Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921131950 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921131500 | Doc | 61.5% | CN | US | 2025-05-12 |

| 4411139090 | Doc | 58.9% | CN | US | 2025-05-12 |

| 4413000000 | Doc | 58.7% | CN | US | 2025-05-12 |

| 4411932000 | Doc | 1.9¢/kg + 1.5%+55.0% | CN | US | 2025-05-12 |

Here is the structured classification and tariff information for Agricultural Composite Boards, based on the provided HS codes and tax details:

📦 Product Classification Overview: Agricultural Composite Boards

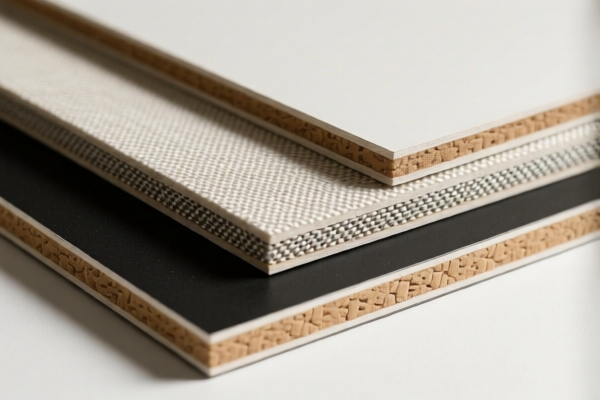

✅ HS CODE: 3921.13.19.50

- Description: Polyurethane textile composite agricultural boards.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to boards made of polyurethane and textile composites, classified under the "Other" category.

✅ HS CODE: 3921.13.15.00

- Description: Polyurethane textile composite agricultural boards, including those combined with other textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for similar products but with a slightly higher base tariff due to material composition.

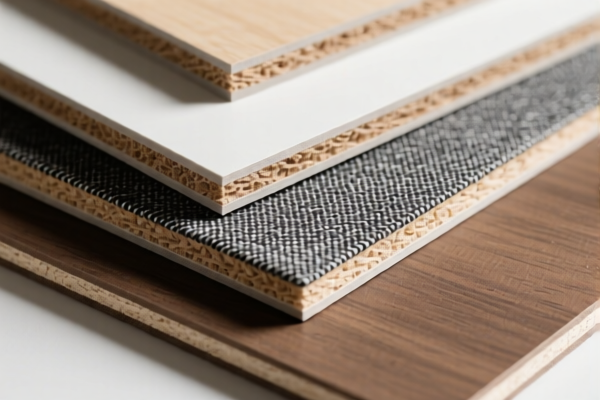

✅ HS CODE: 4411.13.90.90

- Description: Composite fiberboard, specifically medium-density fiberboard (MDF).

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.9%

- Notes: This is a common code for MDF used in agricultural or construction applications.

✅ HS CODE: 4413.00.00.00

- Description: Wood-based composite panels.

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

- Notes: This is a general category for wooden composite boards, including particleboard and similar products.

✅ HS CODE: 4411.93.20.00

- Description: Composite structural boards for construction use.

- Base Tariff Rate: 1.9¢/kg + 1.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 1.9¢/kg + 1.5% + 25.0% + 30.0% = 56.5% (approx.)

- Notes: This code includes a specific per-kilogram rate, which may be more complex to calculate. Ensure you use the correct weight and unit price for accurate customs clearance.

⚠️ Important Reminders:

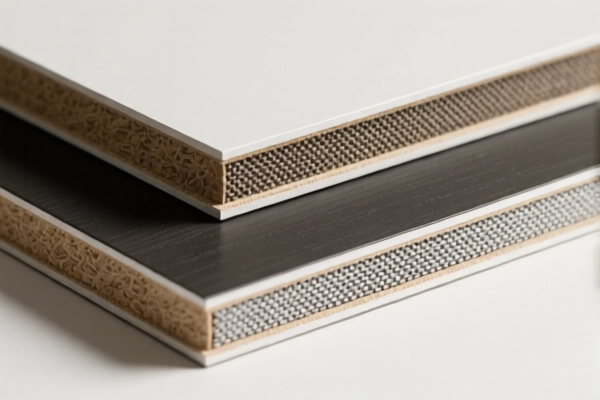

- Verify Material Composition: The HS code depends heavily on the exact composition (e.g., polyurethane, textile, wood, fiberboard).

- Check Unit Price and Weight: Especially for codes with per-kilogram rates (e.g., 4411.93.20.00).

- Certifications Required: Some products may require specific certifications (e.g., environmental, safety, or origin-related).

- April 11, 2025 Deadline: Be aware of the additional tariffs that will apply after this date.

- Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

📌 Proactive Advice:

- Confirm Product Composition: Work with your supplier to get detailed specifications of the composite board (e.g., base material, additives, surface treatment).

- Consult Customs Broker: For accurate HS code selection and tax calculation, especially for complex or mixed-material products.

- Track Policy Updates: Stay informed about any changes in tariff rates or regulations after April 11, 2025.

Let me know if you need help selecting the most appropriate HS code for your specific product. Here is the structured classification and tariff information for Agricultural Composite Boards, based on the provided HS codes and tax details:

📦 Product Classification Overview: Agricultural Composite Boards

✅ HS CODE: 3921.13.19.50

- Description: Polyurethane textile composite agricultural boards.

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 60.3%

- Notes: This code applies to boards made of polyurethane and textile composites, classified under the "Other" category.

✅ HS CODE: 3921.13.15.00

- Description: Polyurethane textile composite agricultural boards, including those combined with other textile materials.

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 61.5%

- Notes: This code is for similar products but with a slightly higher base tariff due to material composition.

✅ HS CODE: 4411.13.90.90

- Description: Composite fiberboard, specifically medium-density fiberboard (MDF).

- Base Tariff Rate: 3.9%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.9%

- Notes: This is a common code for MDF used in agricultural or construction applications.

✅ HS CODE: 4413.00.00.00

- Description: Wood-based composite panels.

- Base Tariff Rate: 3.7%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 58.7%

- Notes: This is a general category for wooden composite boards, including particleboard and similar products.

✅ HS CODE: 4411.93.20.00

- Description: Composite structural boards for construction use.

- Base Tariff Rate: 1.9¢/kg + 1.5%

- Additional Tariff: 25.0%

- April 11 Special Tariff (after April 11, 2025): 30.0%

- Total Tax Rate: 1.9¢/kg + 1.5% + 25.0% + 30.0% = 56.5% (approx.)

- Notes: This code includes a specific per-kilogram rate, which may be more complex to calculate. Ensure you use the correct weight and unit price for accurate customs clearance.

⚠️ Important Reminders:

- Verify Material Composition: The HS code depends heavily on the exact composition (e.g., polyurethane, textile, wood, fiberboard).

- Check Unit Price and Weight: Especially for codes with per-kilogram rates (e.g., 4411.93.20.00).

- Certifications Required: Some products may require specific certifications (e.g., environmental, safety, or origin-related).

- April 11, 2025 Deadline: Be aware of the additional tariffs that will apply after this date.

- Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

📌 Proactive Advice:

- Confirm Product Composition: Work with your supplier to get detailed specifications of the composite board (e.g., base material, additives, surface treatment).

- Consult Customs Broker: For accurate HS code selection and tax calculation, especially for complex or mixed-material products.

- Track Policy Updates: Stay informed about any changes in tariff rates or regulations after April 11, 2025.

Let me know if you need help selecting the most appropriate HS code for your specific product.

Customer Reviews

No reviews yet.