| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921902900 | Doc | 59.4% | CN | US | 2025-05-12 |

| 3921902550 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3921901100 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3921901910 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3921902100 | Doc | 61.5% | CN | US | 2025-05-12 |

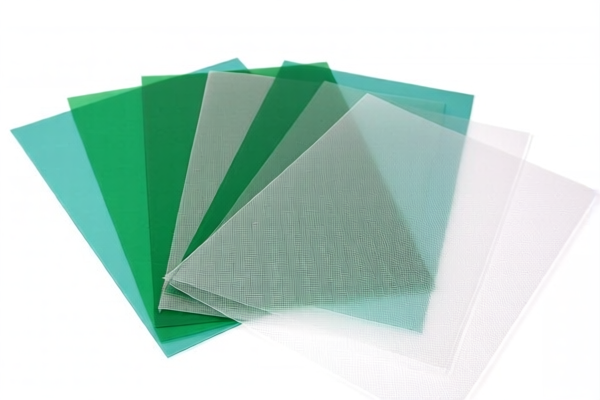

Here is the structured classification and tariff information for Anti Static Textile Plastic Sheets, based on the provided HS codes and tax details:

📦 Product Classification Overview: Anti Static Textile Plastic Sheets

These products are composite materials combining plastic and textile components, with specific weight and composition criteria. The HS codes provided reflect different classifications based on:

- Weight per square meter (≤1.492 kg/m² or >1.492 kg/m²)

- Dominant textile fiber type (e.g., cotton, synthetic fibers)

- Plastic content percentage (>70%)

📊 HS Code Classification & Tax Details

1. HS CODE: 3921902900

- Description: Other composite materials with weight >1.492 kg/m²

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Plastic + textile composite, weight >1.492 kg/m²

2. HS CODE: 3921902550

- Description: Composite with textile (synthetic fiber > any other fiber), plastic >70%, weight >1.492 kg/m²

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Synthetic fiber dominates textile, plastic >70%, weight >1.492 kg/m²

3. HS CODE: 3921901100

- Description: Composite with textile (synthetic fiber > any other fiber), plastic >70%, weight ≤1.492 kg/m²

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Synthetic fiber dominates textile, plastic >70%, weight ≤1.492 kg/m²

4. HS CODE: 3921901910

- Description: Composite with textile (other fibers), plastic >70%, weight ≤1.492 kg/m²

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Textile component is not synthetic fiber, plastic >70%, weight ≤1.492 kg/m²

5. HS CODE: 3921902100

- Description: Composite with textile (cotton > any other fiber), plastic >70%, weight >1.492 kg/m²

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Cotton dominates textile, plastic >70%, weight >1.492 kg/m²

⚠️ Important Notes & Proactive Advice

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30% tariff after this date. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact composition (plastic %, textile fiber type, and weight per square meter) to select the correct HS code.

- Certifications: Check if anti-static certification or textile compliance documentation is required for customs clearance.

- Unit Price: Verify the unit price and weight per square meter to ensure accurate classification and tax calculation.

✅ Summary of Key Tax Changes

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax |

|---|---|---|---|---|

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901100 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921901910 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902100 | 6.5% | 25.0% | 30.0% | 61.5% |

If you provide the exact product specifications, I can help you select the most accurate HS code and calculate the final tax rate. Here is the structured classification and tariff information for Anti Static Textile Plastic Sheets, based on the provided HS codes and tax details:

📦 Product Classification Overview: Anti Static Textile Plastic Sheets

These products are composite materials combining plastic and textile components, with specific weight and composition criteria. The HS codes provided reflect different classifications based on:

- Weight per square meter (≤1.492 kg/m² or >1.492 kg/m²)

- Dominant textile fiber type (e.g., cotton, synthetic fibers)

- Plastic content percentage (>70%)

📊 HS Code Classification & Tax Details

1. HS CODE: 3921902900

- Description: Other composite materials with weight >1.492 kg/m²

- Total Tax Rate: 59.4%

- Base Tariff: 4.4%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Plastic + textile composite, weight >1.492 kg/m²

2. HS CODE: 3921902550

- Description: Composite with textile (synthetic fiber > any other fiber), plastic >70%, weight >1.492 kg/m²

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Synthetic fiber dominates textile, plastic >70%, weight >1.492 kg/m²

3. HS CODE: 3921901100

- Description: Composite with textile (synthetic fiber > any other fiber), plastic >70%, weight ≤1.492 kg/m²

- Total Tax Rate: 59.2%

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Synthetic fiber dominates textile, plastic >70%, weight ≤1.492 kg/m²

4. HS CODE: 3921901910

- Description: Composite with textile (other fibers), plastic >70%, weight ≤1.492 kg/m²

- Total Tax Rate: 60.3%

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Textile component is not synthetic fiber, plastic >70%, weight ≤1.492 kg/m²

5. HS CODE: 3921902100

- Description: Composite with textile (cotton > any other fiber), plastic >70%, weight >1.492 kg/m²

- Total Tax Rate: 61.5%

- Base Tariff: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Applicable if: Cotton dominates textile, plastic >70%, weight >1.492 kg/m²

⚠️ Important Notes & Proactive Advice

- April 11, 2025 Special Tariff: All listed HS codes are subject to an additional 30% tariff after this date. Ensure your import timeline accounts for this.

- Material Verification: Confirm the exact composition (plastic %, textile fiber type, and weight per square meter) to select the correct HS code.

- Certifications: Check if anti-static certification or textile compliance documentation is required for customs clearance.

- Unit Price: Verify the unit price and weight per square meter to ensure accurate classification and tax calculation.

✅ Summary of Key Tax Changes

| HS Code | Base Tariff | Additional Tariff | April 11, 2025 Tariff | Total Tax |

|---|---|---|---|---|

| 3921902900 | 4.4% | 25.0% | 30.0% | 59.4% |

| 3921902550 | 6.5% | 25.0% | 30.0% | 61.5% |

| 3921901100 | 4.2% | 25.0% | 30.0% | 59.2% |

| 3921901910 | 5.3% | 25.0% | 30.0% | 60.3% |

| 3921902100 | 6.5% | 25.0% | 30.0% | 61.5% |

If you provide the exact product specifications, I can help you select the most accurate HS code and calculate the final tax rate.

Customer Reviews

No reviews yet.