Plastics and articles thereof, of polymethyl methacrylate (PMMA), also known as acrylic).

📊 HS Code Breakdown with Tax Rates

1. 3920515050 - 亚克力建筑板材 (Acrylic Building Sheets)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for specific types of acrylic building sheets.

2. 3920598000 - 亚克力建筑板 (Acrylic Building Board)

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a broader category for acrylic building boards.

3. 3920594000 - 建筑级亚克力板材 (Building-Grade Acrylic Sheets)

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

- Notes: This code may be more favorable for building-grade acrylic sheets, possibly due to specific technical or quality classifications.

4. 3906902000 - 亚克力树脂板材 (Acrylic Resin Sheets)

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This code is for acrylic resin sheets, which may be used in manufacturing processes.

5. 3906100000 - 亚克力板材原料 (Acrylic Sheet Raw Material)

- Base Tariff Rate: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.3%

- Notes: This is for raw materials used in the production of acrylic sheets.

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning. -

Anti-Dumping Duties:

No specific anti-dumping duties are mentioned for acrylic products in this context, but it's advisable to check for any ongoing investigations or duties related to your specific product origin. -

Material and Certification Requirements:

Ensure that the product meets building standards and certifications (e.g., fire resistance, UV resistance, etc.) required by the importing country.

✅ Proactive Advice for Importers

- Verify Material Specifications: Confirm whether the product is classified as "building-grade" or "general use" as this can affect the applicable HS code and tax rate.

- Check Unit Price and Quantity: Tariff rates can vary based on the unit price and quantity of the goods, especially under preferential trade agreements.

- Consult Customs Broker: For accurate classification and compliance, especially if the product is borderline or has multiple uses.

- Stay Updated on Tariff Changes: Monitor any updates after April 11, 2025, as the additional tariff may significantly impact your import costs.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.