| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921904010 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920515050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3920598000 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921131910 | Doc | 60.3% | CN | US | 2025-05-12 |

Here is the structured and professional breakdown of the HS codes and associated tariffs for Anti Static Composite Boards, based on your input:

📦 Product Classification Overview: Anti Static Composite Boards

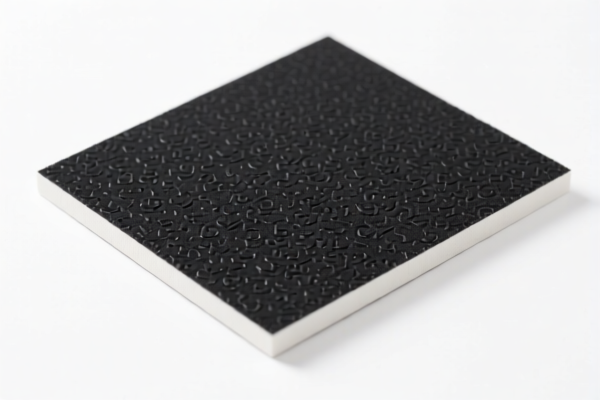

✅ HS CODE: 3921901910

Product Description: Textile composite plastic anti-static board

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This product is a textile composite material with anti-static properties. Ensure the composition and manufacturing process are clearly documented for customs.

✅ HS CODE: 3921904010

Product Description: Anti-static paper-plastic composite sheet

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This product is a paper-plastic composite with anti-static features. No additional tariffs are currently applied, but the 30% special tariff will apply after April 11, 2025.

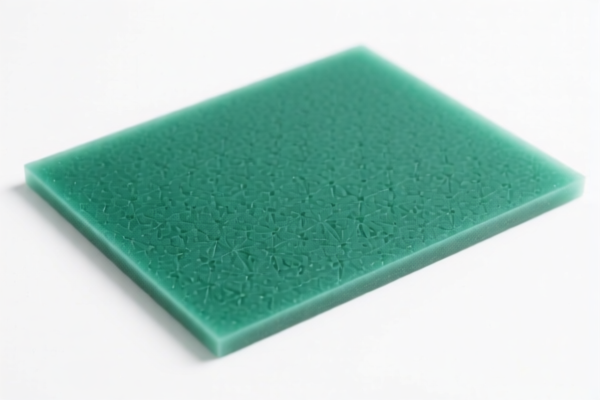

✅ HS CODE: 3920515050

Product Description: Acrylic anti-static board

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a specific type of acrylic composite board. Confirm the exact material composition and whether it is imported as a finished product or raw material.

✅ HS CODE: 3920598000

Product Description: Acrylic anti-static board

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a general category for acrylic-based anti-static boards. Ensure the product is not misclassified under a different HS code due to material or structure differences.

✅ HS CODE: 3921131910

Product Description: Textile composite polyurethane anti-static board

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This product is a textile composite with polyurethane and anti-static properties. Verify the exact composition and whether it falls under a more specific subheading.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product description matches the actual composition and structure to avoid misclassification.

- Check Required Certifications: Some anti-static products may require specific certifications (e.g., ESD standards) for compliance.

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025 will significantly increase costs. Plan accordingly.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

- Consult Customs Broker: For complex classifications, seek professional help to avoid delays or penalties.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools. Here is the structured and professional breakdown of the HS codes and associated tariffs for Anti Static Composite Boards, based on your input:

📦 Product Classification Overview: Anti Static Composite Boards

✅ HS CODE: 3921901910

Product Description: Textile composite plastic anti-static board

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This product is a textile composite material with anti-static properties. Ensure the composition and manufacturing process are clearly documented for customs.

✅ HS CODE: 3921904010

Product Description: Anti-static paper-plastic composite sheet

- Base Tariff Rate: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 34.2%

- Notes: This product is a paper-plastic composite with anti-static features. No additional tariffs are currently applied, but the 30% special tariff will apply after April 11, 2025.

✅ HS CODE: 3920515050

Product Description: Acrylic anti-static board

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a specific type of acrylic composite board. Confirm the exact material composition and whether it is imported as a finished product or raw material.

✅ HS CODE: 3920598000

Product Description: Acrylic anti-static board

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

- Notes: This is a general category for acrylic-based anti-static boards. Ensure the product is not misclassified under a different HS code due to material or structure differences.

✅ HS CODE: 3921131910

Product Description: Textile composite polyurethane anti-static board

- Base Tariff Rate: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

- Notes: This product is a textile composite with polyurethane and anti-static properties. Verify the exact composition and whether it falls under a more specific subheading.

📌 Proactive Advice for Importers:

- Verify Material and Unit Price: Ensure the product description matches the actual composition and structure to avoid misclassification.

- Check Required Certifications: Some anti-static products may require specific certifications (e.g., ESD standards) for compliance.

- Monitor Tariff Changes: The 30% special tariff after April 11, 2025 will significantly increase costs. Plan accordingly.

- Consider Anti-Dumping Duties: If the product contains iron or aluminum components, check for applicable anti-dumping duties.

- Consult Customs Broker: For complex classifications, seek professional help to avoid delays or penalties.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.