| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 63079082 | Doc | Error | CN | US | 2025-05-12 |

| 5705002090 | Doc | 58.3% | CN | US | 2025-05-12 |

| 3924905650 | Doc | 40.9% | CN | US | 2025-05-12 |

| 4818200040 | Doc | 55.0% | CN | US | 2025-05-12 |

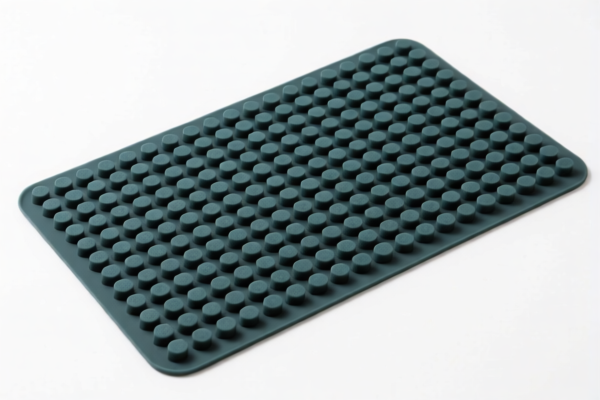

Okay, let's break down the HS codes and tax implications for your declared "BATH MAT" items. Here's a structured analysis to help you understand the classification and potential costs:

Important Note: The "BATH MAT" description can fall into multiple HS codes depending on the material and construction. I'll analyze each code provided and highlight key considerations.

1. HS Code: 6307.90.82 – Other made up articles, including dress patterns: Other: Other towels of cotton

- Breakdown:

- 63: Linens, table cloths, bed linens, toilet linens and kitchen linens. (This chapter covers textile articles for the home.)

- 07: Towels and washcloths.

- 90: Other made up articles.

- 82: Other (specifically cotton towels).

- Classification: This code is specifically for cotton towels. If your bath mat is made of cotton and functions as a towel (absorbent, used for drying), this is a likely fit.

- Tax:

- Tax detail: Failed to retrieve tax information.

- Total Tax: Error.

- Action Needed: You must verify the current tax rate for this code with your customs broker or the relevant customs authority. The "Failed to retrieve" status is critical.

2. HS Code: 5705.00.20.90 – Other carpets and other textile floor coverings, whether or not made up: Other Other

- Breakdown:

- 57: Carpets and other textile floor coverings.

- 05: Other carpets and other textile floor coverings.

- 00: Other.

- 20: Other.

- 90: Other.

- Classification: This code is for textile floor coverings that aren't specifically covered elsewhere. This could apply to bath mats made of synthetic fibers, or those with a more carpet-like construction.

- Tax:

- 基础关税 (Basic Tariff): 3.3%

- 加征关税 (Additional Tariff): 25.0% (currently)

- 加征关税 (Additional Tariff - after April 2, 2025): 30%

- Total Tax: 58.3%

- Important: The tax rate will increase to 30% additional tariff after April 2, 2025.

3. HS Code: 3924.90.56.50 – Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics: Other: Other Other

- Breakdown:

- 39: Plastics and articles thereof.

- 24: Tableware, kitchenware, other household articles and hygienic or toilet articles, of plastics.

- 90: Other.

- 56: Other.

- 50: Other.

- Classification: This code applies to bath mats made of plastic. If your mat is primarily plastic, this is a potential fit.

- Tax:

- 基础关税 (Basic Tariff): 3.4%

- 加征关税 (Additional Tariff): 7.5% (currently)

- 加征关税 (Additional Tariff - after April 2, 2025): 30%

- Total Tax: 40.9%

- Important: The tax rate will increase to 30% additional tariff after April 2, 2025.

4. HS Code: 4818.20.00.40 – Toilet paper and similar paper, cellulose wadding or webs of cellulose fibers, of a kind used for household or sanitary purposes, in rolls of a width not exceeding

- Breakdown:

- 48: Paper and paperboard; articles of paper pulp, paper or cardboard.

- 18: Toilet paper, handkerchiefs, etc.

- 20: Other.

- 00: Other.

- 40: Other.

- Classification: This code is for bath mats made of paper.

- Tax:

- 基础关税 (Basic Tariff): 0.0%

- 加征关税 (Additional Tariff): 25.0% (currently)

- 加征关税 (Additional Tariff - after April 2, 2025): 30%

- Total Tax: 55.0%

- Important: The tax rate will increase to 30% additional tariff after April 2, 2025.

Recommendations & Key Actions:

- Material Verification: Crucially, confirm the exact material composition of your bath mats. This is the biggest factor in determining the correct HS code.

- Construction: How is the mat made? Is it woven, knitted, molded, or layered?

- Tax Rate Confirmation: For HS Code 6307.90.82, immediately verify the current tax rate with your customs broker or the relevant authority. The "Error" status is unacceptable for import planning.

- Single Fiber Content: If the mat is a blend of fibers, determine the dominant fiber.

- April 2, 2025: Be aware of the upcoming tariff changes on April 2, 2025, and factor those into your cost calculations.

- Certifications: Depending on the material and intended use, you may need certifications (e.g., OEKO-TEX for textiles, safety certifications for plastics). Check with your importer and the destination country's regulations.

- Invoice Details: Ensure your commercial invoice clearly states the material composition, construction, and intended use of the bath mats.

Disclaimer: I am an AI assistant and cannot provide definitive customs classification advice. This information is for general guidance only. Always consult with a qualified customs broker or the relevant customs authority for accurate and up-to-date regulations.

Customer Reviews

The page gave a good overview of the different HS codes for bath mats. I especially appreciated the reminders about verifying the material and checking for upcoming tariff changes.

The breakdown of HS codes and tariff rates for bath mats was exactly what I needed. The image examples helped me visualize the products as well.

The information was helpful, but I wish there was a clearer way to determine which HS code applies based on material. It's a bit confusing for someone new to this.

I found the section on HS Code 4818.20.00.40 for paper bath mats very useful. The note about the tariff increase was something I hadn't considered.

The explanation of HS Code 6307.90.82 was thorough, even though there was an error in retrieving the tax rate. I'll definitely follow up with a customs broker as suggested.