| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3908902000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3909505000 | Doc | 61.3% | CN | US | 2025-05-12 |

| 3909390000 | Doc | 61.5% | CN | US | 2025-05-12 |

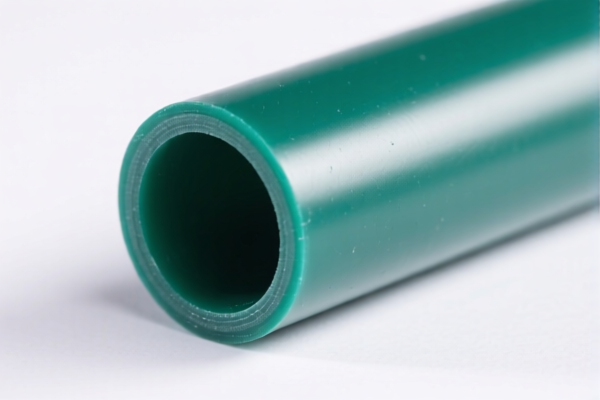

Product Name: Adhesive Grade Polyamide Raw Material

Classification: Based on the provided HS codes, the most likely classification for adhesive grade polyamide raw material is 3908902000.

✅ HS CODE: 3908902000

Description:

- Includes engineering-grade polyamide raw material, injection molding-grade polyamide, extrusion-grade polyamide, high-performance polyamide, and adhesive-grade polyamide resin, among others.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for this product.

- No Additional Tariffs on Specific Materials: Unlike some other HS codes, this one does not include specific anti-dumping duties or other material-specific tariffs.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed polyamide in its primary form and not a finished product or composite.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Monitor Tariff Changes: Keep an eye on the April 11, 2025 deadline to plan for potential cost increases.

- Consider Alternative HS Codes: If the product is a polyurethane adhesive raw material, consider 3909390000 or 3909505000 for more accurate classification.

📊 Comparison with Other HS Codes:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3908902000 | Polyamide, primary form (including adhesive grade) | 0.0% | 25.0% | 30.0% | 55.0% |

| 3909390000 | Polyurethane, primary form (adhesive grade) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3909505000 | Polyurethane, primary form (other) | 6.3% | 25.0% | 30.0% | 61.3% |

📌 Conclusion:

For adhesive-grade polyamide raw material, HS Code 3908902000 is the most appropriate classification. However, if the product is a polyurethane-based adhesive raw material, consider 3909390000 or 3909505000. Be mindful of the April 11, 2025 tariff increase and ensure proper documentation and classification.

Product Name: Adhesive Grade Polyamide Raw Material

Classification: Based on the provided HS codes, the most likely classification for adhesive grade polyamide raw material is 3908902000.

✅ HS CODE: 3908902000

Description:

- Includes engineering-grade polyamide raw material, injection molding-grade polyamide, extrusion-grade polyamide, high-performance polyamide, and adhesive-grade polyamide resin, among others.

🔍 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

⚠️ Important Notes:

- April 11 Special Tariff: A 30% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- No Anti-Dumping Duties Mentioned: No specific anti-dumping duties on iron or aluminum are applicable for this product.

- No Additional Tariffs on Specific Materials: Unlike some other HS codes, this one does not include specific anti-dumping duties or other material-specific tariffs.

📌 Proactive Advice for Importers:

- Verify Material Specifications: Ensure the product is indeed polyamide in its primary form and not a finished product or composite.

- Check Unit Price and Certification: Confirm the unit price and whether any certifications (e.g., REACH, RoHS, or customs documentation) are required for import.

- Monitor Tariff Changes: Keep an eye on the April 11, 2025 deadline to plan for potential cost increases.

- Consider Alternative HS Codes: If the product is a polyurethane adhesive raw material, consider 3909390000 or 3909505000 for more accurate classification.

📊 Comparison with Other HS Codes:

| HS Code | Description | Base Tariff | Additional Tariff | Special Tariff (after 2025.4.2) | Total Tax |

|---|---|---|---|---|---|

| 3908902000 | Polyamide, primary form (including adhesive grade) | 0.0% | 25.0% | 30.0% | 55.0% |

| 3909390000 | Polyurethane, primary form (adhesive grade) | 6.5% | 25.0% | 30.0% | 61.5% |

| 3909505000 | Polyurethane, primary form (other) | 6.3% | 25.0% | 30.0% | 61.3% |

📌 Conclusion:

For adhesive-grade polyamide raw material, HS Code 3908902000 is the most appropriate classification. However, if the product is a polyurethane-based adhesive raw material, consider 3909390000 or 3909505000. Be mindful of the April 11, 2025 tariff increase and ensure proper documentation and classification.

Customer Reviews

No reviews yet.