Found 5 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3920930000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920930000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3920930000 | Doc | 60.8% | CN | US | 2025-05-12 |

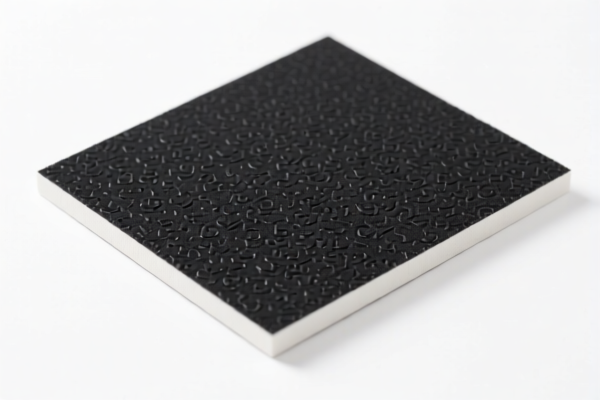

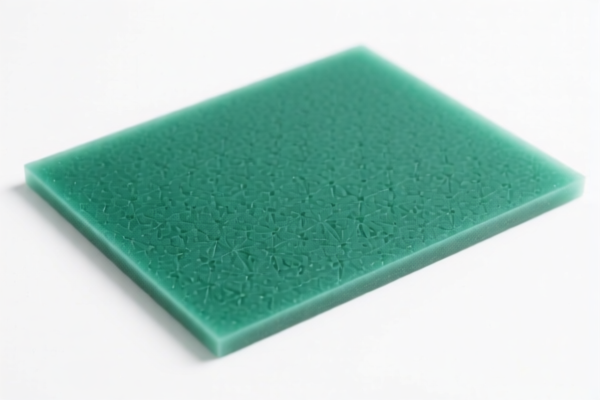

Product Classification: Amino Resin Anti-static Boards

HS CODE: 3920930000

🔍 Classification Summary

- Product Type: Amino resin anti-static boards

- HS Code Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, backed, or otherwise combined with other materials. Specifically, amino resin products.

- Key Features: Non-cellular, not reinforced, made from amino resins, and used for anti-static applications.

📊 Tariff Breakdown

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed after this date. Ensure compliance with updated customs regulations.

- No Anti-dumping Duties Mentioned: No specific anti-dumping duties for iron or aluminum are applicable for this product.

- Material Verification Required: Confirm that the product is indeed made from amino resins and not misclassified as acrylic or other polymer-based materials.

- Certifications: Check if any certifications (e.g., anti-static, fire resistance) are required for import or use in specific industries.

✅ Proactive Advice

- Verify Material Composition: Ensure the product is made from amino resins and not misclassified under other HS codes (e.g., 3920515050 or 3920598000 for acrylic-based products).

- Check Unit Price and Packaging: Customs may inspect based on product description and packaging.

- Consult Customs Authority: For complex classifications, seek confirmation from local customs or a customs broker.

- Document Compliance: Maintain records of product specifications, certifications, and supplier declarations to support classification.

Let me know if you need help with customs documentation or further classification clarification.

Product Classification: Amino Resin Anti-static Boards

HS CODE: 3920930000

🔍 Classification Summary

- Product Type: Amino resin anti-static boards

- HS Code Description: Other plastic sheets, plates, films, foils, and strips, non-cellular and not reinforced, laminated, backed, or otherwise combined with other materials. Specifically, amino resin products.

- Key Features: Non-cellular, not reinforced, made from amino resins, and used for anti-static applications.

📊 Tariff Breakdown

- Base Tariff Rate: 5.8%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 60.8%

⚠️ Important Notes

- April 11, 2025 Special Tariff: A 30.0% additional tariff is imposed after this date. Ensure compliance with updated customs regulations.

- No Anti-dumping Duties Mentioned: No specific anti-dumping duties for iron or aluminum are applicable for this product.

- Material Verification Required: Confirm that the product is indeed made from amino resins and not misclassified as acrylic or other polymer-based materials.

- Certifications: Check if any certifications (e.g., anti-static, fire resistance) are required for import or use in specific industries.

✅ Proactive Advice

- Verify Material Composition: Ensure the product is made from amino resins and not misclassified under other HS codes (e.g., 3920515050 or 3920598000 for acrylic-based products).

- Check Unit Price and Packaging: Customs may inspect based on product description and packaging.

- Consult Customs Authority: For complex classifications, seek confirmation from local customs or a customs broker.

- Document Compliance: Maintain records of product specifications, certifications, and supplier declarations to support classification.

Let me know if you need help with customs documentation or further classification clarification.

Customer Reviews

No reviews yet.