| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940020 | Doc | 55.0% | CN | US | 2025-05-12 |

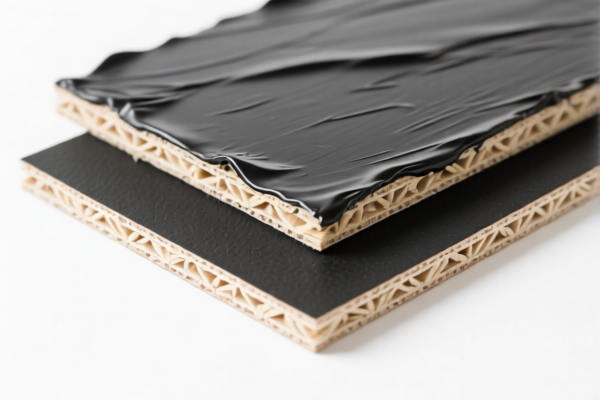

Product Name: Bitumen Impregnated Fiberboard (Density 0.35–0.5 g/cm³)

HS CODE: 4411940010 and 4411940020

🔍 Classification Summary:

- HS CODE 4411940010:

- Description: Bitumen-impregnated fiberboard with a density of 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE 4411940020:

- Description: Fiberboard with a density not exceeding 0.5 g/cm³, and density over 0.35 g/cm³ but not exceeding 0.5 g/cm³

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered for import planning.

-

No Anti-Dumping Duties:

- No specific anti-dumping duties are listed for this product category (iron or aluminum-related).

🛠️ Proactive Advice for Importers:

- Verify Material Composition:

-

Confirm that the product is indeed bitumen-impregnated fiberboard and not a different type of board (e.g., particle board or MDF), as this could affect classification.

-

Check Density Specifications:

-

Ensure the density falls within the specified range (0.35–0.5 g/cm³) to qualify for the correct HS code.

-

Review Certification Requirements:

-

Some countries may require product certifications (e.g., fire resistance, environmental compliance) for import clearance.

-

Monitor Tariff Updates:

-

Stay informed about tariff changes after April 11, 2025, as this could significantly impact your import costs.

-

Consult Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

✅ Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Tariff after April 11, 2025 | Total Tax Rate |

|---|---|---|---|---|---|

| 4411940010 | Bitumen-impregnated fiberboard (0.35–0.5 g/cm³) | 0.0% | 25.0% | 30.0% | 55.0% |

| 4411940020 | Fiberboard (0.35–0.5 g/cm³) | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: Bitumen Impregnated Fiberboard (Density 0.35–0.5 g/cm³)

HS CODE: 4411940010 and 4411940020

🔍 Classification Summary:

- HS CODE 4411940010:

- Description: Bitumen-impregnated fiberboard with a density of 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

-

Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

-

HS CODE 4411940020:

- Description: Fiberboard with a density not exceeding 0.5 g/cm³, and density over 0.35 g/cm³ but not exceeding 0.5 g/cm³

- Total Tax Rate: 55.0%

- Tax Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Tariff after April 11, 2025: 30.0%

📌 Key Tax Rate Changes:

- April 11, 2025 Special Tariff:

- A 30.0% additional tariff will be imposed after April 11, 2025.

-

This is a time-sensitive policy and must be considered for import planning.

-

No Anti-Dumping Duties:

- No specific anti-dumping duties are listed for this product category (iron or aluminum-related).

🛠️ Proactive Advice for Importers:

- Verify Material Composition:

-

Confirm that the product is indeed bitumen-impregnated fiberboard and not a different type of board (e.g., particle board or MDF), as this could affect classification.

-

Check Density Specifications:

-

Ensure the density falls within the specified range (0.35–0.5 g/cm³) to qualify for the correct HS code.

-

Review Certification Requirements:

-

Some countries may require product certifications (e.g., fire resistance, environmental compliance) for import clearance.

-

Monitor Tariff Updates:

-

Stay informed about tariff changes after April 11, 2025, as this could significantly impact your import costs.

-

Consult Customs Broker:

- For complex or high-value shipments, consider engaging a customs broker to ensure compliance and avoid delays.

✅ Summary Table:

| HS CODE | Description | Base Tariff | Additional Tariff | Tariff after April 11, 2025 | Total Tax Rate |

|---|---|---|---|---|---|

| 4411940010 | Bitumen-impregnated fiberboard (0.35–0.5 g/cm³) | 0.0% | 25.0% | 30.0% | 55.0% |

| 4411940020 | Fiberboard (0.35–0.5 g/cm³) | 0.0% | 25.0% | 30.0% | 55.0% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.