| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4412330640 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4412921120 | Doc | 55.0% | CN | US | 2025-05-12 |

Customs Classification and Tariff Analysis for Birch Veneered Plywood (Transparent Coating)

HS CODE: 4412.33.06.40

Product Description:

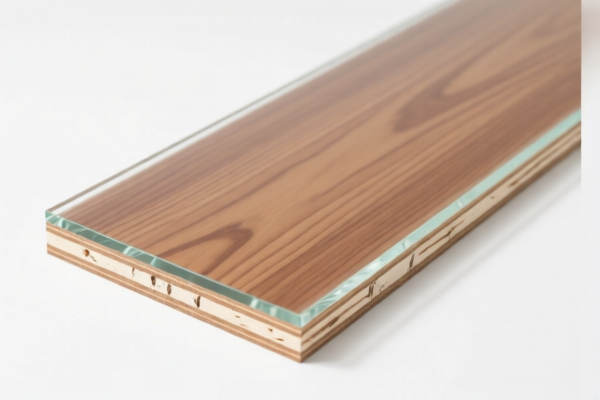

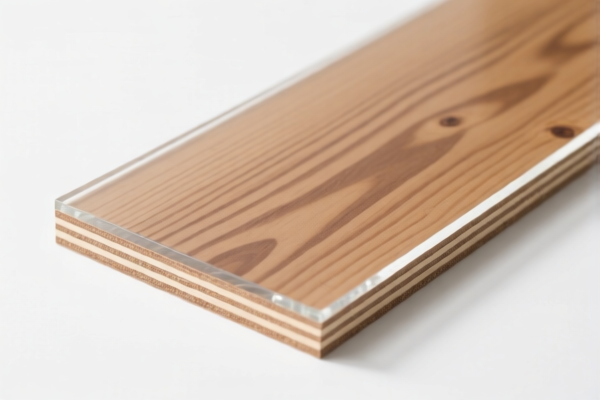

- Birch veneered plywood, not surface covered or covered with a clear/transparent material that does not obscure the grain or texture of the face ply.

- Face ply is made of birch (Betula spp.).

- Plywood with each ply not exceeding 6 mm in thickness.

- Not surface covered.

Tariff Breakdown (as of now)

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Effective Tariff Rate: 55.0%

Key Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for this product category, but always verify with the latest customs updates or consult a customs broker for confirmation.

Proactive Advice for Importers

-

Verify Material Composition:

Ensure the face ply is indeed birch (Betula spp.) and that the ply thickness does not exceed 6 mm. This is critical for correct classification. -

Check Surface Coverage:

The product must be not surface covered or covered with a clear/transparent material that does not obscure the grain. If it is coated with a material that hides the grain, it may fall under a different HS code. -

Document Certification:

Confirm if any certifications (e.g., FSC, CE, or other quality standards) are required for import or sale in the destination country. -

Monitor Tariff Changes:

Keep an eye on tariff updates post-April 11, 2025, as the 30.0% additional tariff could significantly impact your cost structure.

Alternative HS Code: 4412.92.11.20

Product Description:

- Birch face ply plywood, not surface covered or covered with a clear/transparent material.

- Panel dimensions: thickness ≤ 3.6 mm, width ≤ 1.2 m, length ≤ 2.2 m.

- Other plywood with non-coniferous wood outer ply.

Tariff Details (same as above):

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Effective Tariff: 55.0%

Summary of Tax Rate Changes

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff | 0.0% | No duty at the base level |

| Additional Tariff | 25.0% | General additional tariff |

| April 11 Special Tariff | 30.0% | Applies after April 11, 2025 |

| Total Effective Rate | 55.0% | Combined rate after all tariffs |

Final Recommendation

- Ensure product specifications match the HS code description.

- Double-check the ply thickness and surface coverage to avoid misclassification.

- Plan for the 30.0% additional tariff after April 11, 2025, to avoid unexpected costs.

- Consult a customs expert if the product is part of a larger shipment or involves multiple HS codes.

Customs Classification and Tariff Analysis for Birch Veneered Plywood (Transparent Coating)

HS CODE: 4412.33.06.40

Product Description:

- Birch veneered plywood, not surface covered or covered with a clear/transparent material that does not obscure the grain or texture of the face ply.

- Face ply is made of birch (Betula spp.).

- Plywood with each ply not exceeding 6 mm in thickness.

- Not surface covered.

Tariff Breakdown (as of now)

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Effective Tariff Rate: 55.0%

Key Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a time-sensitive policy—plan your import schedule accordingly. -

Anti-dumping duties:

No specific anti-dumping duties are currently listed for this product category, but always verify with the latest customs updates or consult a customs broker for confirmation.

Proactive Advice for Importers

-

Verify Material Composition:

Ensure the face ply is indeed birch (Betula spp.) and that the ply thickness does not exceed 6 mm. This is critical for correct classification. -

Check Surface Coverage:

The product must be not surface covered or covered with a clear/transparent material that does not obscure the grain. If it is coated with a material that hides the grain, it may fall under a different HS code. -

Document Certification:

Confirm if any certifications (e.g., FSC, CE, or other quality standards) are required for import or sale in the destination country. -

Monitor Tariff Changes:

Keep an eye on tariff updates post-April 11, 2025, as the 30.0% additional tariff could significantly impact your cost structure.

Alternative HS Code: 4412.92.11.20

Product Description:

- Birch face ply plywood, not surface covered or covered with a clear/transparent material.

- Panel dimensions: thickness ≤ 3.6 mm, width ≤ 1.2 m, length ≤ 2.2 m.

- Other plywood with non-coniferous wood outer ply.

Tariff Details (same as above):

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

- Total Effective Tariff: 55.0%

Summary of Tax Rate Changes

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff | 0.0% | No duty at the base level |

| Additional Tariff | 25.0% | General additional tariff |

| April 11 Special Tariff | 30.0% | Applies after April 11, 2025 |

| Total Effective Rate | 55.0% | Combined rate after all tariffs |

Final Recommendation

- Ensure product specifications match the HS code description.

- Double-check the ply thickness and surface coverage to avoid misclassification.

- Plan for the 30.0% additional tariff after April 11, 2025, to avoid unexpected costs.

- Consult a customs expert if the product is part of a larger shipment or involves multiple HS codes.

Customer Reviews

No reviews yet.