| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3924104000 | Doc | 33.4% | CN | US | 2025-05-12 |

| 4823901000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 7615102015 | Doc | 58.1% | CN | US | 2025-05-12 |

| 7615103015 | Doc | 65.6% | CN | US | 2025-05-12 |

| 7615105020 | Doc | 65.6% | CN | US | 2025-05-12 |

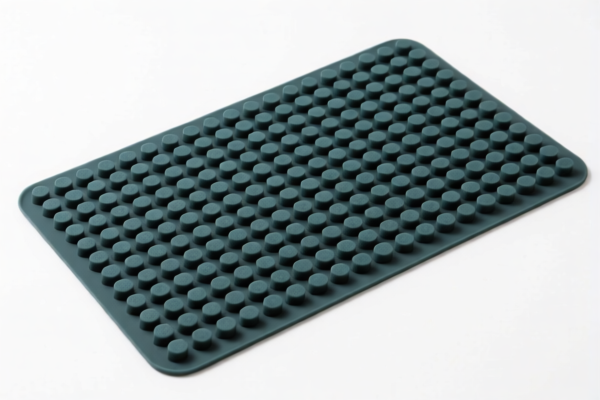

BAKING MAT – HS Code Classification & Duty Analysis

Based on the provided information, you are importing items categorized as “BAKING MAT” and related kitchenware. Here's a breakdown of the HS codes provided, their meanings, and associated duties. Please note that the correct HS code is crucial for accurate duty assessment and smooth customs clearance.

Understanding HS Codes

The Harmonized System (HS) code is a globally standardized system of names and numbers used to classify traded products. It's a six-digit code, but countries can add further digits for more specific categorization. Here's a general breakdown of what each part of the HS code signifies:

- Chapter (First 2 Digits): Broadly defines the product category.

- Heading (Next 2 Digits): More specific classification within the chapter.

- Subheading (Next 2 Digits): Further refines the product classification.

- Further Subdivisions (Additional Digits): Country-specific, providing even greater detail.

1. HS Code: 3924.10.40.00 – Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics: Tableware and kitchenware: Other

- 39: Plastics and articles thereof.

- 24: Plastics and articles thereof.

- 10: Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics.

- 40: Other.

- Duty:

- Basic Duty: 3.4%

- Additional Duty: 0.0%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Duty: 33.4%

- Notes: This code applies to baking mats and similar items made of plastic.

2. HS Code: 4823.90.10.00 – Other paper, paperboard, cellulose wadding and webs of cellulose fibers, cut to size or shape; other articles of paper pulp, paper, paperboard, cellulose wadding or webs of cellulose fibers: Other: Of paper pulp

- 48: Paper or paperboard.

- 23: Paper or paperboard.

- 90: Other.

- 10: Of paper pulp.

- Duty:

- Basic Duty: 0.0%

- Additional Duty: 25.0%

- Post April 2, 2025: Additional Duty increases to 30%

- Total Duty: 55.0%

- Notes: This code applies to baking mats made of paper pulp.

3. HS Code: 7615.10.20.15 – Table, kitchen or other household articles and parts thereof, of aluminum; pot scourers and scouring or polishing pads, gloves and the like, of aluminum; sanitary ware and parts thereof, of aluminum: Table, kitchen or other household articles and parts thereof; pot scourers and scouring or polishing pads, gloves and the like: Other: Cooking and kitchen ware: Enameled or glazed or containing nonstick interior finishes: Cast Bakeware (cookware not suitable for stove top use)

- 76: Aluminum and articles thereof.

- 15: Table, kitchen or other household articles and parts thereof, of aluminum.

- 10: Table, kitchen or other household articles and parts thereof; pot scourers and scouring or polishing pads, gloves and the like.

- 20: Other.

- 15: Cast Bakeware (cookware not suitable for stove top use)

- Duty:

- Basic Duty: 3.1%

- Additional Duty: 0.0%

- Post April 2, 2025: Additional Duty increases to 30% + 25% for steel/aluminum products.

