| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

| 1404904000 | Doc | 57.3% | CN | US | 2025-05-12 |

| 1404909040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

| 3925900000 | Doc | 60.3% | CN | US | 2025-05-12 |

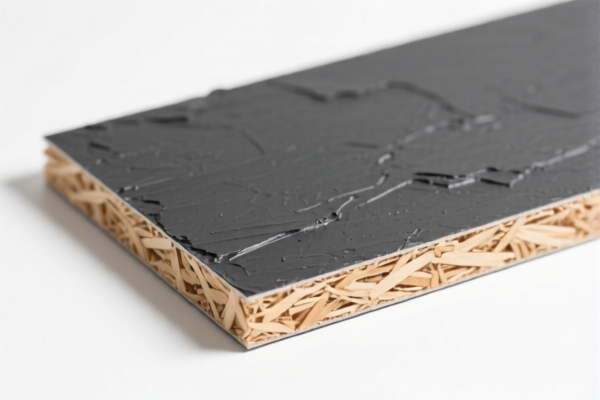

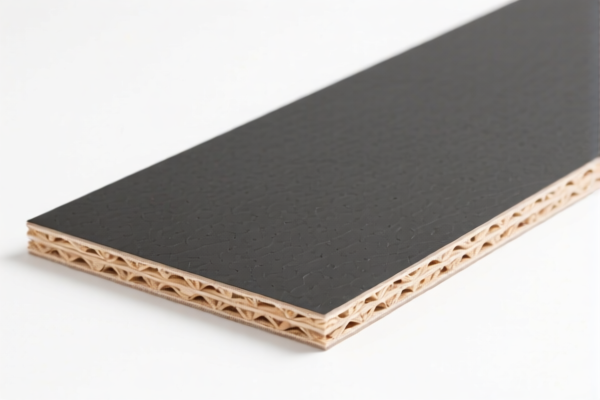

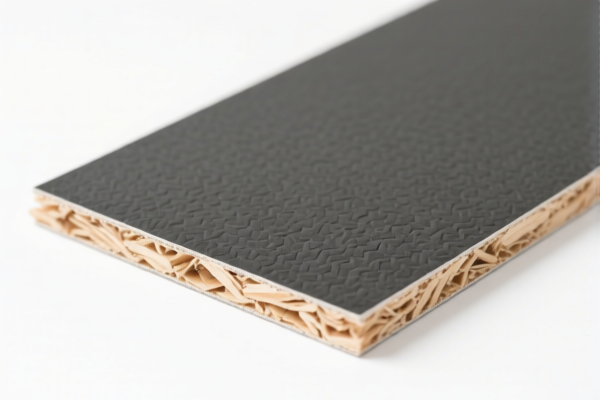

✅ Customs Classification and Tariff Analysis for Bitumen Impregnated Wood Fiberboard (0.35–0.5 g/cm³, Raw State)

🔍 Product Classification Overview

Based on your provided product description:

- Material: Wood fiberboard impregnated with bitumen

- Density: Between 0.35 g/cm³ and 0.5 g/cm³

- Processing: Not mechanically worked or surface covered

- Bonding: May be bonded with resins or other organic substances

This product falls under HS Code 4411.94.00.10.

📦 HS Code and Tariff Details

✅ HS CODE: 4411940010

- Description:

- Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances

- Other: Of a density not exceeding 0.5 g/cm³

- Of a density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³

- Not mechanically worked or surface covered

- Impregnated with bitumen

📊 Tariff Breakdown

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff Rate | 0.0% | Standard import duty |

| Additional Tariff | 25.0% | General additional duty |

| April 11, 2025+ Tariff | 30.0% | Special additional duty after April 11, 2025 |

| Total Tariff Rate | 55.0% | Combined rate (0.0% + 25.0% + 30.0%) |

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

No Anti-Dumping or Countervailing Duties:

No specific anti-dumping or countervailing duties are currently listed for this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fiberboard is indeed impregnated with bitumen and not surface-treated or mechanically worked.

- Confirm Density: The product must fall within the 0.35–0.5 g/cm³ range to qualify for this HS code.

- Check Certifications: Some countries may require product safety or environmental certifications for imported fiberboard.

