| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921901500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921902510 | Doc | 61.5% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Advertising Textile Reinforced Plastic Sheets, based on the provided HS codes and tax details:

✅ Product Classification Overview: Advertising Textile Reinforced Plastic Sheets

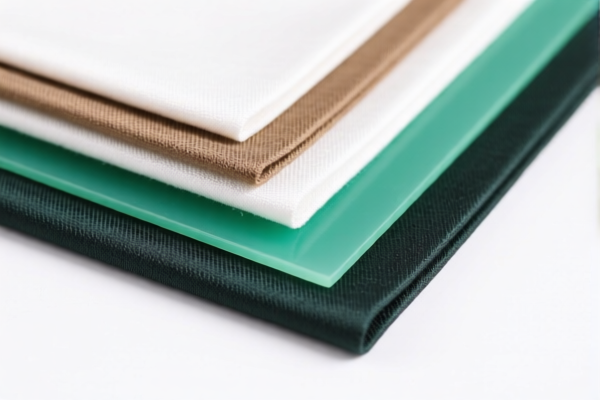

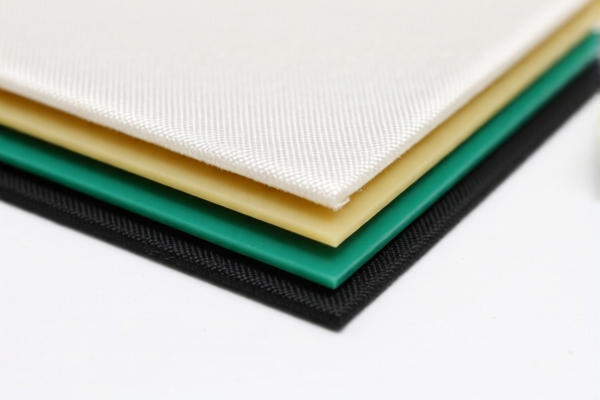

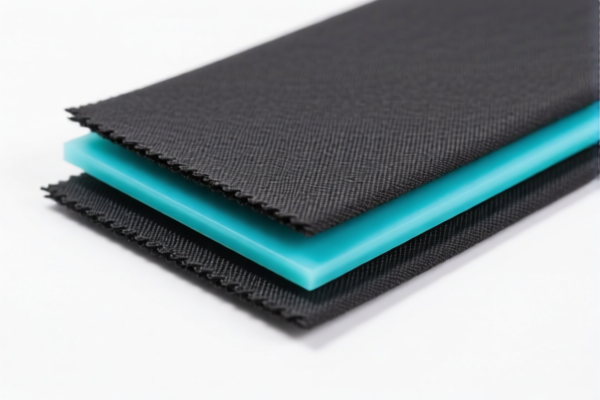

These products are composite materials made of plastic and textile components, with plastic content exceeding 70% by weight. They are used for advertising purposes, such as signage or displays.

📦 HS Code Classification and Tax Details

1. HS CODE: 3921902510

- Description: Textile-reinforced plastic sheets, where textile components are the main weight component, and any single textile fiber weight is less than synthetic fiber, with plastic content >70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is repeated in the input, but the classification remains the same.

2. HS CODE: 3921902550

- Description: Advertising plastic sheets with textile components, weight >1.492 kg/m², where synthetic fiber weight exceeds any other single textile fiber, and plastic content >70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is specific to advertising use and heavier composite materials.

3. HS CODE: 3921902900

- Description: Fiber-reinforced textile plastic sheets, composite with other materials, weight >1.492 kg/m².

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower base tariff compared to others, but still subject to the same additional tariffs.

4. HS CODE: 3921901500

- Description: Textile-supported plastic advertising boards, weight ≤1.492 kg/m², with synthetic fiber weight exceeding other textile fibers.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Designed for advertising, with lighter weight than 3921902550.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping or countervailing duties, especially for iron and aluminum-related products (though not directly applicable here, it's good to be aware).

- Material and Certification Requirements:

- Confirm the exact composition (plastic vs. textile weight).

- Verify if certifications (e.g., environmental, safety, or import permits) are required for the product type.

- Ensure unit price and weight per square meter are accurately documented for customs compliance.

📌 Proactive Advice for Importers

- Double-check the HS code based on material composition, weight, and intended use (e.g., advertising vs. general use).

- Track the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult with customs brokers or legal advisors to ensure full compliance with local and international trade regulations.

- Maintain detailed documentation on product specifications, including material breakdowns and certifications.

Let me know if you need help determining the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Advertising Textile Reinforced Plastic Sheets, based on the provided HS codes and tax details:

✅ Product Classification Overview: Advertising Textile Reinforced Plastic Sheets

These products are composite materials made of plastic and textile components, with plastic content exceeding 70% by weight. They are used for advertising purposes, such as signage or displays.

📦 HS Code Classification and Tax Details

1. HS CODE: 3921902510

- Description: Textile-reinforced plastic sheets, where textile components are the main weight component, and any single textile fiber weight is less than synthetic fiber, with plastic content >70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

- Note: This code is repeated in the input, but the classification remains the same.

2. HS CODE: 3921902550

- Description: Advertising plastic sheets with textile components, weight >1.492 kg/m², where synthetic fiber weight exceeds any other single textile fiber, and plastic content >70%.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: This code is specific to advertising use and heavier composite materials.

3. HS CODE: 3921902900

- Description: Fiber-reinforced textile plastic sheets, composite with other materials, weight >1.492 kg/m².

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Lower base tariff compared to others, but still subject to the same additional tariffs.

4. HS CODE: 3921901500

- Description: Textile-supported plastic advertising boards, weight ≤1.492 kg/m², with synthetic fiber weight exceeding other textile fibers.

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0%

- Note: Designed for advertising, with lighter weight than 3921902550.

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be accounted for in cost planning.

- Anti-dumping duties: Not explicitly mentioned in the data, but always verify if the product is subject to anti-dumping or countervailing duties, especially for iron and aluminum-related products (though not directly applicable here, it's good to be aware).

- Material and Certification Requirements:

- Confirm the exact composition (plastic vs. textile weight).

- Verify if certifications (e.g., environmental, safety, or import permits) are required for the product type.

- Ensure unit price and weight per square meter are accurately documented for customs compliance.

📌 Proactive Advice for Importers

- Double-check the HS code based on material composition, weight, and intended use (e.g., advertising vs. general use).

- Track the April 11, 2025 deadline to avoid unexpected cost increases.

- Consult with customs brokers or legal advisors to ensure full compliance with local and international trade regulations.

- Maintain detailed documentation on product specifications, including material breakdowns and certifications.

Let me know if you need help determining the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.