| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 3901905501 | Doc | 61.5% | CN | US | 2025-05-12 |

| 3914006000 | Doc | 58.9% | CN | US | 2025-05-12 |

| 4016931050 | Doc | 57.5% | CN | US | 2025-05-12 |

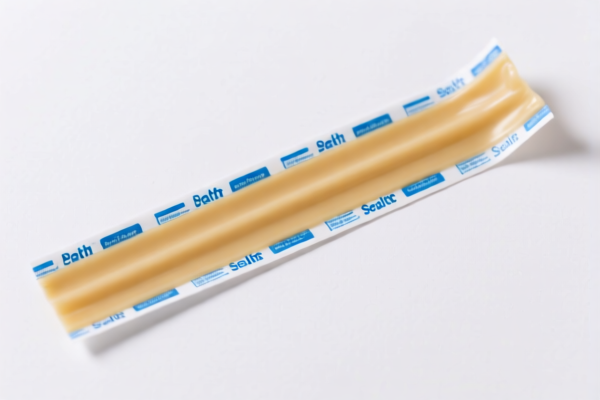

Okay, let's break down the HS codes and tax implications for your declared item "BATH SEALANT STRIP" based on the provided data. I'll analyze each code and offer advice.

Understanding HS Codes – A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. The first 6 digits are generally consistent worldwide, while the last digits can vary by country. Here's what the digits typically mean:

- Chapter (First 2 digits): Broad category of the product.

- Heading (Next 2 digits): More specific classification within the chapter.

- Subheading (Next 2 digits): Further refinement of the product.

- Further Breakdown (Last digits): Most specific classification, often related to material, function, or quality.

Analysis of Provided HS Codes

Here's a breakdown of each code, its potential relevance to "BATH SEALANT STRIP", and associated taxes. I'll also indicate the likelihood of it being the correct code, based on a typical understanding of bath sealant strips.

1. HS Code: 3926.90.99.89 – Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Other

- Chapter 39: Plastics and articles thereof.

- Heading 39.26: Other articles of plastics and articles of other materials. This is a very broad category.

- Subheading 39.26.90: Other. This suggests the item doesn't fit neatly into more specific plastic categories.

- Further Breakdown 39.26.90.99.89: "Other Other" – This is a catch-all, indicating a very generic plastic item.

- Tax:

- Basic Duty: 5.3%

- Additional Duty: 7.5%

- Post-April 2, 2025: Additional Duty increases to 30%

- Total Tax: 42.8%

- Relevance to BATH SEALANT STRIP: Possible, but less likely if the strip has significant rubber content. If the sealant strip is primarily plastic, this could be a fit.

- Recommendation: Check the material composition carefully. If it's mostly plastic, this is a reasonable starting point.

2. HS Code: 3901.90.55.01 – Polymers of ethylene, in primary forms: Other: Other: Ethylene copolymers

- Chapter 39: Plastics and articles thereof.

- Heading 39.01: Polymers of ethylene, in primary forms. This refers to the raw plastic material itself.

- Subheading 39.01.90: Other.

- Further Breakdown 39.01.90.55.01: Ethylene copolymers.

- Tax:

- Basic Duty: 6.5%

- Additional Duty: 25.0%

- Post-April 2, 2025: Additional Duty increases to 30%

- Total Tax: 61.5%

- Relevance to BATH SEALANT STRIP: Highly unlikely. This code is for the raw plastic material used to make the sealant strip, not the finished product itself.

- Recommendation: Do not use this code for the finished sealant strip.

3. HS Code: 3914.00.60.00 – Ion-exchangers based on polymers of headings 3901 to 3913, in primary forms: Other

- Chapter 39: Plastics and articles thereof.

- Heading 39.14: Ion-exchangers based on polymers.

- Subheading 39.14.00: Other.

- Further Breakdown 39.14.00.60.00: Other.

- Tax:

- Basic Duty: 3.9%

- Additional Duty: 25.0%

- Post-April 2, 2025: Additional Duty increases to 30%

- Total Tax: 58.9%

- Relevance to BATH SEALANT STRIP: Extremely unlikely. This code is for ion-exchange resins, which are used in water purification and other chemical processes.

- Recommendation: Do not use this code.

4. HS Code: 4016.93.10.50 – Other articles of vulcanized rubber other than hard rubber: Other: Gaskets, washers and other seals: Of a kind used in the automotive goods of chapter 87 Other

- Chapter 40: Rubber and articles thereof.

- Heading 40.16: Other articles of vulcanized rubber.

- Subheading 40.16.93: Gaskets, washers and other seals.

- Further Breakdown 40.16.93.10.50: Of a kind used in the automotive goods of chapter 87 Other.

- Tax:

- Basic Duty: 2.5%

- Additional Duty: 25.0%

- Post-April 2, 2025: Additional Duty increases to 30%

- Total Tax: 57.5%

- Relevance to BATH SEALANT STRIP: Most Likely, if the strip contains significant rubber. If the sealant strip is made of rubber (or a rubber compound), this is the most appropriate code. The "automotive" specification is less relevant; it's the material that matters.

- Recommendation: This is the best candidate code, assuming the strip is rubber-based. Confirm the rubber content.

Key Recommendations & Next Steps

- Material Composition: Crucially, determine the exact material composition of the sealant strip. What percentage is plastic? What percentage is rubber? Are there any other materials?

- Rubber Type: If it's rubber, what type of rubber is it (e.g., natural rubber, synthetic rubber, silicone rubber)?

- Function: While the automotive specification in 4016.93.10.50 isn't critical, knowing the specific function of the strip (e.g., waterproofing, sealing, vibration dampening) can help refine the classification.

- Consult a Customs Broker: I strongly recommend consulting a licensed customs broker in China. They can provide definitive classification advice based on the specific product and current regulations.

- Consider a Ruling: For complex cases, you can apply for a binding ruling from Chinese customs authorities. This provides legal certainty regarding the correct HS code.

Important Note: Tax rates and regulations are subject to change. The information provided here is based on the data you supplied and my current knowledge, but it's essential to verify everything with official sources before importing.

Customer Reviews

The review of HS Code 3914006000 was spot on. I had no idea it was for ion-exchangers, and it's good to know it doesn't apply to my product.

The information was helpful, but I would have preferred more examples of products that fall under each code. It's a bit confusing without more context.

This page is a lifesaver for someone trying to export bath sealant strips. The detailed explanation of each code and its relevance is exactly what I needed.

The breakdown of the tax rates for each HS code was very useful. I found the note about post-April 2025 duties particularly helpful.

Great analysis of the different HS codes. I especially appreciated the warning about using 3901905501 for the finished product—it could have been a costly mistake!