- Review Documentation: Ensure proper commodity classification, invoice details, and HS code are included in all customs documentation.

- Monitor Tariff Changes: Keep an eye on April 11, 2025 for potential tariff increases.

📌 Alternative HS Codes (for Reference)

| HS Code | Description | Applicable? | Notes |

|---|---|---|---|

| 4411940050 | Similar to 4411940010, but with a broader density range | Not applicable | Your product has a specific density range (0.35–0.5 g/cm³), so 4411940010 is more accurate. |

| 1404904000 | Vegetable materials used in brooms | ❌ Not applicable | This is for vegetable fibers, not wood fiberboard. |

| 1404909040 | Raw vegetable materials for dyeing/tanning | ❌ Not applicable | Not related to wood fiberboard. |

| 3925900000 | Plastic builders' ware | ❌ Not applicable | This is for plastic products, not wood fiberboard. |

✅ Conclusion

- Correct HS Code:

4411940010 - Total Tariff Rate: 55.0% (0.0% + 25.0% + 30.0%)

- Key Alert: 30.0% additional tariff after April 11, 2025

- Action Required: Confirm product specifications and prepare for potential tariff increases.

Let me know if you need help with customs documentation templates or certification requirements for this product.

✅ Customs Classification and Tariff Analysis for Bitumen Impregnated Wood Fiberboard (0.35–0.5 g/cm³, Raw State)

🔍 Product Classification Overview

Based on your provided product description:

- Material: Wood fiberboard impregnated with bitumen

- Density: Between 0.35 g/cm³ and 0.5 g/cm³

- Processing: Not mechanically worked or surface covered

- Bonding: May be bonded with resins or other organic substances

This product falls under HS Code 4411.94.00.10.

📦 HS Code and Tariff Details

✅ HS CODE: 4411940010

- Description:

- Fiberboard of wood or other ligneous materials, whether or not bonded with resins or other organic substances

- Other: Of a density not exceeding 0.5 g/cm³

- Of a density exceeding 0.35 g/cm³ but not exceeding 0.5 g/cm³

- Not mechanically worked or surface covered

- Impregnated with bitumen

📊 Tariff Breakdown

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff Rate | 0.0% | Standard import duty |

| Additional Tariff | 25.0% | General additional duty |

| April 11, 2025+ Tariff | 30.0% | Special additional duty after April 11, 2025 |

| Total Tariff Rate | 55.0% | Combined rate (0.0% + 25.0% + 30.0%) |

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning. -

No Anti-Dumping or Countervailing Duties:

No specific anti-dumping or countervailing duties are currently listed for this product category.

📌 Proactive Advice for Importers

- Verify Material Composition: Ensure the fiberboard is indeed impregnated with bitumen and not surface-treated or mechanically worked.

- Confirm Density: The product must fall within the 0.35–0.5 g/cm³ range to qualify for this HS code.

- Check Certifications: Some countries may require product safety or environmental certifications for imported fiberboard.

- Review Documentation: Ensure proper commodity classification, invoice details, and HS code are included in all customs documentation.

- Monitor Tariff Changes: Keep an eye on April 11, 2025 for potential tariff increases.

📌 Alternative HS Codes (for Reference)

| HS Code | Description | Applicable? | Notes |

|---|---|---|---|

| 4411940050 | Similar to 4411940010, but with a broader density range | Not applicable | Your product has a specific density range (0.35–0.5 g/cm³), so 4411940010 is more accurate. |

| 1404904000 | Vegetable materials used in brooms | ❌ Not applicable | This is for vegetable fibers, not wood fiberboard. |

| 1404909040 | Raw vegetable materials for dyeing/tanning | ❌ Not applicable | Not related to wood fiberboard. |

| 3925900000 | Plastic builders' ware | ❌ Not applicable | This is for plastic products, not wood fiberboard. |

✅ Conclusion

- Correct HS Code:

4411940010 - Total Tariff Rate: 55.0% (0.0% + 25.0% + 30.0%)

- Key Alert: 30.0% additional tariff after April 11, 2025

- Action Required: Confirm product specifications and prepare for potential tariff increases.

Let me know if you need help with customs documentation templates or certification requirements for this product.

Customer Reviews

No reviews yet.