| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940030 | Doc | 55.0% | CN | US | 2025-05-12 |

| 1404909040 | Doc | 55.0% | CN | US | 2025-05-12 |

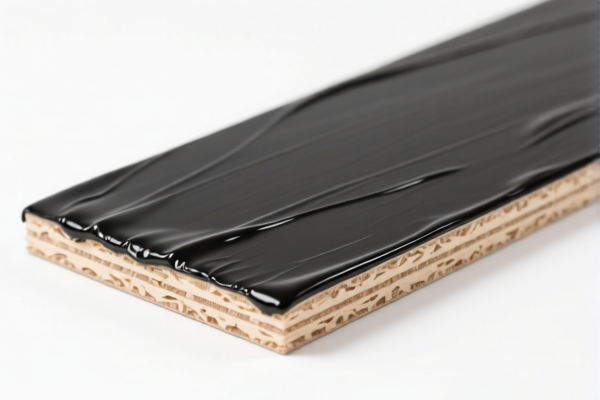

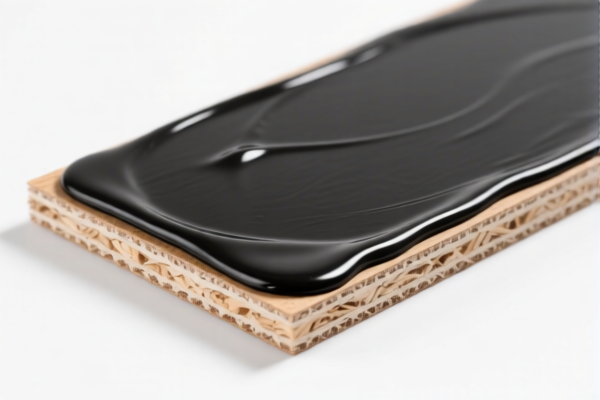

✅ Customs Classification and Tariff Analysis for Bitumen Impregnated Wood Fiberboard

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs for Bitumen Impregnated Wood Fiberboard with a density between 0.35 g/cm³ and 0.5 g/cm³, and not mechanically worked or surface covered.

🔍 Product Classification

- Product Name: Bitumen Impregnated Wood Fiberboard (Density 0.35–0.5 g/cm³, Unworked)

- HS Code: 4411940010 (Preferred classification for unworked fiberboard impregnated with bitumen)

- Alternative HS Code: 4411940030 (for similar products, but may apply to different processing or specifications)

📊 Tariff Breakdown (as of now)

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff Rate | 0.0% | No import duty at the base level |

| Additional Tariff | 25.0% | General additional tariff |

| April 11, 2025 Tariff | 30.0% | Applies after April 11, 2025 |

| Total Tariff Rate | 55.0% | Sum of base + additional + special tariffs |

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. Ensure your import timeline accounts for this change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the fiberboard is unworked, not surface-covered, and impregnated with bitumen. This is critical for correct HS code classification.

- Density Check: Ensure the density is between 0.35 g/cm³ and 0.5 g/cm³. If it's below 0.35 g/cm³, the classification may change.

- Documentation: Provide technical specifications, material composition, and certifications (if required) to support the classification.

- Tariff Timing: If your import is scheduled after April 11, 2025, be prepared for the 30.0% additional tariff.

- Anti-dumping duties: Not applicable for this product category (wood fiberboard).

🛠️ Proactive Advice for Importers

- Double-check the product description to ensure it matches the HS code 4411940010.

- Verify the unit price and material composition to avoid misclassification.

- Consult with a customs broker or classification expert if the product is borderline or has multiple components.

- Keep records of product testing and certification (e.g., density, bitumen content) for customs audits.

📌 Summary

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 4411940010 | Bitumen impregnated fiberboard (unworked) | 0.0% | 25.0% | 30.0% (after 2025.4.11) | 55.0% |

| 4411940030 | Similar, but may apply to other variants | 0.0% | 25.0% | 30.0% (after 2025.4.11) | 55.0% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

✅ Customs Classification and Tariff Analysis for Bitumen Impregnated Wood Fiberboard

Based on your provided product description and HS codes, here is a structured breakdown of the classification and applicable tariffs for Bitumen Impregnated Wood Fiberboard with a density between 0.35 g/cm³ and 0.5 g/cm³, and not mechanically worked or surface covered.

🔍 Product Classification

- Product Name: Bitumen Impregnated Wood Fiberboard (Density 0.35–0.5 g/cm³, Unworked)

- HS Code: 4411940010 (Preferred classification for unworked fiberboard impregnated with bitumen)

- Alternative HS Code: 4411940030 (for similar products, but may apply to different processing or specifications)

📊 Tariff Breakdown (as of now)

| Tariff Type | Rate | Notes |

|---|---|---|

| Base Tariff Rate | 0.0% | No import duty at the base level |

| Additional Tariff | 25.0% | General additional tariff |

| April 11, 2025 Tariff | 30.0% | Applies after April 11, 2025 |

| Total Tariff Rate | 55.0% | Sum of base + additional + special tariffs |

⚠️ Important Note: The 30.0% additional tariff will be imposed after April 11, 2025. Ensure your import timeline accounts for this change.

📌 Key Considerations for Customs Compliance

- Material Verification: Confirm that the fiberboard is unworked, not surface-covered, and impregnated with bitumen. This is critical for correct HS code classification.

- Density Check: Ensure the density is between 0.35 g/cm³ and 0.5 g/cm³. If it's below 0.35 g/cm³, the classification may change.

- Documentation: Provide technical specifications, material composition, and certifications (if required) to support the classification.

- Tariff Timing: If your import is scheduled after April 11, 2025, be prepared for the 30.0% additional tariff.

- Anti-dumping duties: Not applicable for this product category (wood fiberboard).

🛠️ Proactive Advice for Importers

- Double-check the product description to ensure it matches the HS code 4411940010.

- Verify the unit price and material composition to avoid misclassification.

- Consult with a customs broker or classification expert if the product is borderline or has multiple components.

- Keep records of product testing and certification (e.g., density, bitumen content) for customs audits.

📌 Summary

| HS Code | Description | Base Tariff | Additional Tariff | April 11 Tariff | Total Tariff |

|---|---|---|---|---|---|

| 4411940010 | Bitumen impregnated fiberboard (unworked) | 0.0% | 25.0% | 30.0% (after 2025.4.11) | 55.0% |

| 4411940030 | Similar, but may apply to other variants | 0.0% | 25.0% | 30.0% (after 2025.4.11) | 55.0% |

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.