| HS Code | Official Doc | Tariff Rate | Origin | Destination | Effective Date |

|---|---|---|---|---|---|

| 6405100060 | Doc | 47.5% | CN | US | 2025-05-12 |

| 6404206080 | Doc | 75.0% | CN | US | 2025-05-12 |

| 6403593081 | Doc | 35.0% | CN | US | 2025-05-12 |

| 6403599045 | Doc | 40.0% | CN | US | 2025-05-12 |

| 6403593081 | Doc | 35.0% | CN | US | 2025-05-12 |

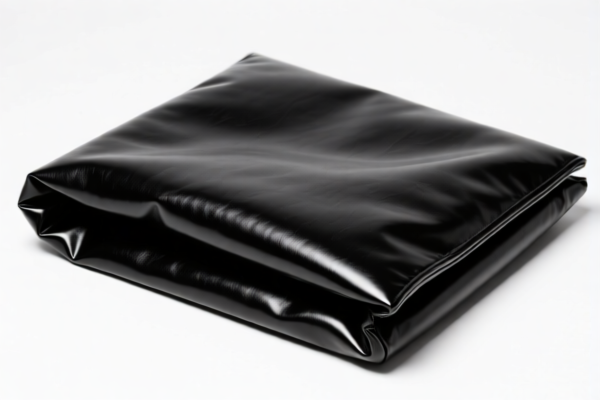

Product Name: Black Patent Leather (Black Patent Leather Shoes)

Classification: Women's shoes made of leather or synthetic leather, with patent leather finish.

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for Black Patent Leather Shoes, based on the provided data:

1. HS CODE: 6405100060

Description: Women's shoes made of leather or synthetic leather.

Total Tax Rate: 47.5%

- Base Tariff: 10.0%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

⚠️ Note: This code is for general women's shoes made of leather or synthetic leather. Ensure the product is not classified under a more specific code.

2. HS CODE: 6404206080

Description: Leather shoes with textile uppers and leather soles.

Total Tax Rate: 75.0%

- Base Tariff: 37.5%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

⚠️ Note: This code applies to shoes with textile uppers and leather soles. If your product has a leather upper, this may not be the correct classification.

3. HS CODE: 6403593081

Description: Shoes with leather uppers and leather soles (Welt footwear).

Total Tax Rate: 35.0%

- Base Tariff: 5.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

✅ Recommended Code: This is likely the most accurate classification for Black Patent Leather Shoes with leather uppers and soles.

4. HS CODE: 6403599045

Description: Shoes with leather uppers and rubber/plastic/leather soles.

Total Tax Rate: 40.0%

- Base Tariff: 10.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

⚠️ Note: This code applies to shoes with non-leather soles (e.g., rubber or plastic). If your shoes have leather soles, this may not be the correct code.

📌 Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and must be considered in your customs planning.

🛑 Anti-Dumping Duties (if applicable)

- Iron and aluminum products may be subject to anti-dumping duties, but leather shoes are generally not subject to these duties.

- However, always verify with customs or a compliance expert if your product is on any anti-dumping duty list.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm whether the shoe has leather uppers and soles or synthetic leather or textile uppers.

- Check Unit Price: Tariff rates may vary based on value per unit or quantity.

- Certifications Required: Ensure compliance with product standards (e.g., safety, labeling, and environmental regulations).

- Consult a Customs Broker: For accurate classification and to avoid delays or penalties.

✅ Recommended Action

If your Black Patent Leather Shoes have leather uppers and soles, the most accurate HS code is likely 6403593081 with a total tax rate of 35.0% (including the 30.0% April 11, 2025 special tariff).

Double-check the material composition and design to ensure correct classification.

Product Name: Black Patent Leather (Black Patent Leather Shoes)

Classification: Women's shoes made of leather or synthetic leather, with patent leather finish.

✅ HS CODE Classification and Tax Details

Below are the HS codes and corresponding tax rates for Black Patent Leather Shoes, based on the provided data:

1. HS CODE: 6405100060

Description: Women's shoes made of leather or synthetic leather.

Total Tax Rate: 47.5%

- Base Tariff: 10.0%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0% (applies after April 11, 2025)

⚠️ Note: This code is for general women's shoes made of leather or synthetic leather. Ensure the product is not classified under a more specific code.

2. HS CODE: 6404206080

Description: Leather shoes with textile uppers and leather soles.

Total Tax Rate: 75.0%

- Base Tariff: 37.5%

- Additional Tariff: 7.5%

- April 11, 2025 Special Tariff: 30.0%

⚠️ Note: This code applies to shoes with textile uppers and leather soles. If your product has a leather upper, this may not be the correct classification.

3. HS CODE: 6403593081

Description: Shoes with leather uppers and leather soles (Welt footwear).

Total Tax Rate: 35.0%

- Base Tariff: 5.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

✅ Recommended Code: This is likely the most accurate classification for Black Patent Leather Shoes with leather uppers and soles.

4. HS CODE: 6403599045

Description: Shoes with leather uppers and rubber/plastic/leather soles.

Total Tax Rate: 40.0%

- Base Tariff: 10.0%

- Additional Tariff: 0.0%

- April 11, 2025 Special Tariff: 30.0%

⚠️ Note: This code applies to shoes with non-leather soles (e.g., rubber or plastic). If your shoes have leather soles, this may not be the correct code.

📌 Key Tax Rate Changes (April 11, 2025)

- All listed HS codes will be subject to an additional 30.0% tariff after April 11, 2025.

- This is a time-sensitive policy and must be considered in your customs planning.

🛑 Anti-Dumping Duties (if applicable)

- Iron and aluminum products may be subject to anti-dumping duties, but leather shoes are generally not subject to these duties.

- However, always verify with customs or a compliance expert if your product is on any anti-dumping duty list.

📌 Proactive Advice for Importers

- Verify Material Composition: Confirm whether the shoe has leather uppers and soles or synthetic leather or textile uppers.

- Check Unit Price: Tariff rates may vary based on value per unit or quantity.

- Certifications Required: Ensure compliance with product standards (e.g., safety, labeling, and environmental regulations).

- Consult a Customs Broker: For accurate classification and to avoid delays or penalties.

✅ Recommended Action

If your Black Patent Leather Shoes have leather uppers and soles, the most accurate HS code is likely 6403593081 with a total tax rate of 35.0% (including the 30.0% April 11, 2025 special tariff).

Double-check the material composition and design to ensure correct classification.

Customer Reviews

No reviews yet.