| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 3926909989 | Doc | 42.8% | CN | US | 2025-05-12 |

| 4008210000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 8307103000 | Doc | 58.8% | CN | US | 2025-05-12 |

| 8307106000 | Doc | 58.8% | CN | US | 2025-05-12 |

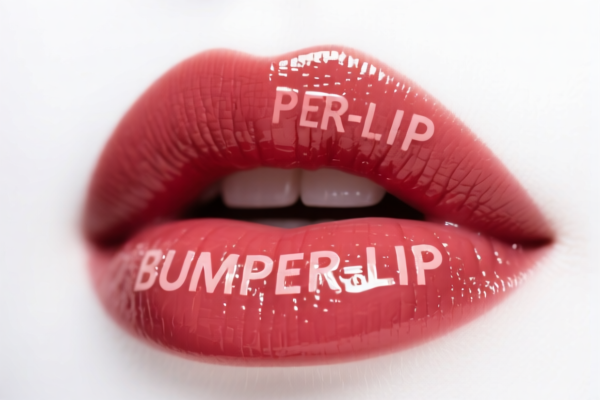

Okay, let's break down the HS codes and tax implications for your declared "BUMPER STRIP" items. Here's a detailed analysis, presented in a structured format to help you understand the classification and potential costs.

Understanding HS Codes: A Quick Primer

HS codes (Harmonized System codes) are internationally standardized codes used to classify traded products. They are crucial for determining tariffs, trade regulations, and statistical reporting. The first six digits are generally consistent worldwide, while additional digits may vary by country.

Analysis of Your Declared HS Codes

Here's a breakdown of each HS code you provided, along with explanations and important considerations:

1. HS Code: 3926.90.99.89 – Other articles of plastics and articles of other materials of headings 3901 to 3914: Other: Other Other

- 39: Plastics and articles thereof. This chapter covers a wide range of plastic products.

- 26: Other articles of plastics and articles of other materials. This narrows down the category to miscellaneous plastic articles.

- 90: Other. This indicates the item doesn't fit into more specific subcategories within 3926.

- 99: Other. Further specifies the item within the "Other" category.

-

89: Other. This is a very broad residual category, suggesting the bumper strip is made of plastic and doesn't have a more precise classification.

Tax Implications: * Basic Duty: 5.3% * Additional Duty: 7.5% (currently) / 30% (after April 2, 2025) * Total Tax: 42.8%

Important Notes: Because this is a very general classification, customs officials may request more detailed information about the material composition and intended use of the bumper strip to ensure accurate classification.

2. HS Code: 4008.21.00.00 – Plates, sheets, strip, rods and profile shapes, of vulcanized rubber other than hard rubber: Of noncellular rubber: Plates, sheets and strip

- 40: Rubber and articles thereof. This chapter covers natural, synthetic, and vulcanized rubber products.

- 08: Plates, sheets, strip, rods and profile shapes. This narrows the category to specific shapes of rubber.

- 21: Of noncellular rubber. This specifies the rubber is not foamed or porous.

-

00: Plates, sheets and strip. This further defines the product as flat or sheet-like rubber items.

Tax Implications: * Basic Duty: 0.0% * Additional Duty: 25.0% (currently) / 30% (after April 2, 2025) * Total Tax: 55.0%

Important Notes: Ensure the bumper strip is specifically made of non-cellular vulcanized rubber. The hardness of the rubber may also be a factor in classification.

3. & 4. HS Code: 8307.10.30.00 & 8307.10.60.00 – Flexible tubing of base metal, with or without fittings: Of iron or steel: With fittings / Other

- 83: Miscellaneous articles of base metal. This chapter covers a wide range of metal products.

- 07: Flexible tubing and fittings of base metal. This narrows the category to metal tubing.

- 10: Of iron or steel. This specifies the tubing is made of iron or steel.

- 30: With fittings. This indicates the tubing includes fittings.

-

60: Other. This covers tubing without fittings or other specific characteristics.

Tax Implications (Both Codes): * Basic Duty: 3.8% * Additional Duty: 25.0% (currently) / 30% (after April 2, 2025) * Total Tax: 58.8%

Important Notes: The material composition of the tubing (specific type of steel) and the presence or absence of fittings are crucial for correct classification.

Recommendations & Key Considerations:

- Material Verification: Critically verify the exact material composition of each bumper strip. Different materials can fall under different HS codes with significantly different tax rates.

- Detailed Description: Provide a very detailed description of each item to customs, including dimensions, material specifications, and intended use.

- April 2, 2025, Tariff Changes: Be aware of the upcoming changes to additional tariffs on April 2, 2025. Factor these changes into your cost calculations.

- Certifications: Depending on the application of the bumper strip (e.g., automotive, safety equipment), you may need specific certifications (e.g., ISO, REACH, RoHS). Check the import regulations for your destination country.

- Single Invoice: If you are importing multiple types of bumper strips, ensure your invoice clearly differentiates each item with its corresponding HS code and price.

- Consult a Customs Broker: For complex classifications or high-value shipments, it's highly recommended to consult a licensed customs broker in China. They can provide expert guidance and ensure compliance with all import regulations.

Disclaimer: This information is for general guidance only and does not constitute professional legal or customs advice. Import regulations are subject to change, and it is your responsibility to verify the accuracy of this information with the relevant customs authorities.

Customer Reviews

The detailed HS code analysis and tax implications were very clear. This was exactly what I needed for my export planning.

The page was really useful for finding HS codes and understanding the tariff rates for exporting bumper strips to the US. I especially liked the material verification tips.

The HS code 8307103000 and 8307106000 breakdowns were very helpful. I was able to determine the correct classification for my metal-based bumper strips.

The information was good, but I found it a bit overwhelming with the technical details. I wish there was a simpler summary for quick reference.

The page made it easy to see the different HS codes for bumper strips. I especially appreciated the tax breakdowns for each classification.