Found 3 matching results

(CN → US)

| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940040 | Doc | 55.0% | CN | US | 2025-05-12 |

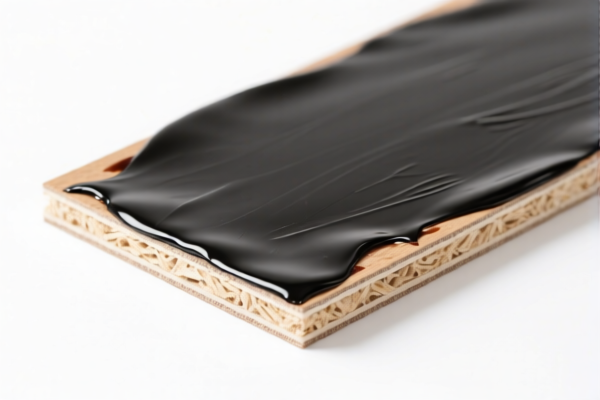

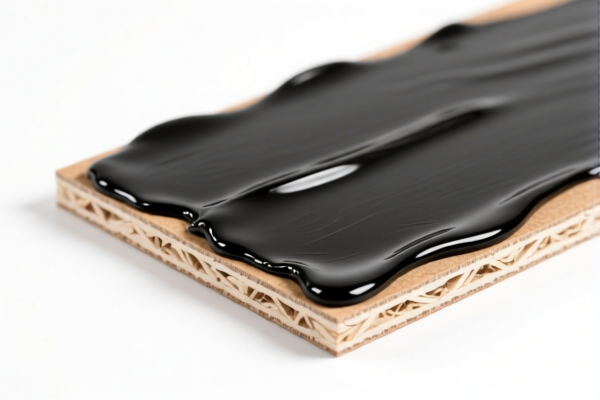

Product Name: Bitumen Impregnated Wood Fiberboard for Packaging (Density 0.35–0.5 g/cm³)

HS CODE:

- 4411940010

- 4411940020

- 4411940040

🔍 Classification Summary:

- All three HS codes apply to wood fiberboard with a density between 0.35–0.5 g/cm³, impregnated with bitumen, and not mechanically processed or surface-covered.

- The key difference lies in descriptive wording, but tariff rates are identical across all three codes.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025: A special additional tariff of 30.0% will be imposed on this product.

- This is not an anti-dumping duty specific to iron or aluminum, but a general trade policy adjustment.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is bitumen-impregnated wood fiberboard and not surface-covered or mechanically processed.

- Check Unit Price: The total tax rate is 55%, so unit price and quantity will affect the total duty payable.

- Certifications Required: Confirm if customs documentation (e.g., commercial invoice, packing list, product specification) is complete and compliant.

- HS Code Confirmation: Although the tariff rates are the same, it is recommended to confirm the exact HS code based on the product description and origin to avoid classification disputes.

✅ Summary of Key Points:

- HS Code Options: 4411940010, 4411940020, 4411940040

- Tariff Rate: 55.0% (0.0% base + 25.0% general + 30.0% after April 11, 2025)

- No Anti-Dumping Duty on this product

- April 11, 2025: A 30.0% additional tariff will be applied

- Action Required: Confirm product details and documentation before importation

Let me know if you need help with customs documentation or certification requirements for this product. Product Name: Bitumen Impregnated Wood Fiberboard for Packaging (Density 0.35–0.5 g/cm³)

HS CODE:

- 4411940010

- 4411940020

- 4411940040

🔍 Classification Summary:

- All three HS codes apply to wood fiberboard with a density between 0.35–0.5 g/cm³, impregnated with bitumen, and not mechanically processed or surface-covered.

- The key difference lies in descriptive wording, but tariff rates are identical across all three codes.

📊 Tariff Breakdown (as of now):

- Base Tariff Rate: 0.0%

- Additional Tariff (General): 25.0%

- Special Tariff (After April 11, 2025): 30.0%

- Total Tax Rate: 55.0% (0.0% + 25.0% + 30.0%)

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025: A special additional tariff of 30.0% will be imposed on this product.

- This is not an anti-dumping duty specific to iron or aluminum, but a general trade policy adjustment.

📌 Proactive Advice for Importers:

- Verify Material Composition: Ensure the product is bitumen-impregnated wood fiberboard and not surface-covered or mechanically processed.

- Check Unit Price: The total tax rate is 55%, so unit price and quantity will affect the total duty payable.

- Certifications Required: Confirm if customs documentation (e.g., commercial invoice, packing list, product specification) is complete and compliant.

- HS Code Confirmation: Although the tariff rates are the same, it is recommended to confirm the exact HS code based on the product description and origin to avoid classification disputes.

✅ Summary of Key Points:

- HS Code Options: 4411940010, 4411940020, 4411940040

- Tariff Rate: 55.0% (0.0% base + 25.0% general + 30.0% after April 11, 2025)

- No Anti-Dumping Duty on this product

- April 11, 2025: A 30.0% additional tariff will be applied

- Action Required: Confirm product details and documentation before importation

Let me know if you need help with customs documentation or certification requirements for this product.

Customer Reviews

No reviews yet.