| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920591000 | Doc | 61.0% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 9405116010 | Doc | 62.6% | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Acrylic Sheets for Lighting, based on the provided HS codes and tax details:

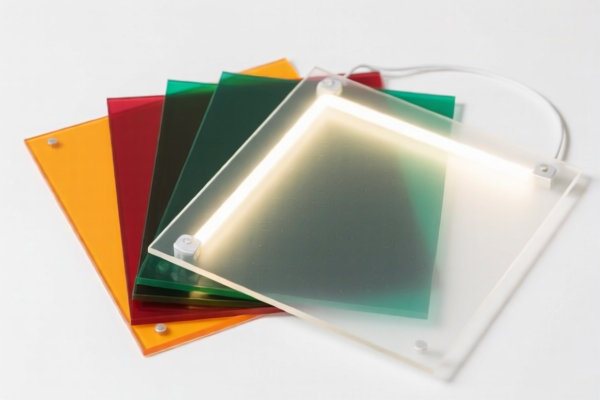

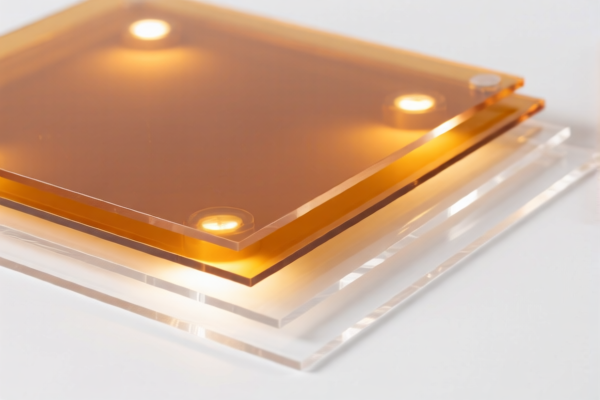

✅ HS CODE: 3920591000

Product Description: Acrylic Lighting Sheets

Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for acrylic sheets used in lighting applications.

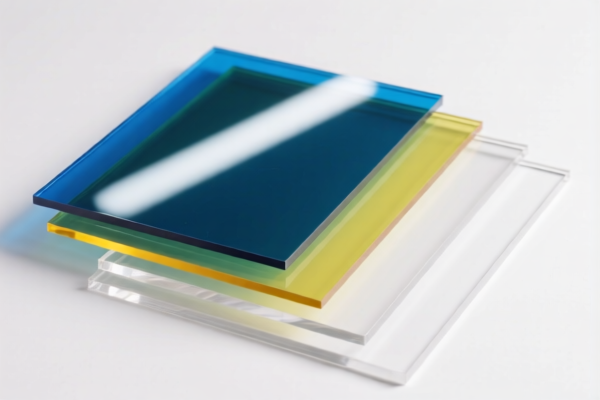

✅ HS CODE: 3920515050

Product Description: Acrylic Light Box Panels

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to acrylic sheets used in light boxes or signage.

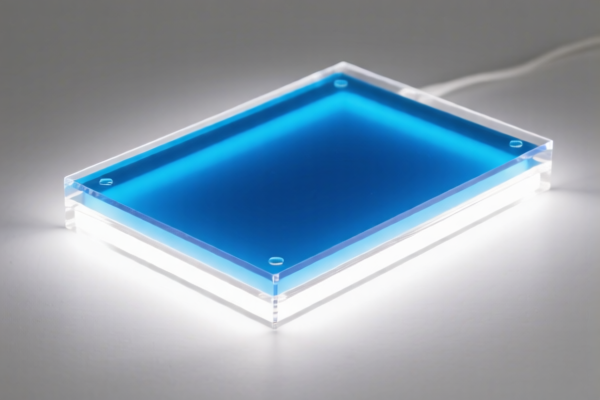

✅ HS CODE: 9405116010

Product Description: Acrylic Lighting Fixtures

Total Tax Rate: 62.6%

- Base Tariff Rate: 7.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for finished acrylic lighting products, such as lamps or light panels.

✅ HS CODE: 3926909989

Product Description: General Acrylic Sheets (Not for Lighting)

Total Tax Rate: 42.8%

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general-purpose acrylic sheets, not specifically for lighting.

⚠️ Important Notes:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

-

Anti-Dumping Duties: Not explicitly mentioned in the data, but be aware that anti-dumping duties on iron and aluminum may apply if the product is made from these materials. Confirm with customs or a compliance expert if applicable.

-

Certifications Required: Ensure your product meets any import certifications (e.g., RoHS, REACH, or specific lighting safety standards) depending on the destination country.

🛠️ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and pricing of the acrylic sheets, as this can affect classification and tax rates.

- Check for Updates: Monitor any changes in HS code classifications or tariff rates, especially after April 11, 2025.

- Consult Customs Authority: For high-value or complex imports, consult with local customs or a customs broker to ensure compliance.

Let me know if you need help with classification based on product specifications or documentation. Here is the structured classification and tariff information for Acrylic Sheets for Lighting, based on the provided HS codes and tax details:

✅ HS CODE: 3920591000

Product Description: Acrylic Lighting Sheets

Total Tax Rate: 61.0%

- Base Tariff Rate: 6.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specifically for acrylic sheets used in lighting applications.

✅ HS CODE: 3920515050

Product Description: Acrylic Light Box Panels

Total Tax Rate: 61.5%

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to acrylic sheets used in light boxes or signage.

✅ HS CODE: 9405116010

Product Description: Acrylic Lighting Fixtures

Total Tax Rate: 62.6%

- Base Tariff Rate: 7.6%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is for finished acrylic lighting products, such as lamps or light panels.

✅ HS CODE: 3926909989

Product Description: General Acrylic Sheets (Not for Lighting)

Total Tax Rate: 42.8%

- Base Tariff Rate: 5.3%

- Additional Tariff: 7.5%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code applies to general-purpose acrylic sheets, not specifically for lighting.

⚠️ Important Notes:

-

April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied to all the above products after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

-

Anti-Dumping Duties: Not explicitly mentioned in the data, but be aware that anti-dumping duties on iron and aluminum may apply if the product is made from these materials. Confirm with customs or a compliance expert if applicable.

-

Certifications Required: Ensure your product meets any import certifications (e.g., RoHS, REACH, or specific lighting safety standards) depending on the destination country.

🛠️ Proactive Advice:

- Verify Material and Unit Price: Confirm the exact composition and pricing of the acrylic sheets, as this can affect classification and tax rates.

- Check for Updates: Monitor any changes in HS code classifications or tariff rates, especially after April 11, 2025.

- Consult Customs Authority: For high-value or complex imports, consult with local customs or a customs broker to ensure compliance.

Let me know if you need help with classification based on product specifications or documentation.

Customer Reviews

No reviews yet.