| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3918901000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101030 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3918101020 | Doc | 60.3% | CN | US | 2025-05-12 |

| 5704200090 | Doc | 55.0% | CN | US | 2025-05-12 |

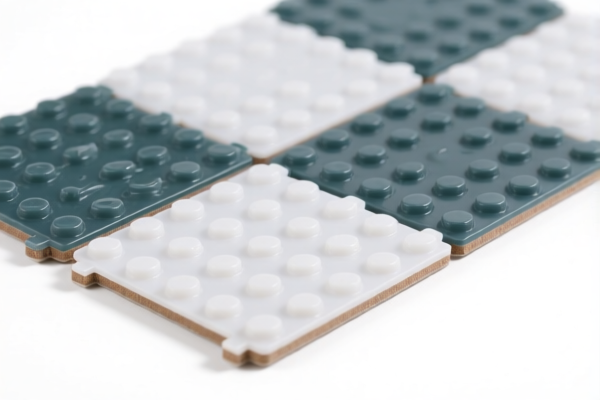

Here is the structured analysis and customs compliance guidance for the Antibacterial PVC Floor Tiles based on the provided HS codes and tariff information:

✅ HS CODE: 3918901000

Product Description: Antibacterial PVC Floor Tiles (Plastic Floor Coverings)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3918101030

Product Description: Home Use PVC Floor Tiles (Vinyl Tiles Made of Polyvinyl Chloride)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3918101020

Product Description: Residential PVC Floor Tiles (Floor Coverings Made of Polyvinyl Chloride)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 5704200090

Product Description: Antibacterial Carpet Tiles (Carpet Made of Felt or Other Textile Materials)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

📌 Key Notes and Recommendations:

-

Tariff Increase Alert:

A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the material composition (e.g., PVC, vinyl, or textile-based) to ensure correct HS code classification. Misclassification may lead to penalties or delays. -

Certifications Required:

For antibacterial products, check if certifications (e.g., ISO, FDA, or local health standards) are required for import compliance. -

Unit Price and Tax Calculation:

Verify the unit price and quantity to calculate the total import tax accurately. Tariffs are often based on the FOB value or customs valuation. -

Documentation:

Ensure all product specifications, certifications, and compliance documents are ready for customs inspection.

🛑 Proactive Advice:

- Consult a customs broker or import compliance expert for HS code confirmation and tariff calculation.

- Monitor policy updates related to anti-dumping duties or special tariffs after April 11, 2025.

- Consider alternative materials or regional sourcing if high tariffs are a concern.

Let me know if you need help with HS code selection or customs documentation. Here is the structured analysis and customs compliance guidance for the Antibacterial PVC Floor Tiles based on the provided HS codes and tariff information:

✅ HS CODE: 3918901000

Product Description: Antibacterial PVC Floor Tiles (Plastic Floor Coverings)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3918101030

Product Description: Home Use PVC Floor Tiles (Vinyl Tiles Made of Polyvinyl Chloride)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 3918101020

Product Description: Residential PVC Floor Tiles (Floor Coverings Made of Polyvinyl Chloride)

Total Tax Rate: 60.3%

Tariff Breakdown:

- Base Tariff: 5.3%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

✅ HS CODE: 5704200090

Product Description: Antibacterial Carpet Tiles (Carpet Made of Felt or Other Textile Materials)

Total Tax Rate: 55.0%

Tariff Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

📌 Key Notes and Recommendations:

-

Tariff Increase Alert:

A 30.0% additional tariff will be applied after April 11, 2025 for all the above HS codes. Ensure your import timeline is planned accordingly. -

Material Verification:

Confirm the material composition (e.g., PVC, vinyl, or textile-based) to ensure correct HS code classification. Misclassification may lead to penalties or delays. -

Certifications Required:

For antibacterial products, check if certifications (e.g., ISO, FDA, or local health standards) are required for import compliance. -

Unit Price and Tax Calculation:

Verify the unit price and quantity to calculate the total import tax accurately. Tariffs are often based on the FOB value or customs valuation. -

Documentation:

Ensure all product specifications, certifications, and compliance documents are ready for customs inspection.

🛑 Proactive Advice:

- Consult a customs broker or import compliance expert for HS code confirmation and tariff calculation.

- Monitor policy updates related to anti-dumping duties or special tariffs after April 11, 2025.

- Consider alternative materials or regional sourcing if high tariffs are a concern.

Let me know if you need help with HS code selection or customs documentation.

Customer Reviews

No reviews yet.