| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 8708100000 | Doc | Error | CN | US | 2025-05-12 |

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

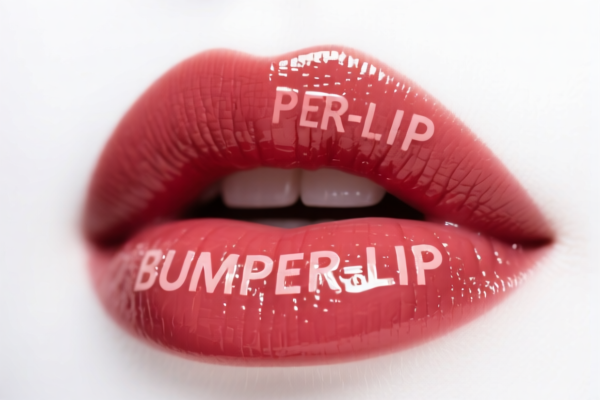

Okay, let's break down the classification and potential import considerations for your "BUMPER LIP" declaration. Based on the provided HS codes, there appear to be two possible classifications, and it's crucial to determine the correct one for accurate duty assessment and smooth clearance.

Understanding the HS Codes & Implications for "BUMPER LIP"

Here's a detailed analysis of each HS code, presented in a structured format:

1. HS Code: 8708.10.00.00 – Parts and accessories of motor vehicles; Bumpers and parts thereof

- Chapter 87: Vehicles and parts thereof. This chapter covers a wide range of motor vehicles and their components.

- 8708: Parts and accessories of motor vehicles of headings 8701 to 8705. This narrows it down to specifically parts designed for those vehicle types.

- 8708.10: Bumpers and parts thereof. This is where your "BUMPER LIP" starts to fit. It specifically identifies bumpers and the components that make them up.

-

8708.10.00.00: This is the most granular level, indicating all bumpers and parts thereof.

- Implications: If your bumper lip is definitively a part of a vehicle bumper (e.g., designed to be attached to a bumper for functional or aesthetic purposes), this is the more appropriate classification. This generally implies it's made for a specific vehicle type.

- Tax: The tax information retrieval failed, so we need to investigate the current rates. However, parts falling under Chapter 87 often have varying rates depending on the vehicle type and country of origin.

2. HS Code: 3926.90.99.89 – Other articles of plastics and articles of other materials; Other

- Chapter 39: Plastics and articles thereof. This chapter covers products made from various types of plastics.

- 3926: Other articles of plastics and articles of other materials. This is a broad category for plastic items not specifically covered elsewhere.

- 3926.90: Other. This further narrows it down to "other" plastic articles.

-

3926.90.99.89: This is a very specific sub-heading for "other" articles of plastics.

- Implications: This classification is more likely if your bumper lip is a standalone item made of plastic, not specifically designed as a direct replacement or attachment for a vehicle bumper. It might be considered an aftermarket accessory or a decorative item.

- Tax: Currently, the indicated tax rate is a combined 42.8% (Basic Duty 5.3% + Additional Tariff 7.5% + Additional Tariff 30% after April 2, 2025). This is a significant duty rate.

Key Considerations & Recommendations:

- Material Composition: Crucially, what is the bumper lip made of? Is it primarily plastic, or is it a composite material with metal components? This will heavily influence the correct HS code.

- Functionality & Attachment: Is it designed to be permanently attached to a vehicle bumper as an integral part? Or is it a clip-on accessory?

- Vehicle Specificity: Is it made for a specific vehicle model or a range of vehicles?

- Detailed Product Description: Provide a more detailed description of the bumper lip. Include dimensions, weight, and any specific features.

- Certification: Depending on the final classification, you may need to provide certifications related to vehicle safety standards or plastic composition. Check with the importing country's customs regulations.

- Invoice Accuracy: Ensure the invoice accurately reflects the material composition and intended use of the bumper lip.

- Tax Verification: Immediately verify the current tax rates for both HS codes with the importing country's customs authorities or a qualified customs broker. Tax rates can change.

Actionable Steps:

- Provide more details about the bumper lip. The more information you provide, the more accurate the classification will be.

- Consult with a customs broker. A broker can review the product details and provide a definitive HS code classification.

- Contact the importing country's customs authorities. They can provide guidance on specific requirements and regulations.

Disclaimer: I am an AI assistant and cannot provide legally binding customs advice. This information is for general guidance only. Always consult with a qualified customs broker or the importing country's customs authorities for accurate and up-to-date information.

Customer Reviews

This page was a lifesaver when I needed to figure out the correct HS code and tariff for my plastic doors. Highly recommend it!

The page gave a good overview of the export process, but I had to search a bit more to find the exact HS code for my product.

I was looking for HS Code info for plastic doors, and this page had exactly what I needed. Very well organized and easy to read.

The tariff rate explanation was spot on, but I wish there were more country-specific details included for other regions.

Great resource for understanding the trade requirements for exporting plastic builder’s doors. The details are precise and easy to follow.