| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940050 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4706930100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4706910000 | Doc | 55.0% | CN | US | 2025-05-12 |

✅ Customs Classification and Tariff Analysis for Bitumen Impregnated Wood Fiberboard

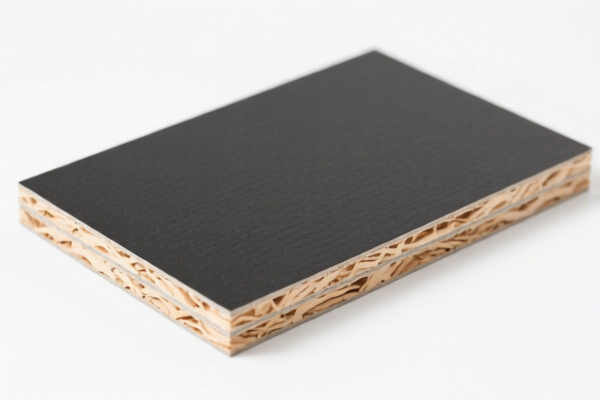

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs for Bitumen Impregnated Wood Fiberboard with a density between 0.35 g/cm³ and 0.5 g/cm³, and not mechanically worked or surface covered.

🔍 HS Code: 4411940010

📌 Product Description Match:

- Fiberboard of wood or other ligneous materials

- Not mechanically worked or surface covered

- Impregnated with bitumen

- Density between 0.35 g/cm³ and 0.5 g/cm³

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Effective Tariff Rate: 55.0%

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently listed for this product category.

- No Specific Tariff for Iron or Aluminum: This product is not made of iron or aluminum, so those duties do not apply.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fiberboard is impregnated with bitumen and not mechanically worked to confirm it falls under HS 4411940010.

- Check Unit Price and Density: Confirm the density is within the 0.35–0.5 g/cm³ range, as this is a key classification criterion.

- Review Certification Requirements: Some countries may require product safety certifications or environmental compliance documents, especially for bitumen-treated materials.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the special tariff will increase from 25% to 30% after that date.

📌 Alternative HS Codes (for reference):

- 4411940050 – Similar to 4411940010, but for fiberboard with density not exceeding 0.5 g/cm³, but not specified in the 0.35–0.5 range.

- 4706910000 / 4706930100 – These are for pulp of recovered paper, not fiberboard, and are not applicable to your product.

✅ Conclusion:

Your Bitumen Impregnated Wood Fiberboard with a density between 0.35 g/cm³ and 0.5 g/cm³ is correctly classified under HS Code 4411940010, with a total effective tariff rate of 55.0% (including the 30.0% special tariff after April 11, 2025). Ensure all documentation and product specifications align with this classification to avoid delays or additional duties.

✅ Customs Classification and Tariff Analysis for Bitumen Impregnated Wood Fiberboard

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs for Bitumen Impregnated Wood Fiberboard with a density between 0.35 g/cm³ and 0.5 g/cm³, and not mechanically worked or surface covered.

🔍 HS Code: 4411940010

📌 Product Description Match:

- Fiberboard of wood or other ligneous materials

- Not mechanically worked or surface covered

- Impregnated with bitumen

- Density between 0.35 g/cm³ and 0.5 g/cm³

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Effective Tariff Rate: 55.0%

⚠️ Important Notes and Alerts:

- April 11, 2025 Special Tariff: A 30.0% additional tariff will be applied after April 11, 2025. This is a time-sensitive policy and must be considered in your import planning.

- No Anti-Dumping or Countervailing Duties: No specific anti-dumping or countervailing duties are currently listed for this product category.

- No Specific Tariff for Iron or Aluminum: This product is not made of iron or aluminum, so those duties do not apply.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the fiberboard is impregnated with bitumen and not mechanically worked to confirm it falls under HS 4411940010.

- Check Unit Price and Density: Confirm the density is within the 0.35–0.5 g/cm³ range, as this is a key classification criterion.

- Review Certification Requirements: Some countries may require product safety certifications or environmental compliance documents, especially for bitumen-treated materials.

- Monitor Tariff Updates: Keep an eye on April 11, 2025, as the special tariff will increase from 25% to 30% after that date.

📌 Alternative HS Codes (for reference):

- 4411940050 – Similar to 4411940010, but for fiberboard with density not exceeding 0.5 g/cm³, but not specified in the 0.35–0.5 range.

- 4706910000 / 4706930100 – These are for pulp of recovered paper, not fiberboard, and are not applicable to your product.

✅ Conclusion:

Your Bitumen Impregnated Wood Fiberboard with a density between 0.35 g/cm³ and 0.5 g/cm³ is correctly classified under HS Code 4411940010, with a total effective tariff rate of 55.0% (including the 30.0% special tariff after April 11, 2025). Ensure all documentation and product specifications align with this classification to avoid delays or additional duties.

Customer Reviews

No reviews yet.