| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920594000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3906902000 | Doc | 61.3% | CN | US | 2025-05-12 |

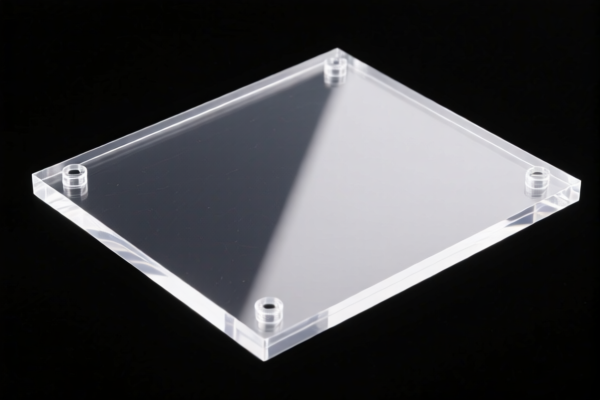

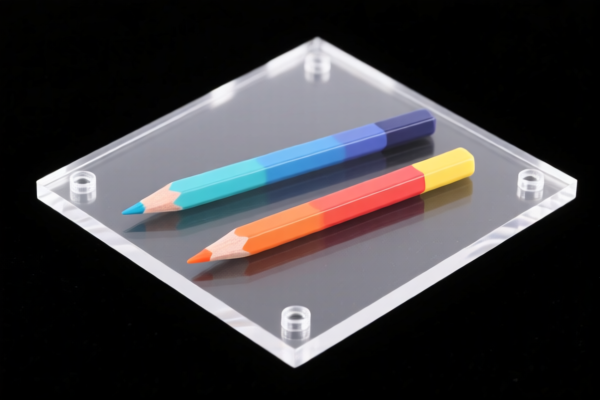

Here is the structured analysis and classification for the "Acrylic Transparent Lead Plate" based on the provided HS codes and tariff details:

✅ Product Classification Overview:

- Product Name: Acrylic Transparent Lead Plate

- HS Code Options:

- 3920594000 – Acrylic Transparent Plate Containing Lead

- 3920598000 – Acrylic Transparent Plate

- 3920515050 – Acrylic Transparent Plate

- 3906902000 – Acrylic Resin Transparent Sheet

📊 Tariff Summary (as of now):

1. HS Code: 3920594000

- Description: Acrylic Transparent Plate Containing Lead

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to lead-containing acrylic plates, which may be subject to additional regulations due to the presence of lead.

2. HS Code: 3920598000

- Description: Acrylic Transparent Plate

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

3. HS Code: 3920515050

- Description: Acrylic Transparent Plate

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

4. HS Code: 3906902000

- Description: Acrylic Resin Transparent Sheet

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff:

- All four HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and should be considered in import planning.

-

Anti-Dumping Duties:

- If the product is imported from countries under anti-dumping measures (e.g., certain countries for iron or aluminum products), additional anti-dumping duties may apply.

-

Verify the origin of the product and check for any anti-dumping investigations or quotas.

-

Lead Content Regulations:

- For HS Code 3920594000, the presence of lead may trigger environmental or safety regulations.

- Ensure compliance with REACH, RoHS, or other relevant standards if exporting to the EU or other strict regulatory regions.

🛠️ Proactive Advice for Importers:

- Verify Material Composition:

-

Confirm whether the product contains lead or other restricted substances. This will determine the correct HS code and applicable regulations.

-

Check Unit Price and Certification Requirements:

-

Some HS codes may require certifications (e.g., safety, environmental compliance) or product testing to qualify for lower tariffs.

-

Monitor Tariff Updates:

-

Keep track of tariff changes after April 11, 2025, and consider early import planning to avoid unexpected costs.

-

Consult Customs Broker or Trade Compliance Specialist:

- For complex cases, especially involving hazardous materials or special tariffs, it is advisable to seek professional guidance.

Let me know if you need help determining the correct HS code based on your product's material, thickness, or intended use. Here is the structured analysis and classification for the "Acrylic Transparent Lead Plate" based on the provided HS codes and tariff details:

✅ Product Classification Overview:

- Product Name: Acrylic Transparent Lead Plate

- HS Code Options:

- 3920594000 – Acrylic Transparent Plate Containing Lead

- 3920598000 – Acrylic Transparent Plate

- 3920515050 – Acrylic Transparent Plate

- 3906902000 – Acrylic Resin Transparent Sheet

📊 Tariff Summary (as of now):

1. HS Code: 3920594000

- Description: Acrylic Transparent Plate Containing Lead

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Note: This code is specific to lead-containing acrylic plates, which may be subject to additional regulations due to the presence of lead.

2. HS Code: 3920598000

- Description: Acrylic Transparent Plate

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

3. HS Code: 3920515050

- Description: Acrylic Transparent Plate

- Total Tax Rate: 61.5%

- Breakdown:

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

4. HS Code: 3906902000

- Description: Acrylic Resin Transparent Sheet

- Total Tax Rate: 61.3%

- Breakdown:

- Base Tariff: 6.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff:

- All four HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

-

This is a time-sensitive policy and should be considered in import planning.

-

Anti-Dumping Duties:

- If the product is imported from countries under anti-dumping measures (e.g., certain countries for iron or aluminum products), additional anti-dumping duties may apply.

-

Verify the origin of the product and check for any anti-dumping investigations or quotas.

-

Lead Content Regulations:

- For HS Code 3920594000, the presence of lead may trigger environmental or safety regulations.

- Ensure compliance with REACH, RoHS, or other relevant standards if exporting to the EU or other strict regulatory regions.

🛠️ Proactive Advice for Importers:

- Verify Material Composition:

-

Confirm whether the product contains lead or other restricted substances. This will determine the correct HS code and applicable regulations.

-

Check Unit Price and Certification Requirements:

-

Some HS codes may require certifications (e.g., safety, environmental compliance) or product testing to qualify for lower tariffs.

-

Monitor Tariff Updates:

-

Keep track of tariff changes after April 11, 2025, and consider early import planning to avoid unexpected costs.

-

Consult Customs Broker or Trade Compliance Specialist:

- For complex cases, especially involving hazardous materials or special tariffs, it is advisable to seek professional guidance.

Let me know if you need help determining the correct HS code based on your product's material, thickness, or intended use.

Customer Reviews

No reviews yet.