| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3921905050 | Doc | 34.8% | CN | US | 2025-05-12 |

| 3920995000 | Doc | 60.8% | CN | US | 2025-05-12 |

| 3921904090 | Doc | 34.2% | CN | US | 2025-05-12 |

| 3920992000 | Doc | 59.2% | CN | US | 2025-05-12 |

| 3923400050 | Doc | 60.3% | CN | US | 2025-05-12 |

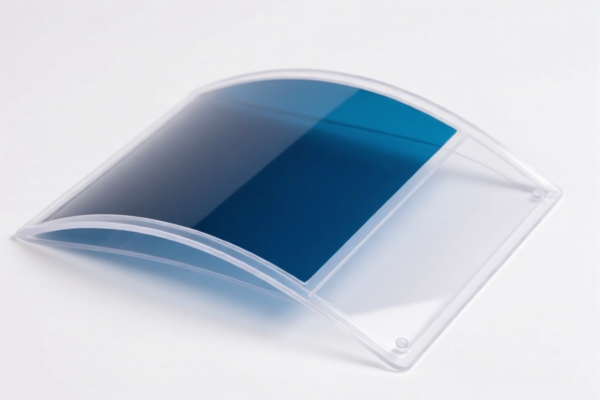

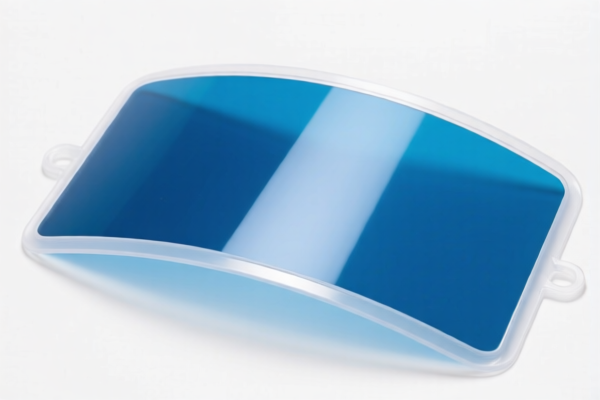

Product Classification: Anti-static Plastic Plates

Below is the detailed classification and tariff information for anti-static plastic plates, based on the provided HS codes and tax details:

1. HS Code: 3921905050

Description: Plastic anti-static plates classified under "Other" category.

Total Tax Rate: 34.8%

Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic plates that are not otherwise specified and fall under the "other" category.

- No additional tariffs are currently applied beyond the base rate.

- Important: The 30% special tariff will apply after April 11, 2025.

2. HS Code: 3920995000

Description: Plastic anti-static plates classified under "Other plastics" — non-cellular, not reinforced, and combined with other materials in a similar way.

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to non-cellular, non-reinforced plastic plates that are combined with other materials (e.g., anti-static treatments).

- High tax burden due to both additional and special tariffs.

- Important: The 30% special tariff will apply after April 11, 2025.

3. HS Code: 3921904090

Description: Plastic anti-static film classified under flexible plastic sheets, films, foils, and strips without specific reinforcement.

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic films that are flexible and not reinforced.

- No additional tariffs are currently applied beyond the base rate.

- Important: The 30% special tariff will apply after April 11, 2025.

4. HS Code: 3920992000

Description: Plastic anti-static film classified under "Other plastics" — non-cellular, not reinforced, and combined with other materials in a similar way.

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to non-cellular, non-reinforced plastic films that are combined with other materials (e.g., anti-static treatments).

- High tax burden due to both additional and special tariffs.

- Important: The 30% special tariff will apply after April 11, 2025.

5. HS Code: 3923400050

Description: Plastic spools (anti-static) classified under "Spools for winding" — anti-static property does not affect classification.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic spools used for winding, regardless of anti-static properties.

- High tax burden due to both additional and special tariffs.

- Important: The 30% special tariff will apply after April 11, 2025.

Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact composition and specifications of the anti-static plastic plates to ensure correct HS code classification.

- Check Required Certifications: Some products may require anti-static certification or safety compliance documents for customs clearance.

- Monitor Tariff Changes: The 30% special tariff will apply after April 11, 2025 — plan accordingly for cost estimation and compliance.

- Consider Alternative Materials: If cost is a concern, explore non-plastic alternatives or materials with lower tariff rates.

Let me know if you need help with certification requirements or customs documentation for these products.

Product Classification: Anti-static Plastic Plates

Below is the detailed classification and tariff information for anti-static plastic plates, based on the provided HS codes and tax details:

1. HS Code: 3921905050

Description: Plastic anti-static plates classified under "Other" category.

Total Tax Rate: 34.8%

Breakdown:

- Base Tariff: 4.8%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic plates that are not otherwise specified and fall under the "other" category.

- No additional tariffs are currently applied beyond the base rate.

- Important: The 30% special tariff will apply after April 11, 2025.

2. HS Code: 3920995000

Description: Plastic anti-static plates classified under "Other plastics" — non-cellular, not reinforced, and combined with other materials in a similar way.

Total Tax Rate: 60.8%

Breakdown:

- Base Tariff: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to non-cellular, non-reinforced plastic plates that are combined with other materials (e.g., anti-static treatments).

- High tax burden due to both additional and special tariffs.

- Important: The 30% special tariff will apply after April 11, 2025.

3. HS Code: 3921904090

Description: Plastic anti-static film classified under flexible plastic sheets, films, foils, and strips without specific reinforcement.

Total Tax Rate: 34.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 0.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic films that are flexible and not reinforced.

- No additional tariffs are currently applied beyond the base rate.

- Important: The 30% special tariff will apply after April 11, 2025.

4. HS Code: 3920992000

Description: Plastic anti-static film classified under "Other plastics" — non-cellular, not reinforced, and combined with other materials in a similar way.

Total Tax Rate: 59.2%

Breakdown:

- Base Tariff: 4.2%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code applies to non-cellular, non-reinforced plastic films that are combined with other materials (e.g., anti-static treatments).

- High tax burden due to both additional and special tariffs.

- Important: The 30% special tariff will apply after April 11, 2025.

5. HS Code: 3923400050

Description: Plastic spools (anti-static) classified under "Spools for winding" — anti-static property does not affect classification.

Total Tax Rate: 60.3%

Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

Key Notes:

- This code is for plastic spools used for winding, regardless of anti-static properties.

- High tax burden due to both additional and special tariffs.

- Important: The 30% special tariff will apply after April 11, 2025.

Proactive Advice for Importers:

- Verify Material and Unit Price: Confirm the exact composition and specifications of the anti-static plastic plates to ensure correct HS code classification.

- Check Required Certifications: Some products may require anti-static certification or safety compliance documents for customs clearance.

- Monitor Tariff Changes: The 30% special tariff will apply after April 11, 2025 — plan accordingly for cost estimation and compliance.

- Consider Alternative Materials: If cost is a concern, explore non-plastic alternatives or materials with lower tariff rates.

Let me know if you need help with certification requirements or customs documentation for these products.

Customer Reviews

No reviews yet.