| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4410110010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4410190010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4412511030 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4412523121 | Doc | 63.0% | CN | US | 2025-05-12 |

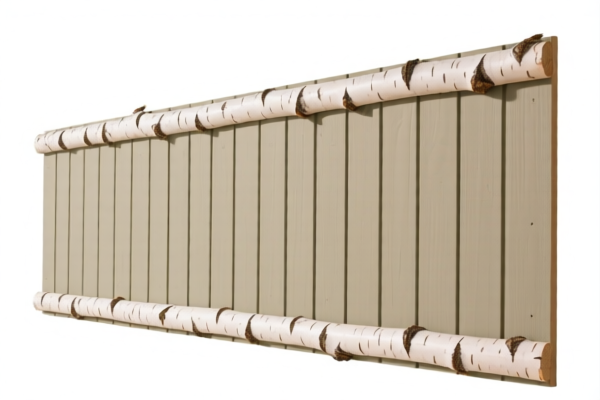

Customs Compliance Analysis for Birch Battenboard (Unsurfaced)

Product Name: Birch Battenboard (Unsurfaced)

HS Code: 4412511030

Classification: Plywood, veneered panels, and similar laminated wood — Blockboard, laminboard, and battenboard — With at least one outer ply of tropical wood — Plywood — Not surface covered, or surface covered with a clear or transparent material which does not obscure the grain, texture, or markings of the face ply — With a face ply of birch (Betula spp.) — Not surface covered

Tariff Overview

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Effective Tariff Rate: 55.0%

Key Notes and Considerations

-

Tariff Changes Effective April 11, 2025:

A 30.0% additional tariff will be applied to this product after this date. This is a time-sensitive policy, so it is crucial to plan import timelines accordingly. -

No Anti-Dumping or Countervailing Duties:

As of now, there are no specific anti-dumping or countervailing duties reported for this product classification. -

Material Verification:

Ensure that the face ply is indeed birch (Betula spp.) and that the product is not surface covered. Misclassification due to incorrect material or finish could lead to higher tariffs or customs delays. -

Certifications and Documentation:

Confirm whether any certifications (e.g., FSC, CITES, or wood product compliance) are required for the product, especially if it involves tropical wood or is being imported into markets with strict environmental regulations. -

Unit Price and Quantity:

Verify the unit price and quantity for accurate duty calculation. Customs may require detailed documentation for verification.

Proactive Advice

- Double-check the product description to ensure it matches the HS code 4412511030.

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with a customs broker or trade compliance expert if the product is part of a larger shipment or involves multiple classifications.

- Maintain records of material sourcing and processing to support classification accuracy.

Summary Table

| Tariff Type | Rate |

|---|---|

| Base Tariff | 0.0% |

| General Additional Tariff | 25.0% |

| Special Tariff (after 2025.4.11) | 30.0% |

| Total Effective Tariff | 55.0% |

If you have further details about the product's origin, processing, or intended market, I can provide a more tailored compliance review.

Customs Compliance Analysis for Birch Battenboard (Unsurfaced)

Product Name: Birch Battenboard (Unsurfaced)

HS Code: 4412511030

Classification: Plywood, veneered panels, and similar laminated wood — Blockboard, laminboard, and battenboard — With at least one outer ply of tropical wood — Plywood — Not surface covered, or surface covered with a clear or transparent material which does not obscure the grain, texture, or markings of the face ply — With a face ply of birch (Betula spp.) — Not surface covered

Tariff Overview

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Effective Tariff Rate: 55.0%

Key Notes and Considerations

-

Tariff Changes Effective April 11, 2025:

A 30.0% additional tariff will be applied to this product after this date. This is a time-sensitive policy, so it is crucial to plan import timelines accordingly. -

No Anti-Dumping or Countervailing Duties:

As of now, there are no specific anti-dumping or countervailing duties reported for this product classification. -

Material Verification:

Ensure that the face ply is indeed birch (Betula spp.) and that the product is not surface covered. Misclassification due to incorrect material or finish could lead to higher tariffs or customs delays. -

Certifications and Documentation:

Confirm whether any certifications (e.g., FSC, CITES, or wood product compliance) are required for the product, especially if it involves tropical wood or is being imported into markets with strict environmental regulations. -

Unit Price and Quantity:

Verify the unit price and quantity for accurate duty calculation. Customs may require detailed documentation for verification.

Proactive Advice

- Double-check the product description to ensure it matches the HS code 4412511030.

- Monitor the April 11, 2025, deadline for the special tariff increase.

- Consult with a customs broker or trade compliance expert if the product is part of a larger shipment or involves multiple classifications.

- Maintain records of material sourcing and processing to support classification accuracy.

Summary Table

| Tariff Type | Rate |

|---|---|

| Base Tariff | 0.0% |

| General Additional Tariff | 25.0% |

| Special Tariff (after 2025.4.11) | 30.0% |

| Total Effective Tariff | 55.0% |

If you have further details about the product's origin, processing, or intended market, I can provide a more tailored compliance review.

Customer Reviews

No reviews yet.