| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3919101050 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3919905010 | Doc | 60.8% | CN | US | 2025-05-12 |

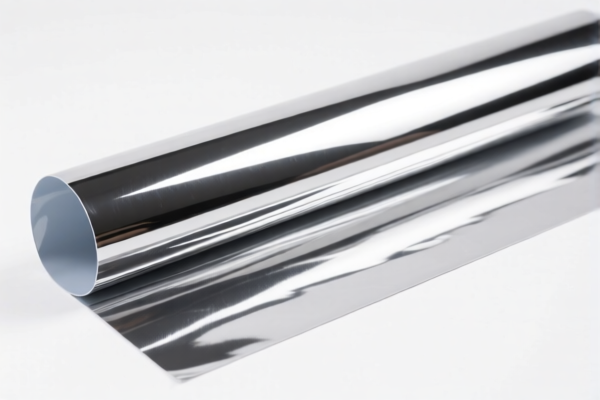

Product Name: Automotive Reflective Self Adhesive Plastic Patches

Classification HS CODEs:

HS CODE: 3919101050

Description:

- Self-adhesive reflective plastic patches, self-adhesive reflective plastic tapes, self-adhesive reflective plastic sheets, etc.

- Applies to self-adhesive plastic sheets, films, foils, tapes, strips, and other flat shapes with a width not exceeding 20 cm, where the reflective surface is fully or partially produced by glass beads (glass spheres).

Tax Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

HS CODE: 3919905010

Description:

- Reflective plastic car stickers, vehicle reflective film, reflective plastic patches, etc.

- Applies to reflective sheets (not limited to self-adhesive).

Tax Details:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied to both HS codes. This is a significant increase and may affect cost calculations for imports after this date.

-

Material Verification:

-

Confirm whether the product is self-adhesive or non-self-adhesive, as this can influence the correct HS code.

-

Certifications Required:

-

Reflective materials may require safety or quality certifications (e.g., reflective performance standards, CE marking, etc.), depending on the destination country.

-

Unit Price and Classification:

-

Ensure the unit price and product description align with the HS code. Misclassification can lead to delays or penalties.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for these HS codes, but this may change based on trade policies.

Proactive Advice:

- Double-check the product specifications (e.g., material, size, adhesive type, and reflective properties) to ensure accurate HS code classification.

- Consult with customs brokers or trade compliance experts if the product is close to the boundary of two HS codes.

- Monitor policy updates after April 11, 2025, as the special tariff may be extended or modified.

Product Name: Automotive Reflective Self Adhesive Plastic Patches

Classification HS CODEs:

HS CODE: 3919101050

Description:

- Self-adhesive reflective plastic patches, self-adhesive reflective plastic tapes, self-adhesive reflective plastic sheets, etc.

- Applies to self-adhesive plastic sheets, films, foils, tapes, strips, and other flat shapes with a width not exceeding 20 cm, where the reflective surface is fully or partially produced by glass beads (glass spheres).

Tax Details:

- Base Tariff Rate: 6.5%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 61.5%

HS CODE: 3919905010

Description:

- Reflective plastic car stickers, vehicle reflective film, reflective plastic patches, etc.

- Applies to reflective sheets (not limited to self-adhesive).

Tax Details:

- Base Tariff Rate: 5.8%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Tax Rate: 60.8%

Key Notes and Recommendations:

- Tariff Increase Alert:

-

Starting April 11, 2025, an additional 30.0% tariff will be applied to both HS codes. This is a significant increase and may affect cost calculations for imports after this date.

-

Material Verification:

-

Confirm whether the product is self-adhesive or non-self-adhesive, as this can influence the correct HS code.

-

Certifications Required:

-

Reflective materials may require safety or quality certifications (e.g., reflective performance standards, CE marking, etc.), depending on the destination country.

-

Unit Price and Classification:

-

Ensure the unit price and product description align with the HS code. Misclassification can lead to delays or penalties.

-

Anti-Dumping Duties:

- Currently, no specific anti-dumping duties are listed for these HS codes, but this may change based on trade policies.

Proactive Advice:

- Double-check the product specifications (e.g., material, size, adhesive type, and reflective properties) to ensure accurate HS code classification.

- Consult with customs brokers or trade compliance experts if the product is close to the boundary of two HS codes.

- Monitor policy updates after April 11, 2025, as the special tariff may be extended or modified.

Customer Reviews

No reviews yet.