| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3913100000 | Doc | 41.7% | CN | US | 2025-05-12 |

| 3913902090 | Doc | 60.8% | CN | US | 2025-05-12 |

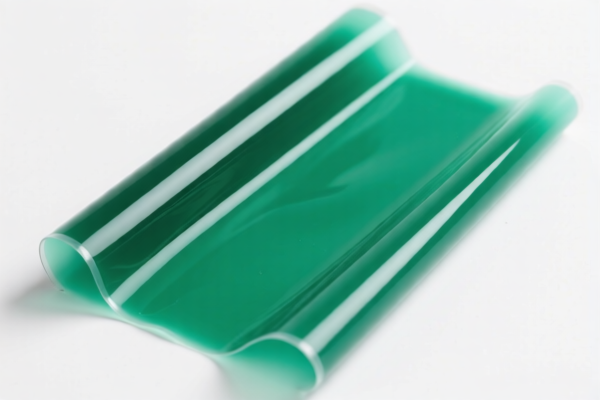

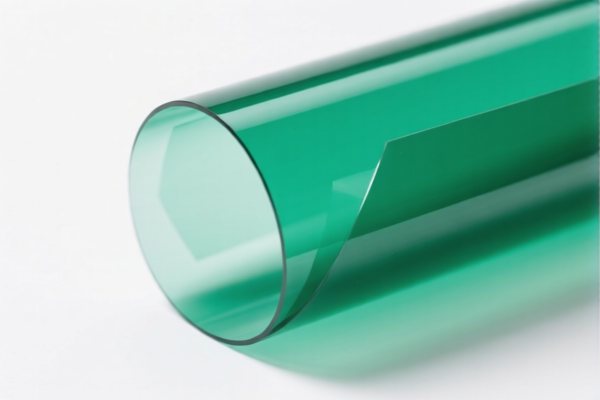

Product Name: Alginate Film

Classification: Natural polymers and their modified derivatives in primary form

🔍 HS Code Classification and Tax Details

1. HS Code: 3913100000

- Product Scope:

- Alginate film

- Alginate salt tablets

- Alginate stearate film

- Alginate salt granules

- Alginate film-forming agents

-

Other primary forms of natural polymers and their modified derivatives

-

Total Tax Rate: 41.7%

- Breakdown of Taxes:

- Base Tariff: 4.2%

- Additional Tariff: 7.5%

- Special Tariff after April 2, 2025: 30.0%

2. HS Code: 3913902090

- Product Scope:

- Alginate salt powder

-

Other natural polymers and their modified derivatives not specifically listed in other HS codes

-

Total Tax Rate: 60.8%

- Breakdown of Taxes:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes and Alerts

- Time-sensitive Policy:

-

Special Tariff after April 2, 2025: A 30.0% additional tariff will be imposed on both HS codes. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category at this time. However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Confirm whether the product is classified as "alginate film" or "alginate salt powder" to ensure correct HS code selection.

-

Check Unit Price and Certification Requirements:

-

Some products may require specific certifications (e.g., food-grade, medical-grade, or environmental compliance). Confirm with the relevant authorities or customs brokers.

-

Monitor Tariff Changes:

-

Keep track of any updates to the HS code classifications and tariff rates, especially after April 2, 2025.

-

Consider Alternative HS Codes:

- If your product has a different form or application (e.g., medical use), it may be classified under a different HS code. Double-check with a customs expert if in doubt.

Let me know if you need help determining the correct HS code for your specific product or if you need assistance with customs documentation.

Product Name: Alginate Film

Classification: Natural polymers and their modified derivatives in primary form

🔍 HS Code Classification and Tax Details

1. HS Code: 3913100000

- Product Scope:

- Alginate film

- Alginate salt tablets

- Alginate stearate film

- Alginate salt granules

- Alginate film-forming agents

-

Other primary forms of natural polymers and their modified derivatives

-

Total Tax Rate: 41.7%

- Breakdown of Taxes:

- Base Tariff: 4.2%

- Additional Tariff: 7.5%

- Special Tariff after April 2, 2025: 30.0%

2. HS Code: 3913902090

- Product Scope:

- Alginate salt powder

-

Other natural polymers and their modified derivatives not specifically listed in other HS codes

-

Total Tax Rate: 60.8%

- Breakdown of Taxes:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 2, 2025: 30.0%

⚠️ Important Notes and Alerts

- Time-sensitive Policy:

-

Special Tariff after April 2, 2025: A 30.0% additional tariff will be imposed on both HS codes. Ensure your customs clearance is completed before this date to avoid higher costs.

-

Anti-dumping duties:

- No specific anti-dumping duties are mentioned for this product category at this time. However, always verify with the latest customs updates or consult a customs broker for confirmation.

📌 Proactive Advice for Importers

- Verify Material Composition:

-

Confirm whether the product is classified as "alginate film" or "alginate salt powder" to ensure correct HS code selection.

-

Check Unit Price and Certification Requirements:

-

Some products may require specific certifications (e.g., food-grade, medical-grade, or environmental compliance). Confirm with the relevant authorities or customs brokers.

-

Monitor Tariff Changes:

-

Keep track of any updates to the HS code classifications and tariff rates, especially after April 2, 2025.

-

Consider Alternative HS Codes:

- If your product has a different form or application (e.g., medical use), it may be classified under a different HS code. Double-check with a customs expert if in doubt.

Let me know if you need help determining the correct HS code for your specific product or if you need assistance with customs documentation.

Customer Reviews

No reviews yet.