| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918101040 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5704200090 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4412925205 | Doc | 55.0% | CN | US | 2025-05-12 |

| 6907229051 | Doc | 63.5% | CN | US | 2025-05-12 |

| 6810191200 | Doc | 59.9% | CN | US | 2025-05-12 |

Here is the structured analysis and customs compliance guidance for Anti Static PVC Floor Tiles based on the provided HS codes and tariff information:

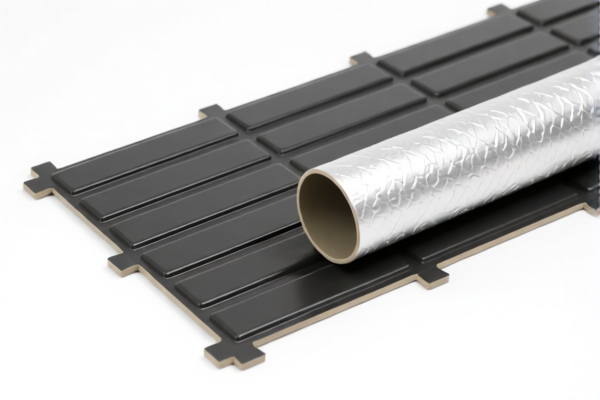

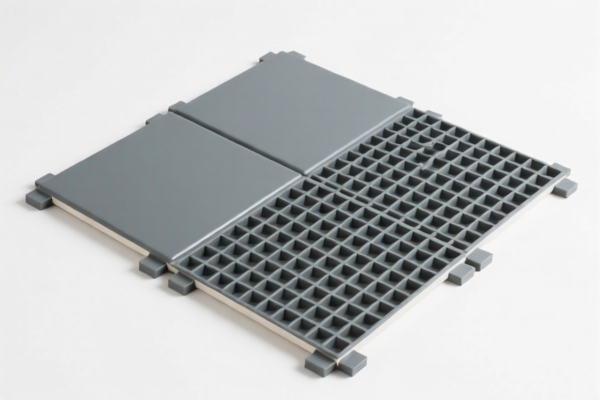

✅ HS CODE: 3918101040

Product Description: Anti Static PVC Floor Tiles (classified as "Other Vinyl Tiles")

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This classification applies to PVC tiles that are not rigid solid polymer core or rigid foam polymer core.

- Ensure the product is not misclassified as rigid or foam-based tiles, which may fall under different HS codes.

- Proactive Advice: Confirm the material composition and structure of the tiles to avoid misclassification.

⚠️ HS CODE: 5704200090

Product Description: Anti Static Carpet Tiles (classified as "Other Carpets")

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to non-needled or non-flocked carpets with a surface area between 0.3 and 1 square meter.

- If the product is not a carpet tile (e.g., it's a floor tile), this classification may be inappropriate.

- Proactive Advice: Verify whether the product is a carpet tile or a floor tile to ensure correct classification.

⚠️ HS CODE: 4412925205

Product Description: Anti Static Wooden Floor Tiles (classified as "Other Plywood")

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to wooden floor tiles made of plywood with non-coniferous outer layers.

- If the product is not made of plywood, this classification may be inaccurate.

- Proactive Advice: Confirm the material and construction of the tiles to avoid misclassification.

⚠️ HS CODE: 6907229051

Product Description: Anti Static Ceramic Floor Tiles (classified as "Ceramic Floor Tiles")

Tariff Summary:

- Base Tariff Rate: 8.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.5%

Key Notes:

- This code applies to ceramic tiles used for floors, paving stones, or wall tiles.

- If the product is not ceramic, this classification may be inappropriate.

- Proactive Advice: Confirm the material and surface finish of the tiles to ensure correct classification.

⚠️ HS CODE: 6810191200

Product Description: Anti Static Polymer Stone Floor Tiles (classified as "Aggregate Stone Tiles")

Tariff Summary:

- Base Tariff Rate: 4.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.9%

Key Notes:

- This code applies to stone aggregate tiles made of polymer or composite materials.

- If the product is not made of stone aggregate, this classification may be inaccurate.

- Proactive Advice: Confirm the material composition and structure of the tiles to avoid misclassification.

📌 General Recommendations:

- Verify Product Composition: Ensure the product is PVC-based and not ceramic, wooden, or stone-based, which may fall under different HS codes.

- Check for Additional Tariffs: All listed products are subject to 25% additional tariffs and 30% special tariffs after April 11, 2025.

- Confirm Classification: Misclassification can lead to customs penalties or delayed clearance.

- Documentation: Provide product specifications, material composition, and certifications (if required) to support the correct HS code.

Let me know if you need help with certification requirements or customs documentation for this product. Here is the structured analysis and customs compliance guidance for Anti Static PVC Floor Tiles based on the provided HS codes and tariff information:

✅ HS CODE: 3918101040

Product Description: Anti Static PVC Floor Tiles (classified as "Other Vinyl Tiles")

Tariff Summary:

- Base Tariff Rate: 5.3%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.3%

Key Notes:

- This classification applies to PVC tiles that are not rigid solid polymer core or rigid foam polymer core.

- Ensure the product is not misclassified as rigid or foam-based tiles, which may fall under different HS codes.

- Proactive Advice: Confirm the material composition and structure of the tiles to avoid misclassification.

⚠️ HS CODE: 5704200090

Product Description: Anti Static Carpet Tiles (classified as "Other Carpets")

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to non-needled or non-flocked carpets with a surface area between 0.3 and 1 square meter.

- If the product is not a carpet tile (e.g., it's a floor tile), this classification may be inappropriate.

- Proactive Advice: Verify whether the product is a carpet tile or a floor tile to ensure correct classification.

⚠️ HS CODE: 4412925205

Product Description: Anti Static Wooden Floor Tiles (classified as "Other Plywood")

Tariff Summary:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 55.0%

Key Notes:

- This code applies to wooden floor tiles made of plywood with non-coniferous outer layers.

- If the product is not made of plywood, this classification may be inaccurate.

- Proactive Advice: Confirm the material and construction of the tiles to avoid misclassification.

⚠️ HS CODE: 6907229051

Product Description: Anti Static Ceramic Floor Tiles (classified as "Ceramic Floor Tiles")

Tariff Summary:

- Base Tariff Rate: 8.5%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 63.5%

Key Notes:

- This code applies to ceramic tiles used for floors, paving stones, or wall tiles.

- If the product is not ceramic, this classification may be inappropriate.

- Proactive Advice: Confirm the material and surface finish of the tiles to ensure correct classification.

⚠️ HS CODE: 6810191200

Product Description: Anti Static Polymer Stone Floor Tiles (classified as "Aggregate Stone Tiles")

Tariff Summary:

- Base Tariff Rate: 4.9%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 59.9%

Key Notes:

- This code applies to stone aggregate tiles made of polymer or composite materials.

- If the product is not made of stone aggregate, this classification may be inaccurate.

- Proactive Advice: Confirm the material composition and structure of the tiles to avoid misclassification.

📌 General Recommendations:

- Verify Product Composition: Ensure the product is PVC-based and not ceramic, wooden, or stone-based, which may fall under different HS codes.

- Check for Additional Tariffs: All listed products are subject to 25% additional tariffs and 30% special tariffs after April 11, 2025.

- Confirm Classification: Misclassification can lead to customs penalties or delayed clearance.

- Documentation: Provide product specifications, material composition, and certifications (if required) to support the correct HS code.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.