| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4601219000 | Doc | 63.0% | CN | US | 2025-05-12 |

| 4601214000 | Doc | 58.3% | CN | US | 2025-05-12 |

| 4601218000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4601922000 | Doc | 61.6% | CN | US | 2025-05-12 |

| 9619001530 | Doc | 37.5% | CN | US | 2025-05-12 |

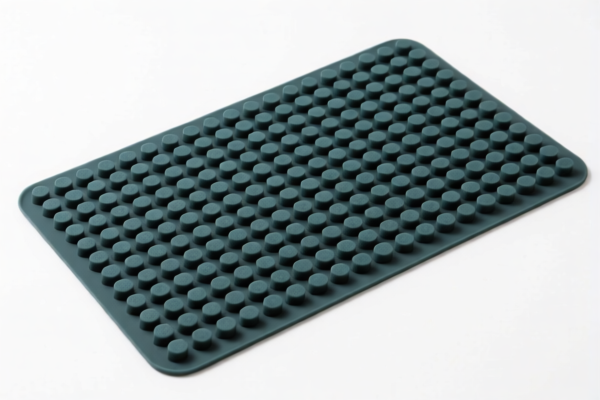

Product Name: Bamboo Bathroom Mats

Classification: Based on the provided HS codes, the most likely classification for Bamboo Bathroom Mats is under HS Code 4601219000 or 4601214000, depending on the specific manufacturing process and material composition.

✅ HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4601219000 | Bamboo mats, mats, and screens | 63.0% | Most likely classification for bamboo bathroom mats |

| 4601214000 | Mats, mats, and screens made of plant materials, specifically bamboo, in woven or partially assembled condition | 58.3% | If the mats are woven or partially assembled |

| 4601218000 | Mats, mats, and screens made of woven materials, specifically bamboo mats, mats, and screens | 55.0% | If the mats are made of woven bamboo |

| 4601922000 | Woven materials and their products, especially bamboo mats | 61.6% | If the mats are made of woven bamboo fibers |

| 9619001530 | Bamboo fiber products | 37.5% | If the mats are made of bamboo fiber (not woven) |

📌 Tariff Breakdown (for 4601219000 - Bamboo Mats)

- Base Tariff Rate: 8.0%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 63.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- Anti-dumping duties: Not applicable for bamboo products unless specifically targeted by trade agreements or investigations.

- Material Verification: Confirm whether the mats are woven, partially assembled, or solid bamboo to determine the correct HS code.

- Unit Price and Certification: Check if any certifications (e.g., eco-friendly, safety standards) are required for import, especially if exporting to countries with strict regulations.

🛠️ Proactive Advice for Importers

- Verify the exact product composition (e.g., woven, solid, or fiber-based) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Review the April 11, 2025 deadline and plan accordingly to avoid unexpected cost increases.

- Consult with customs brokers or trade compliance experts if the product is complex or if you're unsure about the classification.

Let me know if you need help determining the most accurate HS code for your specific bamboo bathroom mat product.

Product Name: Bamboo Bathroom Mats

Classification: Based on the provided HS codes, the most likely classification for Bamboo Bathroom Mats is under HS Code 4601219000 or 4601214000, depending on the specific manufacturing process and material composition.

✅ HS Code Classification Overview

| HS Code | Description | Total Tax Rate | Notes |

|---|---|---|---|

| 4601219000 | Bamboo mats, mats, and screens | 63.0% | Most likely classification for bamboo bathroom mats |

| 4601214000 | Mats, mats, and screens made of plant materials, specifically bamboo, in woven or partially assembled condition | 58.3% | If the mats are woven or partially assembled |

| 4601218000 | Mats, mats, and screens made of woven materials, specifically bamboo mats, mats, and screens | 55.0% | If the mats are made of woven bamboo |

| 4601922000 | Woven materials and their products, especially bamboo mats | 61.6% | If the mats are made of woven bamboo fibers |

| 9619001530 | Bamboo fiber products | 37.5% | If the mats are made of bamboo fiber (not woven) |

📌 Tariff Breakdown (for 4601219000 - Bamboo Mats)

- Base Tariff Rate: 8.0%

- Additional Tariff (General): 25.0%

- Special Tariff (April 11, 2025 onwards): 30.0%

- Total Tax Rate: 63.0%

⚠️ Important Notes and Alerts

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and may significantly increase the total cost.

- Anti-dumping duties: Not applicable for bamboo products unless specifically targeted by trade agreements or investigations.

- Material Verification: Confirm whether the mats are woven, partially assembled, or solid bamboo to determine the correct HS code.

- Unit Price and Certification: Check if any certifications (e.g., eco-friendly, safety standards) are required for import, especially if exporting to countries with strict regulations.

🛠️ Proactive Advice for Importers

- Verify the exact product composition (e.g., woven, solid, or fiber-based) to ensure correct HS code classification.

- Check the unit price to determine if any preferential tariff rates apply (e.g., under free trade agreements).

- Review the April 11, 2025 deadline and plan accordingly to avoid unexpected cost increases.

- Consult with customs brokers or trade compliance experts if the product is complex or if you're unsure about the classification.

Let me know if you need help determining the most accurate HS code for your specific bamboo bathroom mat product.

Customer Reviews

No reviews yet.