| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4807001000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811101100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811102100 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4807001000 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4811101100 | Doc | 55.0% | CN | US | 2025-05-12 |

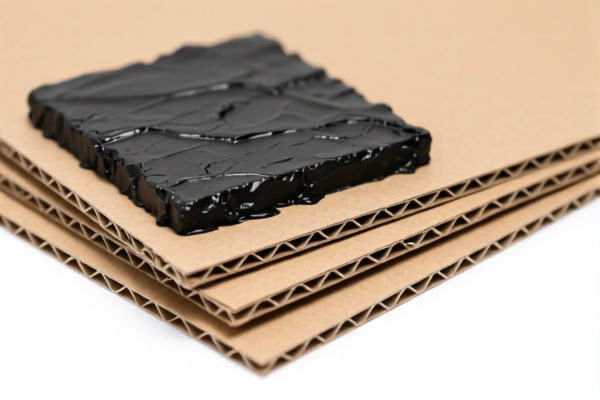

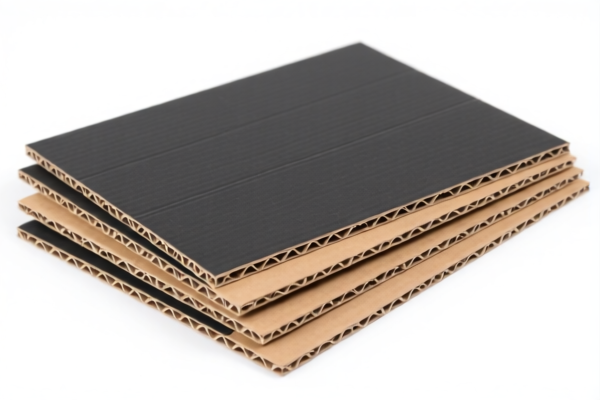

Product Classification: Bitumen Reinforced Paperboard Sheets

Based on the provided HS codes and descriptions, the Bitumen Reinforced Paperboard Sheets fall under the following classifications:

✅ HS CODE: 4807001000

Description: Applicable to paperboard sheets with internal lamination of bitumen (asphalt).

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 4811101100

Description: Applicable to paper, paperboard, cellulose cotton, and cellulose fiber nets that are coated, impregnated, covered, surface-colored, decorated, or printed, in rolls or rectangular (including square) sheets.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 4811102100

Description: Applicable to paper, paperboard, cellulose cotton, and cellulose fiber nets that are coated, impregnated, covered, surface-colored, decorated, or printed, including tar paper, bitumen paper, and paperboard.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 Key Observations:

- All three HS codes apply to bitumen-reinforced paperboard or asphalt-treated paper products, with identical tax rates.

- No anti-dumping duties are mentioned for this product category.

- No specific duties on iron or aluminum are applicable here, as the product is paper-based.

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025.

This is a critical date for customs clearance planning and cost estimation.

📌 Proactive Advice for Importers:

- Verify the exact material composition of the paperboard (e.g., type of bitumen, paper thickness, and coating method) to ensure correct HS code classification.

- Check the unit price and total value of the shipment, as this may affect the application of additional tariffs.

- Confirm required certifications (e.g., environmental compliance, safety standards) for import into the destination country.

- Consult with customs brokers or legal advisors to ensure full compliance with local and international trade regulations.

Let me know if you need help with certification requirements or customs documentation for this product.

Product Classification: Bitumen Reinforced Paperboard Sheets

Based on the provided HS codes and descriptions, the Bitumen Reinforced Paperboard Sheets fall under the following classifications:

✅ HS CODE: 4807001000

Description: Applicable to paperboard sheets with internal lamination of bitumen (asphalt).

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 4811101100

Description: Applicable to paper, paperboard, cellulose cotton, and cellulose fiber nets that are coated, impregnated, covered, surface-colored, decorated, or printed, in rolls or rectangular (including square) sheets.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

✅ HS CODE: 4811102100

Description: Applicable to paper, paperboard, cellulose cotton, and cellulose fiber nets that are coated, impregnated, covered, surface-colored, decorated, or printed, including tar paper, bitumen paper, and paperboard.

Total Tax Rate: 55.0%

Tax Breakdown:

- Base Tariff Rate: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

🔍 Key Observations:

- All three HS codes apply to bitumen-reinforced paperboard or asphalt-treated paper products, with identical tax rates.

- No anti-dumping duties are mentioned for this product category.

- No specific duties on iron or aluminum are applicable here, as the product is paper-based.

⏱️ Time-Sensitive Policy Alert:

- April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed after April 11, 2025.

This is a critical date for customs clearance planning and cost estimation.

📌 Proactive Advice for Importers:

- Verify the exact material composition of the paperboard (e.g., type of bitumen, paper thickness, and coating method) to ensure correct HS code classification.

- Check the unit price and total value of the shipment, as this may affect the application of additional tariffs.

- Confirm required certifications (e.g., environmental compliance, safety standards) for import into the destination country.

- Consult with customs brokers or legal advisors to ensure full compliance with local and international trade regulations.

Let me know if you need help with certification requirements or customs documentation for this product.

Customer Reviews

No reviews yet.