| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940040 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411931000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

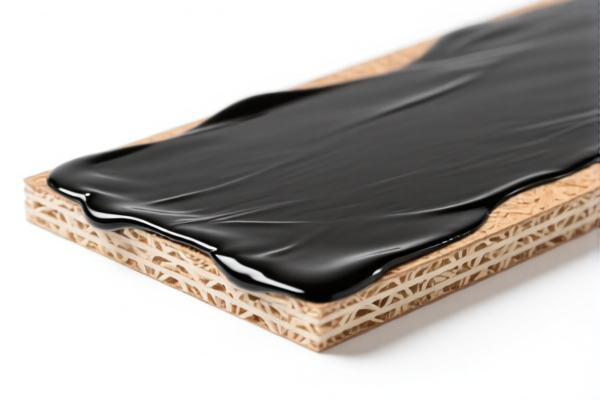

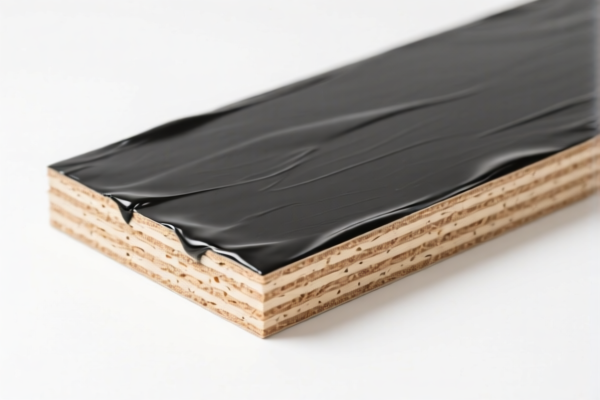

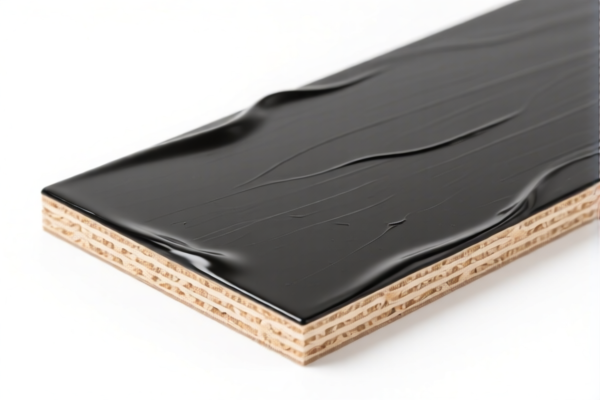

Product Classification: Bitumen Impregnated Wood Fiberboard for Building (Density 0.35–0.5 g/cm³)

HS CODE: 4411940010 (as per the provided data)

🔍 Classification Summary:

- Product: Bitumen (asphalt) impregnated wood fiberboard used in construction.

- Density: 0.35–0.5 g/cm³.

- HS Code: 4411940010 (specific to impregnated wood fiberboard with the specified density).

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date to note for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties:

- Not applicable for this product (no mention of anti-dumping duties on wood fiberboard in the provided data).

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed bitumen-impregnated and not just treated or coated, as this affects classification.

- Check Unit Price: Confirm the unit price and density to ensure it falls within the 0.35–0.5 g/cm³ range for HS code 4411940010.

- Certifications Required: Confirm if any customs or import certifications (e.g., product standards, origin documentation) are required for the product.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly impact import costs.

✅ Conclusion:

The Bitumen Impregnated Wood Fiberboard with a density of 0.35–0.5 g/cm³ is correctly classified under HS CODE 4411940010, with a total tax rate of 55.0%. Be mindful of the April 11, 2025 tariff increase and ensure all product details align with the classification criteria.

Product Classification: Bitumen Impregnated Wood Fiberboard for Building (Density 0.35–0.5 g/cm³)

HS CODE: 4411940010 (as per the provided data)

🔍 Classification Summary:

- Product: Bitumen (asphalt) impregnated wood fiberboard used in construction.

- Density: 0.35–0.5 g/cm³.

- HS Code: 4411940010 (specific to impregnated wood fiberboard with the specified density).

📊 Tariff Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0%

⏰ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025. This is a critical date to note for customs clearance planning and cost estimation.

🛑 Anti-Dumping Duties:

- Not applicable for this product (no mention of anti-dumping duties on wood fiberboard in the provided data).

📌 Proactive Advice:

- Verify Material Composition: Ensure the product is indeed bitumen-impregnated and not just treated or coated, as this affects classification.

- Check Unit Price: Confirm the unit price and density to ensure it falls within the 0.35–0.5 g/cm³ range for HS code 4411940010.

- Certifications Required: Confirm if any customs or import certifications (e.g., product standards, origin documentation) are required for the product.

- Monitor Tariff Updates: Stay informed about tariff changes after April 11, 2025, as this could significantly impact import costs.

✅ Conclusion:

The Bitumen Impregnated Wood Fiberboard with a density of 0.35–0.5 g/cm³ is correctly classified under HS CODE 4411940010, with a total tax rate of 55.0%. Be mindful of the April 11, 2025 tariff increase and ensure all product details align with the classification criteria.

Customer Reviews

No reviews yet.