| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 4411940010 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940020 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940030 | Doc | 55.0% | CN | US | 2025-05-12 |

| 4411940040 | Doc | 55.0% | CN | US | 2025-05-12 |

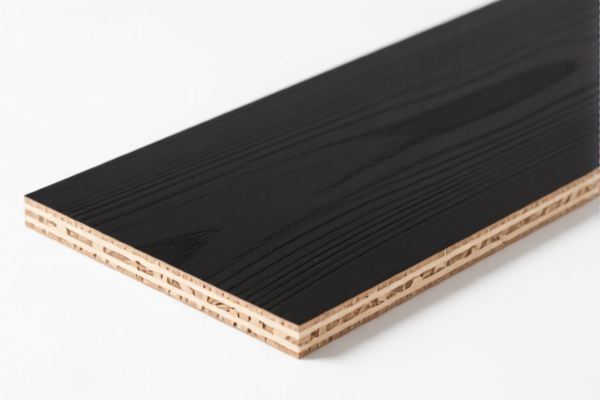

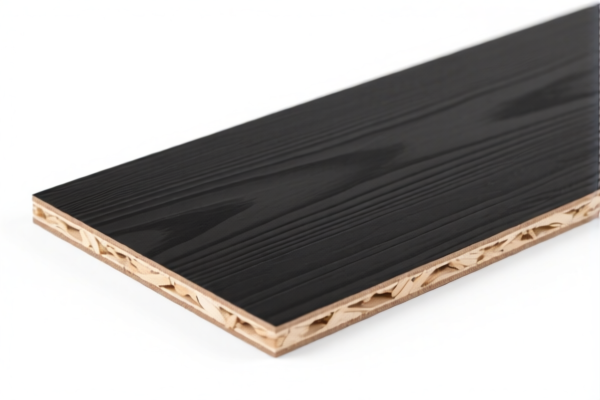

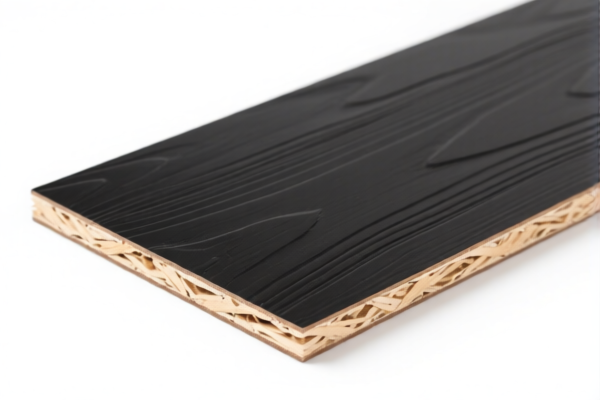

Product Name: Bitumen Treated Wood Fiberboard (Density 0.35–0.5 g/cm³)

Classification: HS Code 4411.94.00.10 / 4411.94.00.20 / 4411.94.00.30 / 4411.94.00.40

✅ HS CODES AND TAX DETAILS

- HS CODE: 4411.94.00.10

- Description: Wood boards with density between 0.35–0.5 g/cm³, not mechanically worked or surfaced, impregnated with bitumen

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411.94.00.20

- Description: Fiberboard made of wood or cellulose materials with density between 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411.94.00.30

- Description: Wood fiberboard with density between 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411.94.00.40

- Description: Fiberboard made of wood or cellulose materials with density between 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all four HS codes after April 11, 2025. This is a time-sensitive policy—ensure your import timeline is aligned accordingly. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently listed for this product category (wood fiberboard with bitumen treatment). -

No Specific Tariffs on Iron or Aluminum:

This product is not composed of iron or aluminum, so no related anti-dumping duties apply.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Confirm that the product is indeed wood fiberboard with bitumen treatment and density between 0.35–0.5 g/cm³ to ensure correct HS code classification. -

Check Unit Price and Certification:

Ensure that the unit price is correctly declared and that any certifications (e.g., environmental, safety, or quality) required by the importing country are in place. -

Monitor Tariff Changes:

Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs. -

Consult Customs Broker:

For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid delays.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Product Name: Bitumen Treated Wood Fiberboard (Density 0.35–0.5 g/cm³)

Classification: HS Code 4411.94.00.10 / 4411.94.00.20 / 4411.94.00.30 / 4411.94.00.40

✅ HS CODES AND TAX DETAILS

- HS CODE: 4411.94.00.10

- Description: Wood boards with density between 0.35–0.5 g/cm³, not mechanically worked or surfaced, impregnated with bitumen

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411.94.00.20

- Description: Fiberboard made of wood or cellulose materials with density between 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411.94.00.30

- Description: Wood fiberboard with density between 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

-

Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

-

HS CODE: 4411.94.00.40

- Description: Fiberboard made of wood or cellulose materials with density between 0.35–0.5 g/cm³

- Total Tax Rate: 55.0%

- Breakdown:

- Base Tariff: 0.0%

- Additional Tariff: 25.0%

- Special Tariff after April 11, 2025: 30.0%

⚠️ Important Notes and Alerts

-

April 11, 2025 Special Tariff:

A 30.0% additional tariff will be imposed on all four HS codes after April 11, 2025. This is a time-sensitive policy—ensure your import timeline is aligned accordingly. -

No Anti-Dumping Duties:

No specific anti-dumping duties are currently listed for this product category (wood fiberboard with bitumen treatment). -

No Specific Tariffs on Iron or Aluminum:

This product is not composed of iron or aluminum, so no related anti-dumping duties apply.

📌 Proactive Advice for Importers

-

Verify Material Composition:

Confirm that the product is indeed wood fiberboard with bitumen treatment and density between 0.35–0.5 g/cm³ to ensure correct HS code classification. -

Check Unit Price and Certification:

Ensure that the unit price is correctly declared and that any certifications (e.g., environmental, safety, or quality) required by the importing country are in place. -

Monitor Tariff Changes:

Keep track of the April 11, 2025 deadline to avoid unexpected increases in import costs. -

Consult Customs Broker:

For complex or high-value shipments, consider engaging a customs broker to ensure full compliance and avoid delays.

Let me know if you need help with certification requirements, customs documentation, or tariff calculation tools.

Customer Reviews

No reviews yet.