- Total Duty: 58.1%

- Notes: This code applies to cast bakeware made of aluminum with enamel, glaze, or non-stick coating.

4. HS Code: 7615.10.30.15 – Table, kitchen or other household articles and parts thereof, of aluminum; pot scourers and scouring or polishing pads, gloves and the like, of aluminum; sanitary ware and parts thereof, of aluminum: Table, kitchen or other household articles and parts thereof; pot scourers and scouring or polishing pads, gloves and the like: Other: Cooking and kitchen ware: Enameled or glazed or containing nonstick interior finishes: Other Bakeware (cookware not suitable for stove top use)

- 76: Aluminum and articles thereof.

- 15: Table, kitchen or other household articles and parts thereof, of aluminum.

- 10: Table, kitchen or other household articles and parts thereof; pot scourers and scouring or polishing pads, gloves and the like.

- 30: Other.

- 15: Other Bakeware (cookware not suitable for stove top use)

- Duty:

- Basic Duty: 3.1%

- Additional Duty: 7.5%

- Post April 2, 2025: Additional Duty increases to 30% + 25% for steel/aluminum products.

- Total Duty: 65.6%

- Notes: This code applies to other bakeware made of aluminum with enamel, glaze, or non-stick coating.

5. HS Code: 7615.10.50.20 – Table, kitchen or other household articles and parts thereof, of aluminum; pot scourers and scouring or polishing pads, gloves and the like, of aluminum; sanitary ware and parts thereof, of aluminum: Table, kitchen or other household articles and parts thereof; pot scourers and scouring or polishing pads, gloves and the like: Other: Cooking and kitchen ware: Not enameled or glazed and not containing nonstick interior finishes: Cast Bakeware (cookware not suitable for stove top use)

- 76: Aluminum and articles thereof.

- 15: Table, kitchen or other household articles and parts thereof, of aluminum.

- 10: Table, kitchen or other household articles and parts thereof; pot scourers and scouring or polishing pads, gloves and the like.

- 50: Other.

- 20: Cast Bakeware (cookware not suitable for stove top use)

- Duty:

- Basic Duty: 3.1%

- Additional Duty: 7.5%

- Post April 2, 2025: Additional Duty increases to 30% + 25% for steel/aluminum products.

- Total Duty: 65.6%

- Notes: This code applies to cast bakeware made of aluminum without enamel, glaze, or non-stick coating.

Important Considerations & Recommendations:

- Material Verification: Crucially, confirm the exact material composition of your baking mats. The duty rates vary significantly based on whether they are plastic, paper pulp, or aluminum.

- Coating Verification: For aluminum products, determine if they have an enamel, glaze, or non-stick coating. This will determine the correct HS code.

- Unit Price: The unit price of your goods may influence the applicable duty rate.

- Certification: Depending on the end-use of the baking mats (e.g., food contact), you may need to provide specific certifications (e.g., FDA compliance).

- Post April 2, 2025 Changes: Be aware of the upcoming duty changes on April 2, 2025, particularly the increased additional duties on steel and aluminum products.

- Consult a Customs Broker: It is highly recommended to consult with a licensed customs broker in your importing country. They can provide definitive HS code classification and ensure compliance with all applicable regulations.

Disclaimer: This information is for general guidance only and does not constitute professional legal or customs advice. Duty rates and regulations are subject to change. Always verify the latest information with the relevant customs authorities.

Customer Reviews

This resource helped me understand the classification of my baking mats as kitchenware. The 3924.10.40.00 code was explained in simple terms, which made it easy to apply to my product.

The page provided a clear overview of the different HS codes and their corresponding duties. I especially appreciated the note about the upcoming duty changes after April 2025.

I was importing aluminum baking mats and needed to know the exact HS code. The detailed explanation of code 7615.10.30.15 and the 65.6% duty rate was exactly what I was looking for.

The site has a lot of information, but I found the section on material verification a bit overwhelming. It would be helpful to have a quick checklist for determining the correct HS code.

I was confused about the difference between paper pulp and plastic baking mats. The page clearly explained the HS codes and duty rates for each material, which was exactly what I needed.